When I first stumbled upon options trading, I was immediately drawn to the alluring possibilities it offered. One particular strategy that captured my attention was diagonal options trading. Unlike traditional vertical spreads, diagonal options provide more flexibility and leverage, allowing traders to customize their risk and reward profile.

Image: tickertape.tdameritrade.com

In this comprehensive guide, we’ll delve into the intricacies of diagonal options trading, exploring its nuances, latest trends, and practical applications. We’ll also uncover insights from industry experts and share valuable tips to empower you in your trading journey.

What is Diagonal Options Trading?

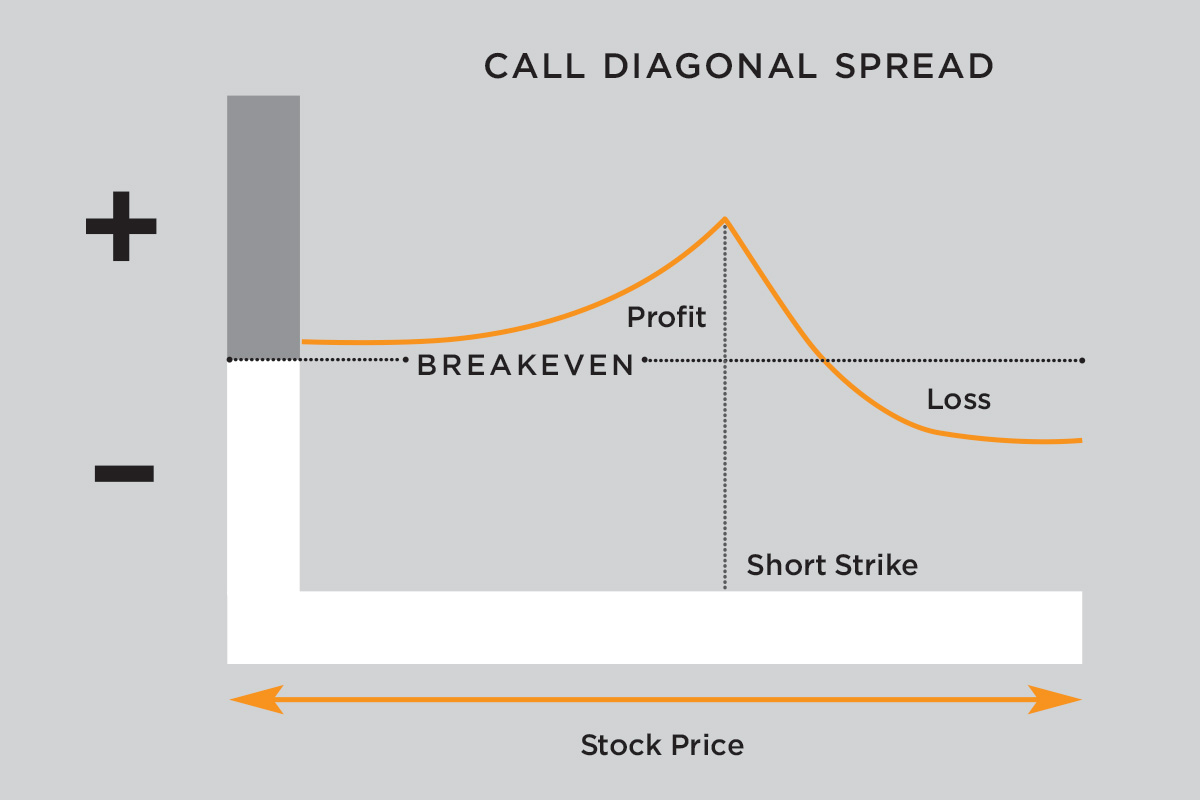

Diagonal options trading involves buying or selling options with different expiration dates and strike prices. Unlike vertical spreads, where both options have the same expiration date, diagonal options allow for flexibility in timing and strike selection.

In a typical diagonal setup, traders buy a deep in-the-money (ITM) option with a distant expiration date and sell an out-of-the-money (OTM) option with a near-term expiration date. This combination creates a spread that is intended to profit from a modest gain in the underlying asset.

Why Trade Diagonals?

Diagonal options trading offers several advantages:

- Flexibility: Allows traders to adjust the timing and strike of the options legs for a customized risk and reward profile.

- Leverage: Provides greater leverage compared to vertical spreads, as the sold leg offsets the cost of the bought leg.

- Reduced Risk: When managed effectively, diagonal options can limit the trader’s potential loss compared to outright ownership of options.

Key Trends and Developments

The landscape of diagonal options trading is constantly evolving, with new strategies and insights emerging. Here are some notable trends:

- Artificial Intelligence (AI): AI algorithms can assist traders in finding optimal diagonal spread combinations based on historical data and market conditions.

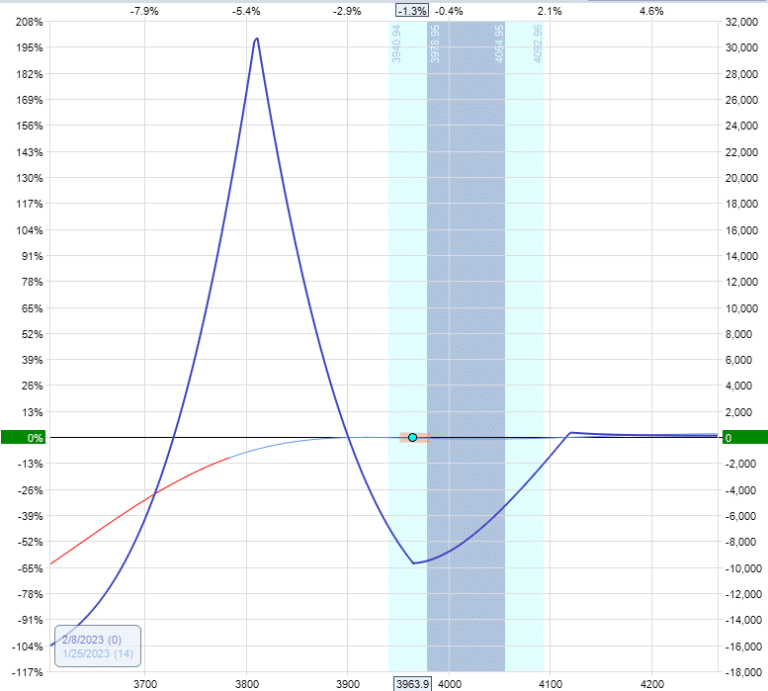

- Trading Platforms: Advanced trading platforms offer specialized tools for diagonal options analysis, including spread analyzers and backtesting capabilities.

- ETFs and Mutual Funds: Some structured products and fund managers now incorporate diagonal options strategies to enhance portfolio returns.

Image: www.wyattresearch.com

Tips and Expert Advice

To excel at diagonal options trading, consider these tips from experienced professionals:

- Choose the Right Underlying: Select an asset with sufficient liquidity and volatility to support a profitable trade.

- Manage Risk: Properly size your positions and consider using stop-loss orders to mitigate potential losses.

- Monitor Market Conditions: Stay attuned to economic data, earnings reports, and other news that could impact the price of the underlying asset.

Expert insights from Ryan Bradley, Trading Coach:

“Incorporating diagonal spreads into your trading arsenal provides a versatile tool to navigate varying market conditions. By combining different time frames and strikes, you can exploit subtle trends and capitalize on price fluctuations in your favor.”

FAQs on Diagonal Options Trading

To address common questions, here’s a comprehensive FAQ:

- Q: What is the maximum profit for a diagonal spread?

A: The maximum profit is the net premium received at the sale of the spread minus any transaction costs. - Q: What is the maximum loss for a diagonal spread?

A: The maximum loss is limited to the difference between the strike prices of the options minus the net premium received. - Q: When is a diagonal spread considered to be “bullish” or “bearish”?

A: A bullish diagonal spread is created when the bought option is ITM and the sold option is OTM, while a bearish diagonal spread involves the reverse.

Trading Diagonal Options

Image: optionstradingiq.com

Conclusion

Unlocking the power of diagonal options trading requires a combination of knowledge, skill, and a keen understanding of market dynamics. By implementing the techniques and insights outlined in this guide, you’ll be well-equipped to navigate the complexities of diagonal options and potentially enhance your trading profits.

Whether you’re an experienced trader seeking to expand your toolkit or a novice eager to explore advanced strategies, I encourage you to delve into the world of diagonal options trading. Its versatility and potential to amplify returns are worth exploring.

Are you ready to embark on your diagonal options trading adventure? Get started today and discover the exciting possibilities it holds!