Hello, readers! Welcome here. I’m excited to jump into the world of short butterfly option trading and share the strategies and insights that have helped me navigate this dynamic market. My journey in the world of short butterfly options trading has been an enlightening one. It has taken me on a rollercoaster of ups and downs, but the lessons I’ve learned along the way have been invaluable.

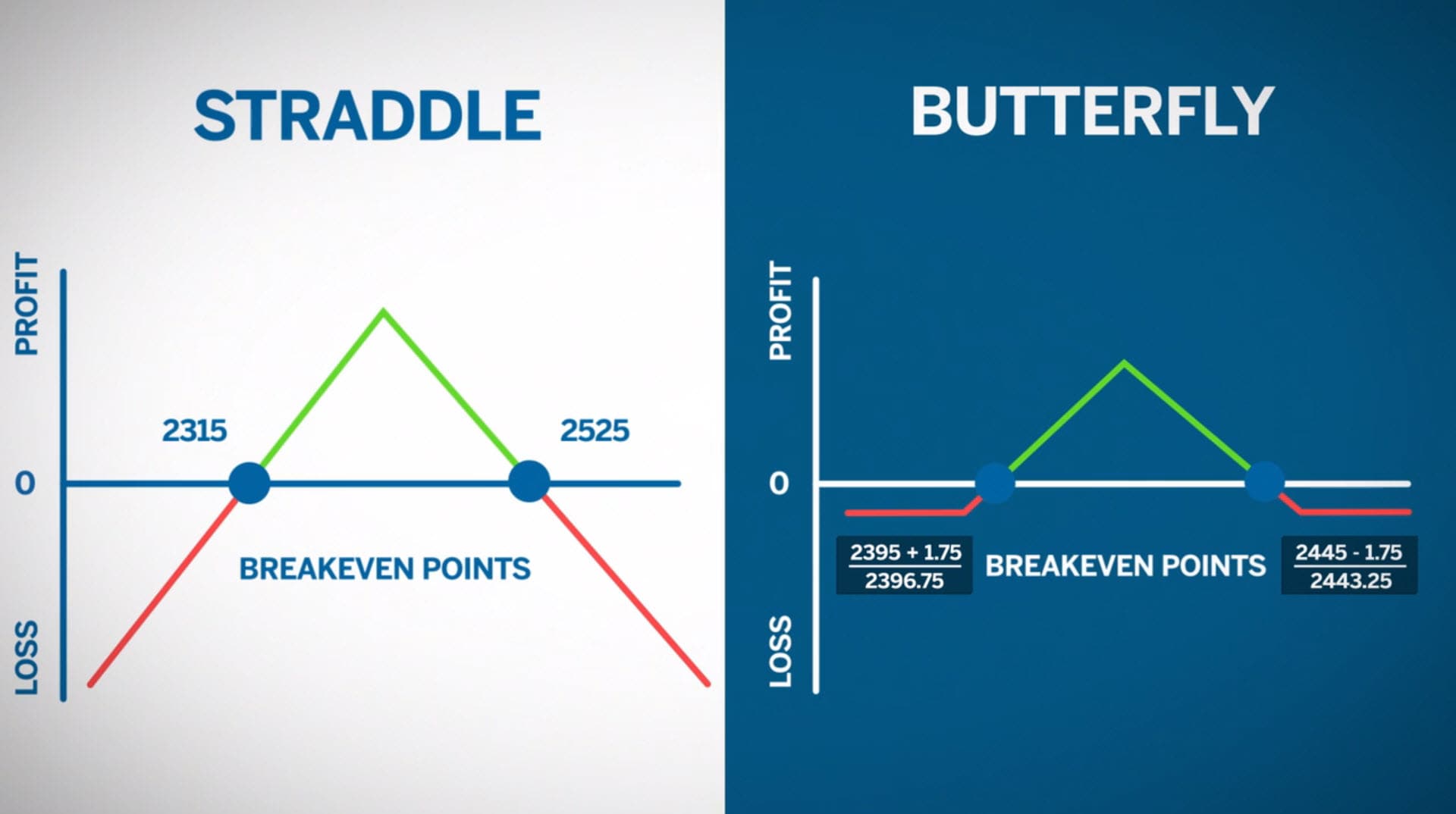

Image: www.cmegroup.com

Short butterfly options trading is a strategy that involves selling a combination of options. It is designed to profit from a narrow range of price movements within a specified timeline. Whether you’re a seasoned trader or just starting out, understanding the intricacies of short butterfly options trading is crucial for success.

Understanding Short Butterfly Options Trading

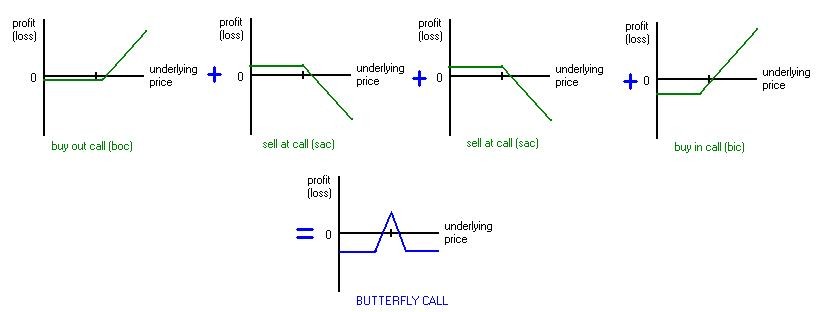

A short butterfly spread is an options strategy that involves selling one option at the strike price below the current stock price and buying two options at the strike price above the current stock price. The trader aims to profit if the stock price stays within a narrow range, as it requires the underlying asset to move within a specific price range to achieve profitability.

The spread is constructed by selling one option at the lowest strike price, buying two options at the middle strike price, and selling another option at the highest strike price. The profit potential is limited to the premium received from selling the options, while the maximum loss is the difference between the strike prices of the sold and bought options.

Benefits of Short Butterfly Options Trading

Short butterfly options trading offers several benefits, including:

- Limited Risk: The maximum loss is known, while the profit potential is capped.

- Potential for High Returns: If the stock price moves within the desired range, the returns can be high.

- Suitable for Range-Bound Markets: The strategy can benefit when volatility is relatively low.

Drawbacks of Short Butterfly Options Trading

However, short butterfly options trading also has some drawbacks, such as:

- Limited Profit Potential: The profit is capped at the premium received.

- High Margin Requirements: Selling options involves high margin requirements.

- Volatility Risk: The strategy is vulnerable to high volatility, which can result in significant losses.

Image: investpost.org

Tips for Short Butterfly Options Trading Success

To increase your chances of success in short butterfly options trading, consider these tips:

- Choose the Right Stocks: Select stocks with low volatility and a clear trading range.

- Manage Risk: Determine the maximum loss you’re willing to accept and trade accordingly.

- Monitor the Market: Keep a close eye on market conditions and adjust your strategy as needed.

- Seek Professional Advice: Consult a financial advisor to assess your suitability for short butterfly options trading.

FAQ on Short Butterfly Options Trading

Here are some frequently asked questions about short butterfly options trading:

- What is the profit potential of a short butterfly spread? It is limited to the premium received from selling the options.

- What is the maximum loss of a short butterfly spread?It is the difference between the strike prices of the sold and bought options.

- When is it best to use a short butterfly spread? It is best suited for range-bound markets with low volatility.

Short Butterfly Options Trading Pedia

Image: csjla.pe

Conclusion

Short butterfly options trading can be a rewarding strategy when executed correctly. By understanding the risks and rewards involved, and with diligent risk management, traders can potentially generate returns while limiting their potential losses. Remember, knowledge is power in the world of options trading. So, keep learning and refining your strategies to maximize your success in short butterfly options trading.

I hope this article has provided a comprehensive overview of short butterfly options trading. I encourage you to further explore the topic and seek additional resources to enhance your understanding. I’d love to hear from you- if you found this article informative or have any questions, please don’t hesitate to reach out. Happy trading!