Introduction

In the exhilarating realm of finance, where strategic maneuvering meets astute anticipation, index options have emerged as a versatile instrument empowering traders with the potential for substantial gains. Among the luminaries shaping this dynamic landscape stands Larry Bittman, an options trading virtuoso whose innovative insights have revolutionized how professionals navigate the complexities of index option markets. Join us as we delve into Bittman’s groundbreaking strategies, unraveling the intricate tapestry of index options trading and unlocking its boundless profit-making opportunities.

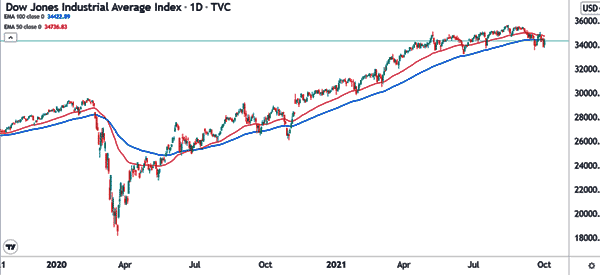

Image: marketwiseasia.com

Index options, unlike their stock option counterparts, derive their value from the underlying index, such as the S&P 500 or the Nasdaq 100. These contracts bestow upon their holders the right, but not the obligation, to buy (call option) or sell (put option) the underlying index at a predetermined price on or before a specified date. By harnessing the profound insights of Larry Bittman, traders gain an unparalleled advantage, wielding index options as potent tools to manage risk, hedge against market volatility, and augment their profit potential.

Deciphering the Intricacies of Index Option Trading

To fully grasp the transformative power of index options, it is imperative to delve into their fundamental concepts. Calls and puts, as previously mentioned, represent the cornerstone of this trading domain. When purchasing a call option, the trader anticipates an upward trajectory in the underlying index’s value, while a put option purchase reflects their belief in a downward trend. The strike price, another crucial element, denotes the predetermined price at which the underlying index can be bought (call option) or sold (put option).

Understanding the time value of index options is equally vital. This element represents the premium paid by the option buyer in exchange for the right to exercise the option before its expiration date. As the expiration date approaches, the time value diminishes, which adds urgency to effective trading decisions. By mastering these fundamental concepts, traders equip themselves with the essential tools to embark on the path towards index option trading success.

Unveiling the Bittman Edge: Time-Tested Strategies for Profit Maximization

Larry Bittman, a seasoned veteran in the index options arena, has generously imparted his profound wisdom upon the trading community. Among his time-tested strategies is the “Iron Condor,” an ingenious tactic that simultaneously sells both a bull call spread and a bear put spread, creating a profit zone bounded by pre-determined strike prices. This strategy flourishes when the market exhibits low volatility, enabling traders to capture consistent income.

Another Bittman brainchild is the “Covered Call,” a strategy where traders sell call options against their underlying stock holdings. By doing so, they generate additional income while maintaining their bullish outlook on the stock. This tactic proves particularly lucrative when the stock price hovers near the call option’s strike price.

Real-World Application: Navigating Market Dynamics with Index Options

To illustrate the practical application of index options, consider the following scenario. An astute investor anticipates a period of heightened market volatility. By purchasing a straddle, which involves buying both a call option and a put option with the same strike price and expiration date, they effectively position themselves to profit from price fluctuations in either direction. This strategy shields them against unforeseen market swings, providing a valuable safety net in tumultuous times.

Alternatively, a trader may adopt the “Collar” strategy to mitigate risk while maintaining a bullish market outlook. This involves purchasing a protective put option with a strike price below the stock’s current price while simultaneously selling a call option against the stock. This strategy limits potential losses while providing ample room for appreciation within the predefined range.

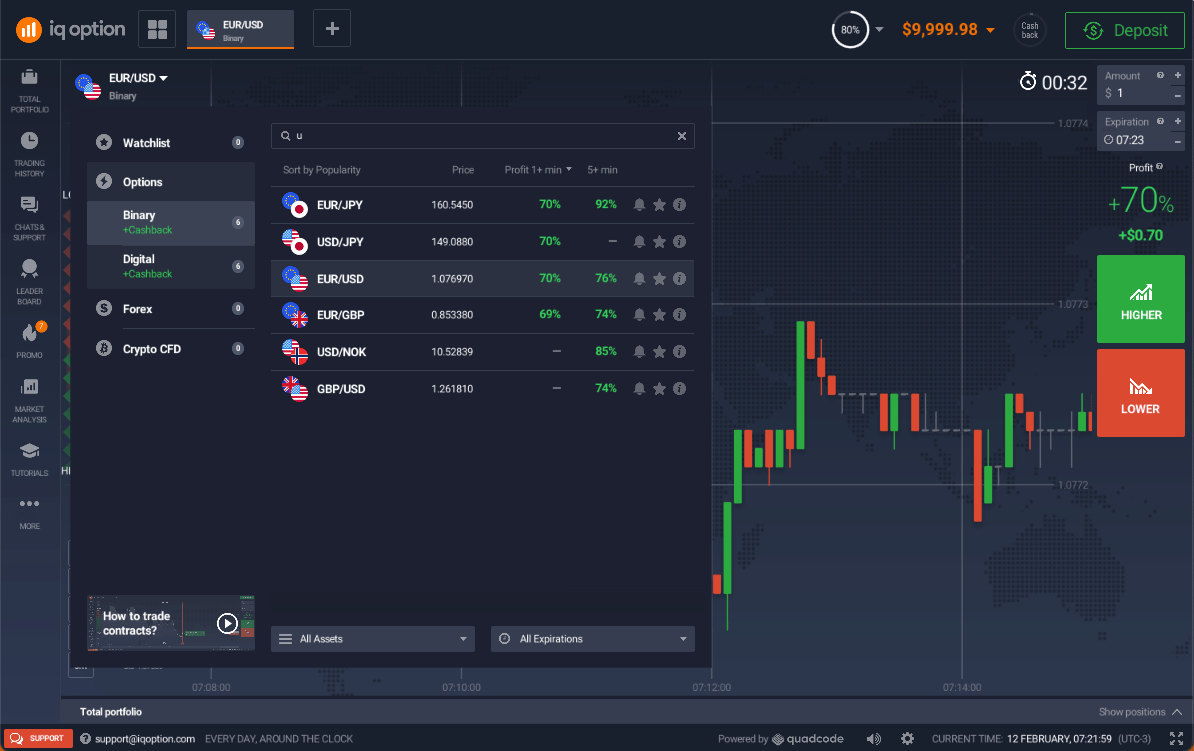

Image: www.daytradetheworld.com

Trading Index Options By Bittman

Image: iqbroker.com

Conclusion

Trading index options by Bittman’s methodologies empowers individuals with the knowledge and tools necessary to navigate the intricate world of financial markets. By embracing his innovative strategies, traders can unlock a wealth of profit-making opportunities while effectively managing risk and harnessing market dynamics to their advantage. As the financial landscape continues to evolve, the legacy of Larry Bittman and his profound insights will undoubtedly serve as a beacon of guidance for aspiring traders seeking to conquer the challenges and reap the rewards of index option trading.