Embarking on the intricate world of options trading can be an exhilarating yet daunting endeavor, especially when navigating advanced strategies like the iron butterfly spread. In this comprehensive guide, we delve into the intricacies of the iron butterfly SPX, its mechanics, and how it can potentiate your trading prowess. Brace yourself for a transformative journey into the realm of options trading!

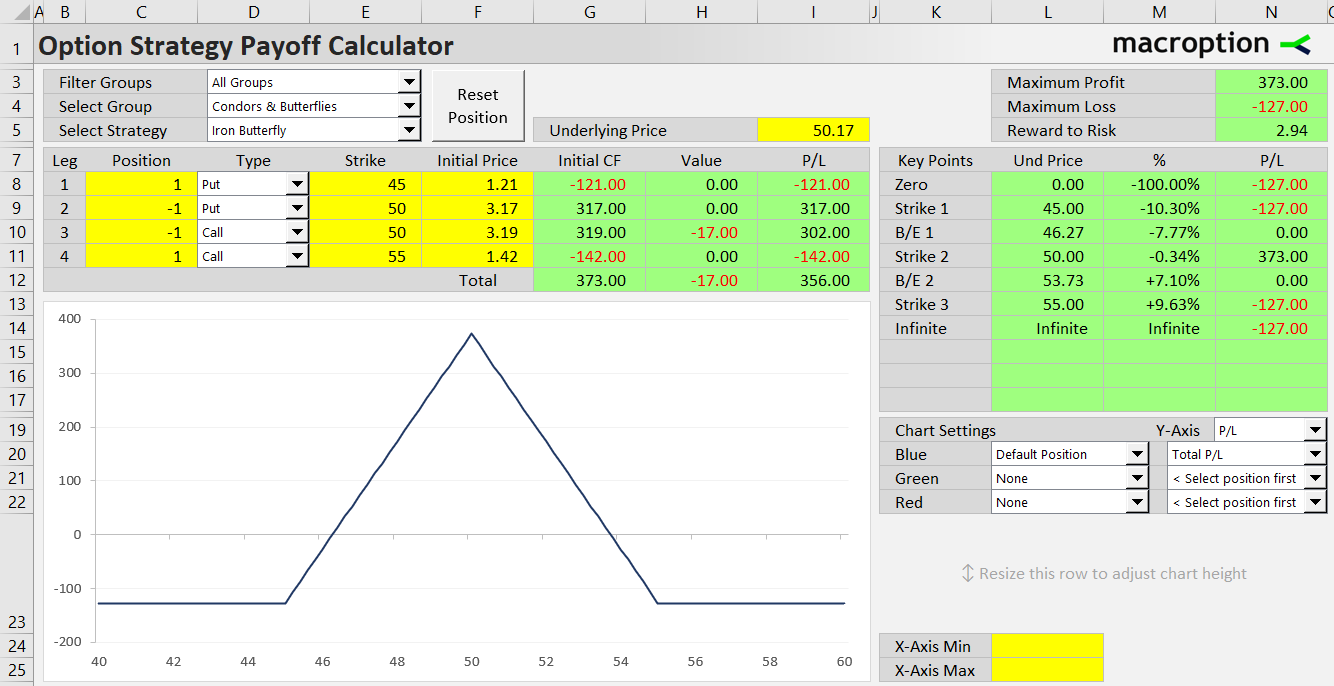

Image: www.macroption.com

Options trading, a formidable yet lucrative domain, empowers investors to speculate on the future price movements of underlying assets without incurring the obligation to buy or sell the underlying directly. Amidst the plethora of options strategies, the iron butterfly spread stands apart as a versatile technique that seeks to tap into price range-bound fluctuations.

The Iron Butterfly: A Strategy Decoded

The iron butterfly is an options strategy that involves simultaneously buying one at-the-money (ATM) call and one ATM put option, while selling two out-of-the-money (OTM) calls and two OTM puts. The equidistant OTM options are typically set one strike price above and below the ATM options.

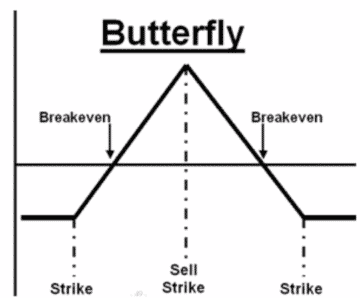

Visually, the iron butterfly resembles the delicate wings of a butterfly, hence its captivating moniker. This strategy is ideally employed when the trader anticipates the underlying asset to trade within a specific range for the duration of the contract. If the asset price remains within the predetermined boundaries, the trader stands to reap the maximum profit potential of the strategy.

Unveiling the Iron Butterfly’s Mechanics

Executing an iron butterfly strategy entails a series of precise transactions: purchasing one ATM call option, purchasing one ATM put option, selling two OTM call options, and selling two OTM put options. Notably, the number of contracts traded for each option type must align to maintain the desired butterfly formation.

The profit potential of the iron butterfly strategy is capped and defined by the difference between the strike prices of the OTM options and the net premium received at the outset of the trade. Should the underlying asset meander outside the anticipated range, the trader may incur losses that could potentially exceed the initial premium received.

Navigating the Iron Butterfly Landscape

To effectively harness the iron butterfly strategy, traders must possess a keen understanding of implied volatility, time decay, and the Greeks. Implied volatility gauges market participants’ expectations of future price volatility, while time decay erodes the value of options contracts as they approach expiration. The Greeks, a suite of metrics, provide traders with insights into how options contracts respond to changes in underlying asset prices, volatility, and time.

Mastering these concepts enables traders to fine-tune their iron butterfly strategies, gauging optimal strike prices, expiration dates, and position sizing. By intricately intertwining these variables, traders can craft iron butterfly spreads that align with their risk tolerance and profit objectives.

Image: tradepik.com

Expert Advice and Tips for Iron Butterfly Success

To enhance your iron butterfly trading prowess, consider these valuable tips from seasoned experts:

- Identify the right underlying assets: Opt for assets with ample liquidity and predictable price action to minimize adverse surprises.

- Set realistic profit targets: Be mindful of the potential rewards and risks when establishing profit targets. Avoiding overly ambitious aspirations will safeguard your trading capital.

- Monitor the market closely: Vigilantly track the underlying asset’s price movements and market conditions to make informed adjustments to your strategy, if necessary.

Adhering to these guidelines will bolster your iron butterfly trading acumen, steering you towards a path of increased profitability.

Frequently Asked Questions

- What is the optimal holding period for an iron butterfly?

- How does implied volatility impact iron butterfly strategies?

Options Trading Iron Butterfly Spx

Image: investluck.com

Conclusion

The iron butterfly spread offers a versatile and sophisticated options trading strategy, empowering traders to capture profit from range-bound price movements. By comprehending its mechanics, nuances, and expert insights, you can confidently navigate the intricacies of the options market. Embark on this exciting journey today and harness the power of the iron butterfly to catapult your trading prowess to new heights.

Now, tell us – are you eager to conquer the world of iron butterfly trading? Your success awaits!