The Allure of Options: A Path to Amplified Profits

Options trading presents a tantalizing opportunity for traders to capitalize on market fluctuations while limiting their financial exposure. Unlike traditional stock investments, options offer the unique ability to bet on the future direction of an underlying asset without the obligation to buy or sell it directly. This inherent flexibility empowers traders to devise strategic trades tailored to their risk tolerance and profit objectives.

Image: tacticaltradingstrategies.com

Options Basics: Unraveling the Mechanics

An option contract represents a right, not an obligation, to buy or sell an underlying asset at a predetermined price (strike price) within a specific time frame (expiration date). There are two main types of options: calls and puts. A call option grants the holder the right to buy the underlying asset, while a put option conveys the right to sell.

The price of an option is influenced by various factors, including the market price of the underlying asset, its volatility, time to expiration, and interest rates. Traders can execute trades by buying or selling these contracts at the prevailing market price, known as the premium.

The Risk Management Edge: Harnessing Options to Tame Market Volatility

Options trading opens up a wide array of strategies to help traders manage risk effectively. By utilizing options, traders can cap their potential losses and enhance their profit margins.

One such strategy involves purchasing a put option as insurance against potential price declines in the underlying asset. If the price falls below the strike price, the put option will offset the losses incurred on the stock position.

Another risk-mitigating strategy entails selling call options against an existing stock holding. By granting others the right to buy the stock at a higher price, the trader collects a premium while limiting their potential upside.

The Landscape Evolves: Exploring Advanced Options Trading Strategies

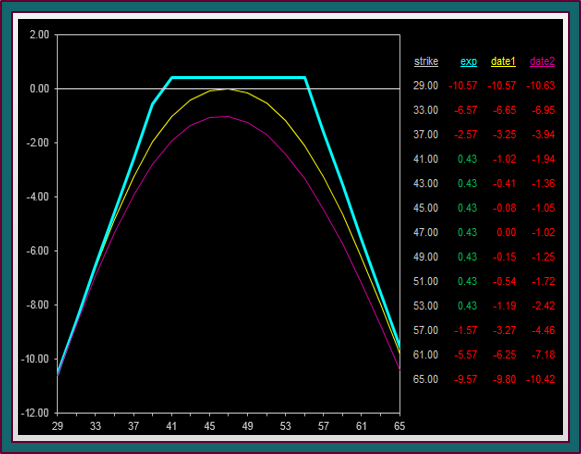

The realm of options trading extends beyond basic strategies, offering sophisticated approaches to cater to the needs of experienced traders. For instance, multi-leg options strategies, such as spreads and straddles, involve combining multiple options contracts to create customized risk-reward profiles.

Advanced options traders may also delve into volatility trading, seeking to profit from the fluctuations in option prices. By exploiting changes in implied volatility, these traders capitalize on the market’s expectations about future price movements.

Image: zyfaluyohod.web.fc2.com

Conquering Options Trading: A Path to Financial Success

Mastering options trading requires a multifaceted approach encompassing in-depth market knowledge, analytical skills, and a disciplined risk management strategy. Aspiring traders should equip themselves with a firm grasp of options mechanics, volatility dynamics, and market trends.

Practicing with paper trading simulators provides a safe environment to experiment with various strategies and refine trading techniques. Moreover, seeking guidance from experienced mentors or enrolling in reputable courses can accelerate the learning curve and enhance trading proficiency.

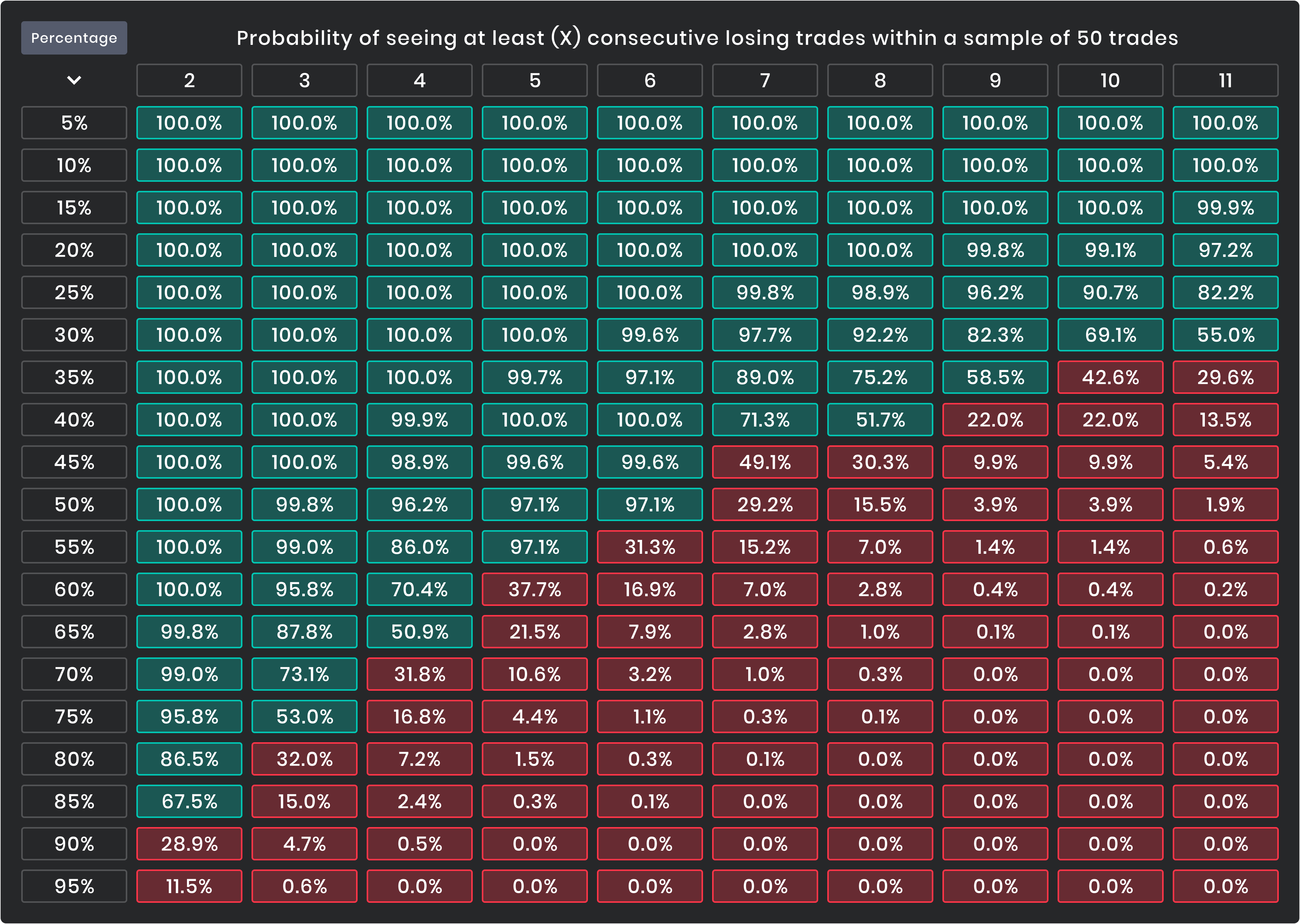

Options Trading Limited Risk

Image: ftmo.com

Embarking on the Options Trading Journey: Prudence and Education Lead the Way

Options trading presents a powerful tool for investors seeking to amplify returns and mitigate risks. However, it is imperative to approach this venture with prudence and a thorough understanding of its complexities.

Adequate research, continuous education, and a disciplined trading plan are cornerstones of success in the options market. Traders who embrace these principles will be well-positioned to harness the full potential of options while minimizing financial risks.