The stock market is a complex beast, often feeling like a tangled web of numbers and volatile trends. But what if you could harness that volatility, turning it into a tool for potential gains? Enter the world of SPX options – a gateway to unlocking the power of the S&P 500 index, one of the world’s most influential benchmarks.

Image: www.ainfosolutions.com

Picture this: you’re watching the news, witnessing a global economic shift. Perhaps there’s a technological breakthrough, or a geopolitical event sending ripples through the markets. Suddenly, you’re not just a passive observer, but a player, equipped with the knowledge and tools to navigate this dynamic landscape. This is the potential of SPX options – a way to express your view on the direction of the broader market while managing your risk.

Unlocking the Enigma of SPX Options

Imagine a powerful lever, capable of multiplying your gains or losses in the S&P 500. That’s essentially what an SPX option represents – a contract offering the right (but not the obligation) to buy or sell the index at a specific price on or before a certain date. It’s like a time machine, letting you bet on the market’s future while locking in a specific price.

Think of it as a virtual magnifying glass, focusing your trading power on the S&P 500. With options, your investment can grow exponentially if the market moves in your favor, but the same magnifying principle can amplify potential losses. It’s a high-reward, high-risk dance, and understanding the nuances is crucial.

Decoding the Jargon: Calls, Puts, and the Expiration Date

Navigating the world of options requires understanding its unique language. Let’s clear up the common terms:

- Call options: Give you the right to buy the S&P 500 at a fixed price. If the index rallies, your call option becomes more valuable.

- Put options: Grant you the right to sell the S&P 500 at a fixed price. If the index declines, your put option gains value.

- Expiration date: This is the deadline by which you must exercise your right to buy or sell. After the expiration date, the option loses its value.

These terms paint a picture of the diverse strategies you can employ. Perhaps you believe the economy is rebounding, so you purchase a call option to profit from potential appreciation. Or maybe you foresee a market correction, prompting you to acquire a put option to benefit from a potential downturn.

The Power and Peril of Leverage

Options are known for their leverage – the ability to control a larger position with a smaller investment. Imagine controlling a 100-pound boulder with a tiny lever. That’s effectively what options offer, allowing you to speculate on significant market swings with a relatively small investment.

While this leverage can magnify your profits, it also amplifies your potential losses. This makes it crucial to understand risk management techniques and implement a robust strategy.

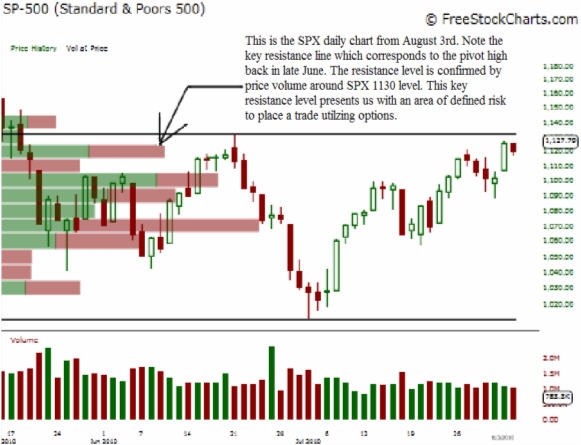

Image: www.thegoldandoilguy.com

Understanding the Risk-Reward Spectrum

Navigating the world of options necessitates a deep comprehension of risk. The potential for both massive gains and losses requires a cautious approach.

- Limited Risk: Unlike buying shares directly, the maximum loss you face with an option is usually the premium you paid for it. This element of limited risk makes options attractive for some traders.

- Unlimited Potential: On the flip side, your potential gains can be substantial, potentially exceeding the initial investment by a significant margin. However, this potential is tied to the market’s volatility, which is inherently unpredictable.

Crafting a Winning Strategy

The magic of options lies in crafting a strategy that aligns with your risk tolerance and investment objectives. Here are some common strategies:

- Covered Calls: A strategy for generating income from your existing shares by selling a call option. This limits potential upside but offers a steady income stream.

- Cash Secured Put: This strategy allows you to sell a put option while simultaneously holding the underlying asset. It can offer a lower purchase price and potentially higher income, but be mindful of potential losses.

- Protective Put: If your existing shares are in a volatile market, a protective put can limit potential downside risks.

- Bullish Calls: This strategy involves buying a call option when you believe the market will rise.

- Bearish Puts: Buying a put option when you expect a market decline.

The Importance of Education and Experience

Navigating the intricate world of SPX options demands a dedication to learning and a commitment to consistent practice. The following steps are crucial:

- Deepen your knowledge: Explore comprehensive resources like books, courses, and online articles to gain a solid understanding of the fundamentals.

- Practice with a simulation: Many platforms offer free or paid simulation environments where you can experiment with SPX options without risking real money.

- Start small: Once you feel confident, begin with a small investment amount and gradually increase your position size as you gain experience.

- Seek professional guidance: Consult with financial advisors or experienced options traders to receive personalized advice and guidance.

Trading Spx Options

Conclusion: Embracing the Power of SPX Options

The world of SPX options stands as a gateway to a more dynamic and potentially profitable way to engage with the S&P 500. As with any financial endeavor, knowledge and experience are your most potent tools. Remember to approach your trading with a measured mindset, prioritize risk management, and continuously refine your strategies. With dedication and a thirst for learning, you can unlock the potential of SPX options and chart your own path in the dynamic world of market volatility.

Now, it’s your turn to take the first step. Explore reputable online resources, connect with experienced traders, and embark on your own journey into the fascinating realm of SPX options.