Introduction

In the ever-evolving realm of options trading, the iron butterfly strategy has emerged as a versatile tool for risk-averse traders seeking income generation. This strategy combines elements of bullish and bearish positions to create a neutral stance, making it adaptable to a wide range of market conditions. Understanding the nuances of the iron butterfly can empower traders to navigate market fluctuations and potentially maximize profits.

Image: www.pinterest.com

Anatomy of the Iron Butterfly

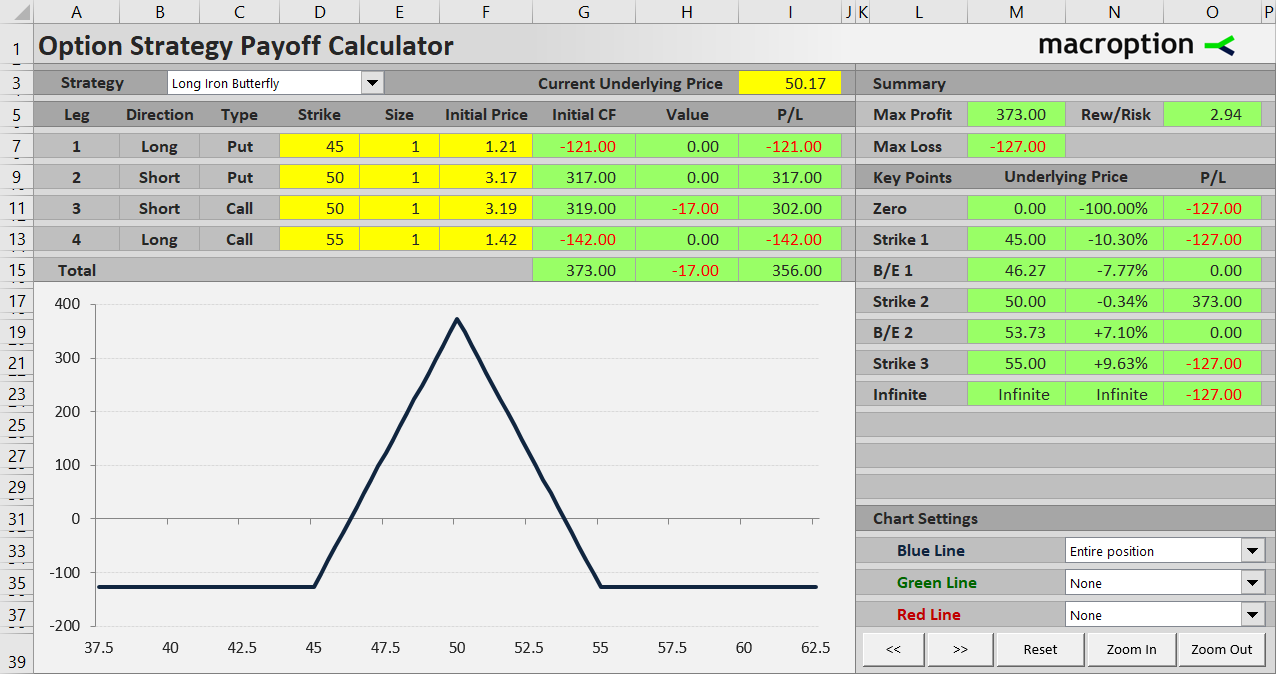

The iron butterfly strategy involves simultaneous execution of four options contracts: one long call (bought at a higher strike price), one short call (sold at an even higher strike price), one short put (sold at a lower strike price), and one long put (bought at an even lower strike price). The strike prices of the calls are equidistant from each other, as are the strike prices of the puts. The width of this “butterfly spread” determines the potential profit and loss parameters.

Neutral Market Bias

The essence of the iron butterfly strategy lies in its neutral market positioning. By balancing both bullish (buying a call) and bearish (selling a put) bets, traders refrain from making directional predictions about the underlying asset’s price. This allows them to capitalize on fluctuations within a specified range without being overly exposed to significant price movements.

Earnings Potential

The iron butterfly strategy derives its income potential from two main sources. Firstly, the premiums received from selling the two short options contribute to the overall profit. Secondly, a “time decay” effect comes into play as the options approach their expiration dates. This is because the extrinsic value (the value due to remaining time) of the short options decreases at a faster rate than the extrinsic value of the long options.

Image: investluck.com

Risk Management

One of the primary advantages of the iron butterfly strategy is its ability to limit risk. The premiums received from the short options act as a cushion against potential losses, thereby mitigating the downside. However, it is crucial to note that losses can still occur if the underlying asset’s price moves beyond the predetermined strike price range.

Market Conditions and Execution

The iron butterfly strategy is best suited for markets characterized by low volatility and low interest rates. It is typically implemented when the trader anticipates a limited price movement within the chosen range. The optimal strike prices and expiration dates should be selected based on a thorough analysis of market conditions and volatility trends.

Suitable Candidates

The iron butterfly strategy is a viable option for traders with moderate risk tolerance and a desire for steady income generation. It requires a good understanding of options trading principles and a keen eye for identifying periods of relative price stability. Traders should also be aware of the potential limitations and risks associated with this strategy.

Historical Success and Notable Examples

Throughout history, the iron butterfly strategy has been employed successfully by both retail and institutional traders. One notable example is the 2008 financial crisis, during which the iron butterfly provided a source of income for traders seeking to navigate extreme market uncertainty.

Options Trading Iron Butterfly

Image: www.macroption.com

Conclusion

The iron butterfly strategy offers traders a sophisticated tool for income generation and risk management. Its neutral market positioning and limited downside potential make it a compelling option for traders seeking tocapitalize on market fluctuations within a defined range. By understanding the components, execution, and underlying principles of the iron butterfly, traders can harness its capabilities to enhance their options trading strategies.