In the arena of finance, where fortunes are made and lost, mastering the art of option trading is essential. As an avid trader, I have witnessed firsthand the allure and risks associated with this complex yet rewarding world. Embark on this journey with me as we delve into the intricacies of a popular option trading strategy: the Iron Butterfly.

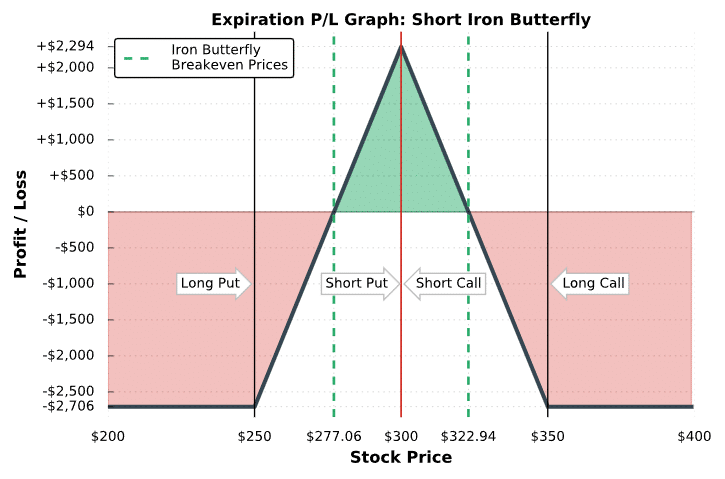

Image: www.projectfinance.com

Understanding the Iron Butterfly

An Iron Butterfly is a neutral option strategy involving buying two options at different strike prices: a bullish call option and a bearish put option with the same expiration date. Both options are accompanied by the sale of two additional options at the same strike price: another call option (sold) with a slightly higher strike price and another put option (sold) with a slightly lower strike price. The net premium paid for the construction of an Iron Butterfly is typically low compared to other option strategies.

Unveiling the Mechanics

To construct an Iron Butterfly, you would purchase one call option at a lower strike price (Call 1), sell one call option at a higher strike price (Call 2), sell one put option at a lower strike price (Put 1), and purchase one put option at a higher strike price (Put 2). The strike prices of Call 1 and Put 2 should be equidistant from the current underlying security price, while Call 2 and Put 1 should be equidistant but at a higher and lower strike price, respectively.

For instance, if the underlying security is trading at $100, you could create an Iron Butterfly by purchasing one call option with a strike price of $95 (Call 1), selling one call option with a strike price of $100 (Call 2), selling one put option with a strike price of $100 (Put 1), and purchasing one put option with a strike price of $105 (Put 2).

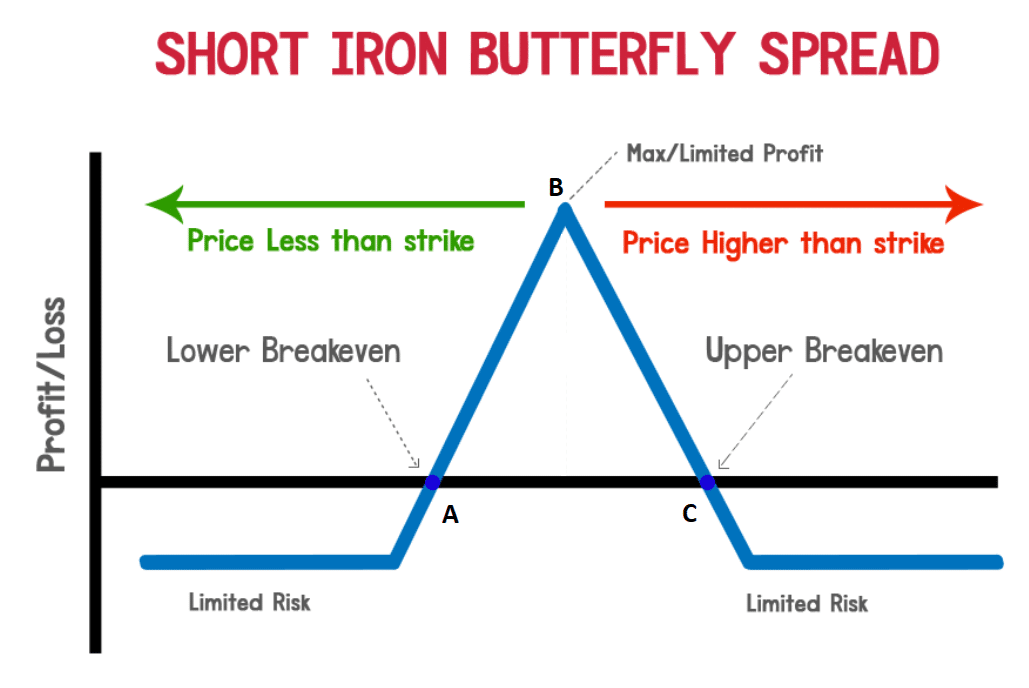

Navigating the Iron Butterfly Profit Potential

The Iron Butterfly thrives within a narrow range, profiting when the underlying security price remains relatively stable. The maximum profit is capped at the net premium paid to establish the position and is realized if the security price finishes exactly at the middle strike price (strike price of Call 1 and Put 2) at expiration. Losses occur when the underlying security price moves significantly above or below the breakeven points (strike prices of Call 2 and Put 1).

Image: medium.com

Unleashing the Power of Iron Butterflies

The Iron Butterfly is an excellent strategy for traders seeking a neutral to slightly bullish or bearish outlook on the underlying security. It allows for a defined risk and capped profit potential, making it suitable for investors with a moderate risk tolerance.

Seasoned traders often employ Iron Butterflies to generate income through premium selling. By selling the higher-strike call and put options, they collect an upfront premium, which can partially offset the cost of the purchased options. If the underlying security price remains within the desired range, they retain the premium while limiting their potential loss.

Top Tips for Iron Butterfly Success

- Meticulous Strike Price Selection: Choose strike prices that align with your expectations for the underlying security’s price movement.

- Timely Execution: Execute the Iron Butterfly strategy carefully, ensuring accurate order placement and timely adjustments as needed.

- Risk Management: Monitor the position closely and exit if the underlying security price moves beyond your intended range.

- Understand the Greeks: Familiarize yourself with the Greeks (Delta, Gamma, Vega, etc.) to assess the potential impact of market fluctuations on your position.

Expert Insights

“The Iron Butterfly is a powerful tool for capitalizing on market neutrality or a slightly directional view. However, thorough understanding and prudent risk management are crucial for successful deployment,” advises financial expert Mark Douglas.

“Traders must recognize that Iron Butterflies have limited profit potential, but they can generate consistent returns over time through disciplined trading practices,” adds veteran option trader Peter Brandt.

FAQs on Iron Butterflies

- Q: What are the profit and loss scenarios for an Iron Butterfly?

- A: Profits are generated when the underlying security price remains within a narrow range around the middle strike price. Losses occur when the security price moves significantly outside this range.

- Q: How can I calculate the risk and reward of an Iron Butterfly?

- A: The net premium paid represents the maximum risk, while the maximum profit is capped at this same amount.

- Q: What is the best time to use an Iron Butterfly strategy?

- A: Iron Butterflies are ideal when you anticipate low volatility and a range-bound underlying security.

How To Make An Iron Butterfly Option Trading

Image: www.youtube.com

Embracing the Iron Butterfly: Conclusion

Mastering the art of Iron Butterfly trading requires a blend of knowledge, skill, and discipline. By understanding the mechanics, profit potential, and risk management strategies associated with this strategy, you can harness its power to navigate the ever-changing landscape of financial markets. As you delve deeper into the realm of options trading, I encourage you to explore the Iron Butterfly and embrace the opportunities it presents.

Are you intrigued by the nuances of Iron Butterfly trading? If so, I invite you to continue exploring this fascinating financial instrument through exclusive resources and expert insights on our platform. Stay tuned for more comprehensive guides, market updates, and valuable trading strategies.