Introduction

When I first started trading options, I was immediately drawn to their versatility. They allow you to create a wide range of trading strategies, from simple to complex. One of the most popular and effective options trading strategies is called the diagonal spread.

Image: www.youtube.com

A diagonal spread is a neutral strategy that involves buying one option and selling another option with a different expiration date. The options have the same strike price but different underlying assets. This strategy is often used to take advantage of a perceived change in volatility or time value.

Diagonals in Options Trading

A diagonal spread is a combination of a long option and a short option with the same underlying asset but different expiration dates.

The long option is the option that is bought. It has a longer expiration date than the short option.

The short option is the option that is sold. It has a shorter expiration date than the long option.

The strike price is the price at which the underlying asset can be bought or sold.

The expiration date is the date on which the option expires.

The premium is the price that is paid or received for the option.

Types of Diagonals

There are two main types of diagonals:

- Bullish diagonals are used to profit from a perceived increase in the underlying asset’s price.

- Bearish diagonals are used to profit from a perceived decrease in the underlying asset’s price.

Advantages of Diagonals

Diagonals offer a number of advantages over other options trading strategies:

- They can be used to take advantage of both time value and volatility.

- They are relatively easy to implement.

- They can be used to create a variety of trading strategies.

Image: en.rattibha.com

Disadvantages of Diagonals

Diagonals also have some disadvantages:

- They can be more expensive than other options trading strategies.

- They can be more difficult to manage than other options trading strategies.

- They can be more risky than other options trading strategies.

Conclusion

Diagonals are a powerful options trading strategy that can be used to profit from a variety of market conditions. However, it is important to understand the risks involved before using this strategy.

Would you like to learn more about diagonals in options trading? Contact us today and we can provide you with more information.

What Is Diagonals In Options Trading

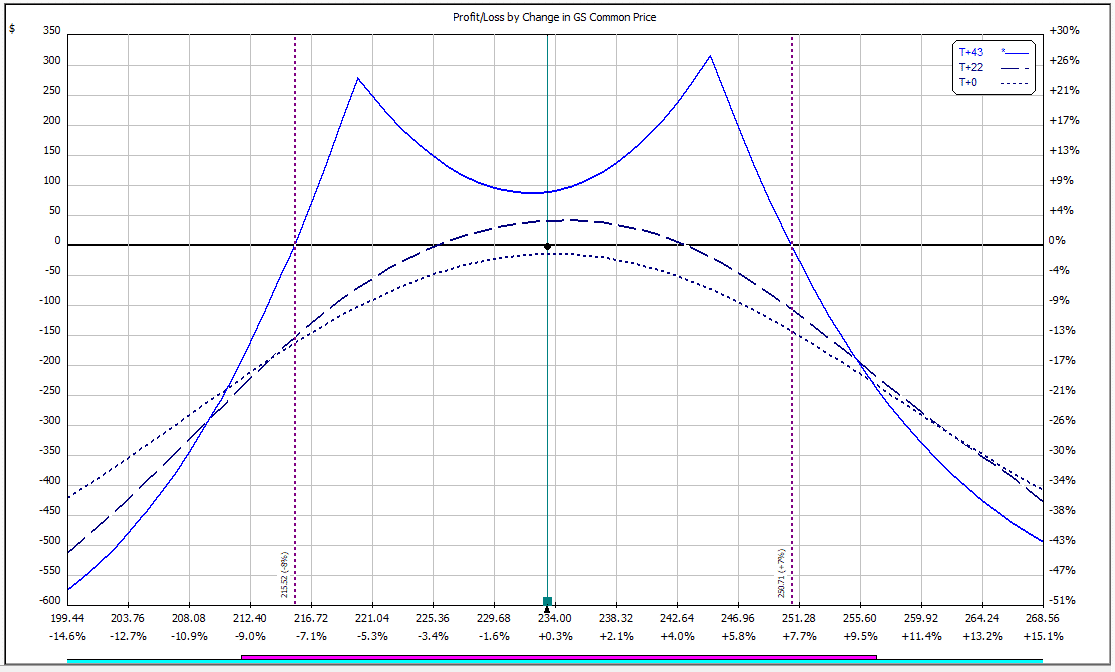

Image: optionstradingiq.com

FAQ

- What is the difference between a diagonal spread and a butterfly spread?

- A diagonal spread is a combination of a long option and a short option with the same underlying asset but different expiration dates. A butterfly spread is a combination of three options with the same underlying asset and expiration date. The two long options have different strike prices, and the short option has a strike price that is in between the two long options.

- How do I calculate the profit and loss for a diagonal spread?

- The profit and loss for a diagonal spread depends on the difference between the premiums of the two options. If the premium of the long option increases more than the premium of the short option, the spread will be profitable. If the premium of the short option increases more than the premium of the long option, the spread will be unprofitable.

- What are the risks of using a diagonal spread?

- The risks of using a diagonal spread include the risk of losing the entire investment, the risk of the underlying asset’s price moving in a direction that is opposite to what was expected, and the risk of the volatility of the underlying asset changing in a way that is not expected.