Introduction

The dynamic world of options trading demands an array of analytical tools and strategies to navigate its complexities. Among them, uptick options trading stands out as a powerful technique that can amplify your trading prowess. It involves identifying and capitalizing on opportunities to buy calls on stocks that are experiencing a surge in buying pressure, promising the potential for substantial profits. To harness the full potential of this strategy, Excel plays a pivotal role. In this comprehensive guide, we will delve into the fundamentals of uptick options trading, its integration with Excel, and the key insights and actionable tips that will elevate your trading journey.

Image: www.activetick.com

Understanding Uptick Options Trading

Uptick options trading is predicated on the concept of buying call options when a stock’s price is exhibiting an upward trend, indicated by a rise in its trading volume. The rationale behind this strategy is that continued buying pressure typically drives stock prices higher, providing a favorable environment for call options to appreciate in value. By identifying stocks with strong buying momentum, traders can position themselves to capture potential gains.

Integrating Excel into Uptick Options Trading

Excel serves as an invaluable tool for uptick options trading, enabling traders to analyze stock data, identify trading opportunities, and track their performance. The following steps outline the process:

-

Data Collection: Import historical stock prices and trading volume data into Excel from reliable sources such as Yahoo Finance or Bloomberg.

-

Trend Analysis: Apply technical indicators such as moving averages and Bollinger Bands to identify stocks displaying a sustained upward trend.

-

Volume Analysis: Filter the data to isolate stocks experiencing significant increases in trading volume, indicating strong buying pressure.

-

Trade Execution: Determine appropriate entry and exit prices for call options based on the identified trends. Utilize Excel formulas to calculate potential profit targets and risk parameters.

Expert Insights and Actionable Tips

Renowned experts in options trading emphasize the following strategies to maximize the efficacy of uptick options trading:

-

Trade Momentum Stocks: Target stocks with both strong upward trends and increasing trading volume, as they offer the highest potential for call options to appreciate.

-

Price Momentum Confirmation: Employ technical indicators like the Relative Strength Index (RSI) to confirm that the stock’s price momentum is aligned with its rising trading volume.

-

Set Realistic Profit Targets: Determine reasonable profit targets based on the stock’s historical behavior and market conditions. Avoid overambitious goals that could lead to excessive risk.

-

Manage Risk: Implement prudent risk management strategies by setting stop-loss orders to limit potential losses. Regularly monitor your positions and adjust them as market conditions change.

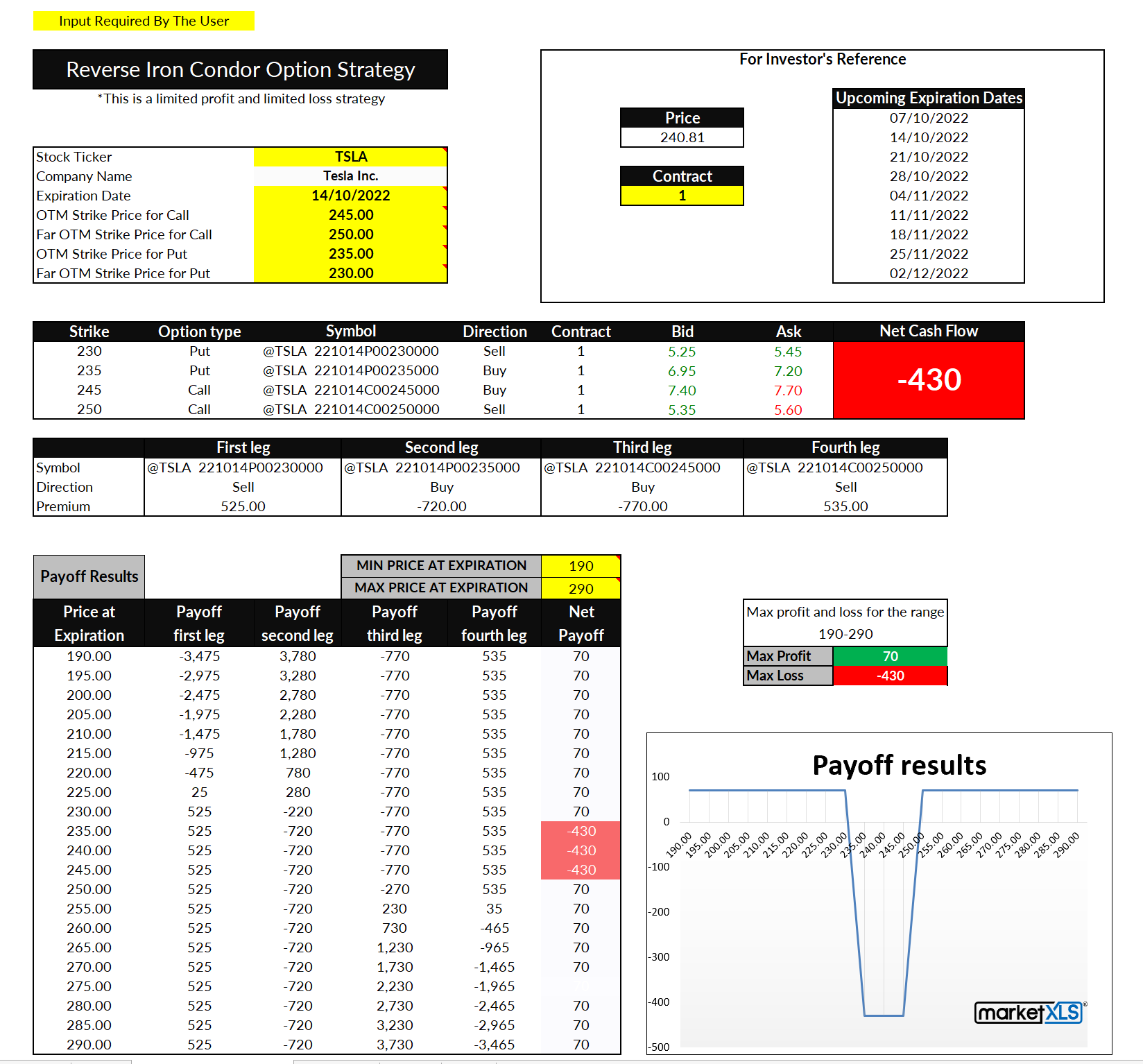

Image: marketxls.com

Uptick Option Trading Excel

Image: www.youtube.com

Conclusion

Uptick options trading, combined with the analytical capabilities of Excel, empowers traders to identify and capitalize on market opportunities. By understanding the underlying concepts, leveraging Excel’s data analysis features, and adhering to expert insights, you can enhance your trading strategies, boost your profits, and navigate the complexities of the financial markets with confidence. Embrace the power of uptick options trading in Excel, and embark on a transformative trading journey that will unlock your financial potential.