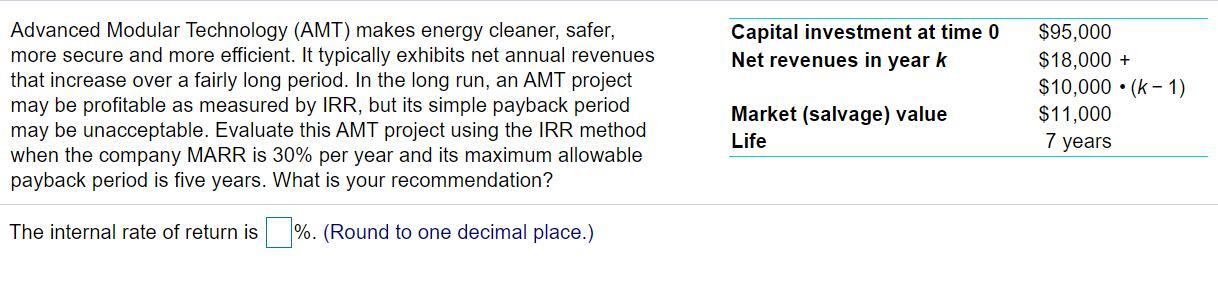

Options trading can be an effective vehicle to generate substantial income, but it requires a significant initial capital investment. So, how much capital do you need to realistically attain an annual return of $80,000?

Image: www.chegg.com

Calculating Capital Requirements

Estimating the amount of capital required largely depends on your trading strategy and risk tolerance. Generally, experienced traders suggest allocating at least $25,000 for every $1,000 of targeted monthly income. Applying this principle to our goal of earning $80,000 per year, a starting capital of approximately $200,000 would be prudent.

The Role of Trading Strategy and Risk Management

Your trading strategy and risk management techniques also influence capital requirements. If you employ a relatively conservative strategy, such as selling covered calls, your capital needs may be less. Conversely, more aggressive strategies, like buying naked options, demand a higher cushion of capital. Furthermore, employing sound risk management practices, like limiting position sizes and understanding potential losses, can minimize capital erosion and allow you to trade with less.

Understanding Options Trading

Options trading involves the buying and selling of option contracts, which give traders the right (not the obligation) to buy or sell an underlying asset at a specified price within a specific time frame. Options trading can be a complex and risky endeavor, but it also offers the potential for substantial gains.

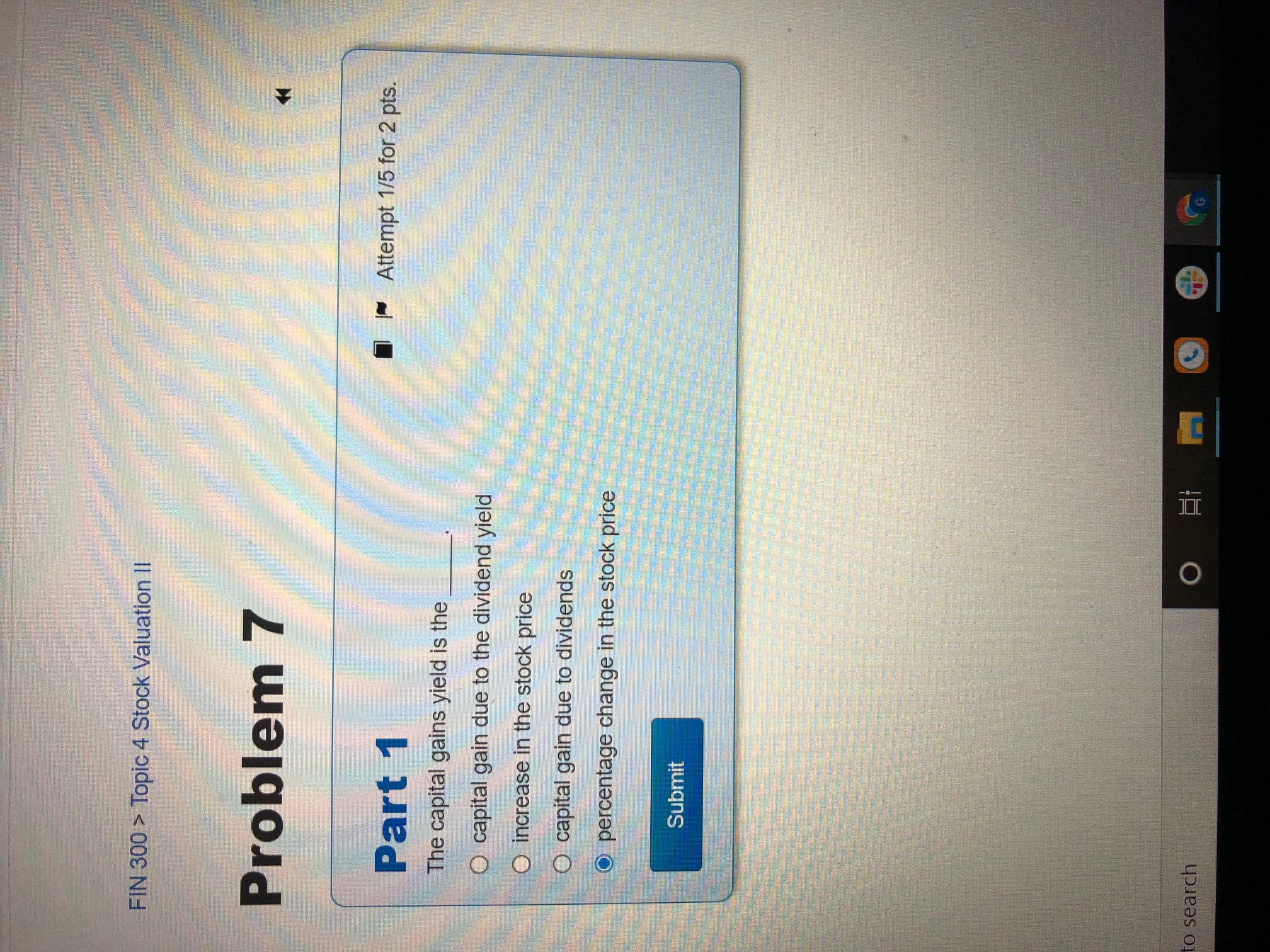

Image: www.chegg.com

Image: www.chegg.comTypes of Options Strategies

There are numerous options trading strategies, each with its own risk and reward profile. Some common strategies include:

- Covered Calls: A low-risk strategy that involves selling a call option on shares you already own.

- Cash-Secured Puts: Selling a put option that requires you to buy an underlying asset if the option is exercised.

- Naked Calls: Selling a call option without owning the underlying asset, potentially resulting in unlimited losses.

- Naked Puts: Similar to naked calls, but it involves selling a put option and requiring you to buy the underlying asset if the option is exercised.

Tips for Success

Beyond capital requirements, here are additional tips to enhance your options trading success:

- Educate Yourself: Thoroughly understand options trading concepts, strategies, and risk management techniques.

- Test Strategies: Practice trading with a paper money account before committing real capital.

- Start Small: Begin trading with small amounts of capital to manage risk and gain experience.

- Control Emotions: Avoid making trades based on emotions. Stay disciplined and stick to your trading plan.

- Seek Professional Advice: Consult with a financial advisor or experienced options trader for personalized guidance.

FAQs

-

Q: What is an option premium?

- A: The price you pay to purchase an option contract.

-

Q: How long do options contracts last?

- A: Most options contracts expire within a few months.

-

Q: Can you lose more than your investment in options trading?

- A: Yes, particularly with certain high-risk strategies like naked calls and naked puts.

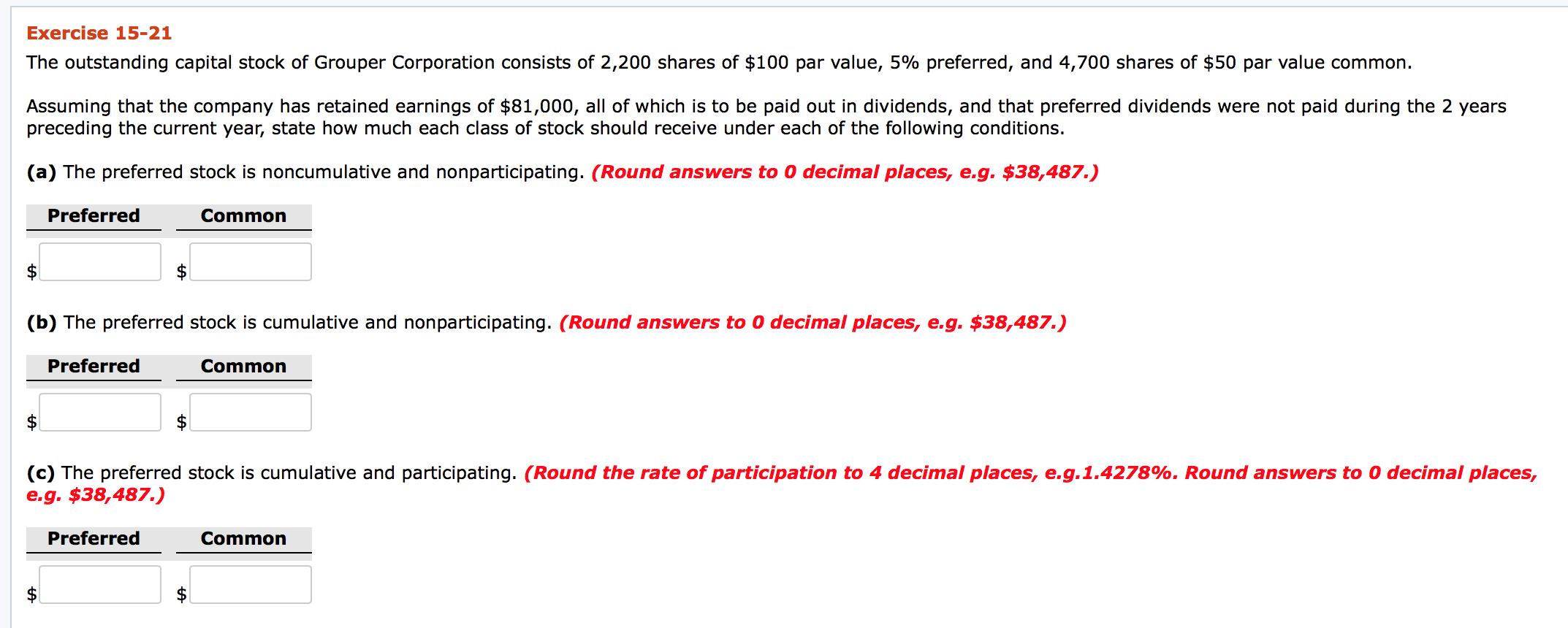

Capital Required To Return 80k Per Year Options Trading

Image: www.chegg.com

Conclusion

Determining the capital required to earn $80,000 annually through options trading is a multi-faceted consideration. By carefully assessing your trading strategy, managing risk effectively, and seeking professional advice, you can tailor your capital requirements to your individual circumstances and goals. Remember to approach options trading with education, discipline, and a realistic expectation of risks and rewards.

Are you interested in learning more about options trading and exploring its profitability potential?