Unleashing the Power of Volatility

Image: forextraininggroup.com

In the world of finance, volatility is akin to a double-edged sword. It can amplify market gains but also magnify losses. Enter the CBOE Volatility Index (VIX), the benchmark for volatility in the U.S. equity markets. While its swings can be unpredictable, savvy investors have discovered a lucrative avenue in trading VIX options.

What is the VIX?

The VIX measures the implied volatility of S&P 500 index options over the next 30 days. It serves as a barometer of market sentiment, indicating the level of fear and greed among investors. When the VIX spikes, it suggests investors are bracing for significant price swings, while low VIX values indicate complacency.

Enter the VIX Options

Options on VIX provide investors with a versatile instrument to capitalize on the volatility spectrum. These contracts grant the holder the right, but not the obligation, to buy (call options) or sell (put options) VIX futures at a predetermined price (strike price) on a specific expiration date.

Trading Strategies for Volatility’s Fluctuations

-

Buying Call Options: When market volatility is expected to increase, buying VIX call options can generate substantial profits. However, these options are more expensive and require careful timing.

-

Selling Put Options: Selling VIX put options allows investors to profit when volatility remains low or decreases. However, if volatility spikes, losses can be substantial.

-

Spreads: By combining two or more VIX options (such as a call and a put), traders can create spreads that offer a range of risk and reward profiles, depending on their market outlook.

Tips for Trading VIX Options

-

Research volatility trends: Understand the factors that drive volatility, such as economic indicators, geopolitical events, and market news.

-

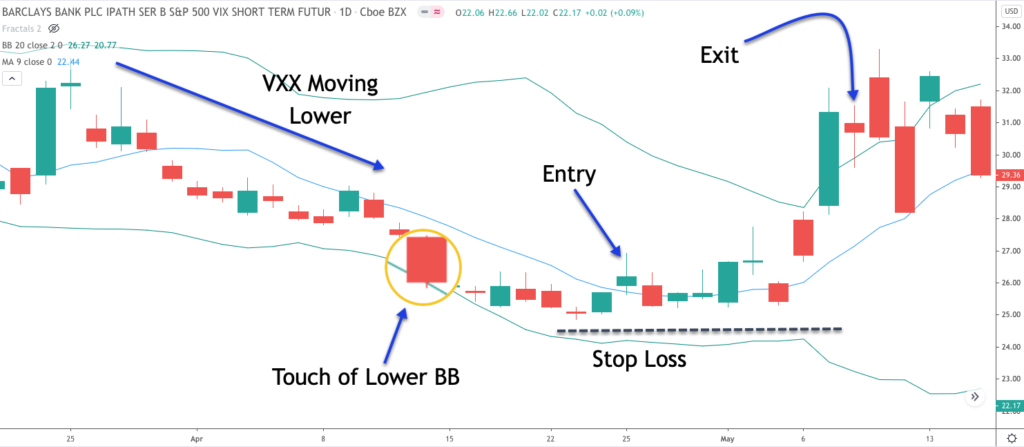

Set realistic expectations: VIX options can be volatile, so it’s crucial to have clear profit targets and stop-loss levels.

-

Manage your risk: Limit the number of contracts you trade and avoid using leveraged strategies. Preserve capital for the inevitable volatility swings.

-

Seek expert guidance: Consider consulting with a financial advisor to fully comprehend VIX options and develop a tailored trading strategy.

Conclusion

Trading VIX options offers a unique opportunity to profit from market volatility. By understanding the nuances of the index and applying sound trading strategies, investors can harness the power of volatility to achieve financial success. As the saying goes, “The VIX is a wild beast, but those who tame it conquer the markets.”

Image: www.seeitmarket.com

Trading Options On Vxx

Image: optionstradingiq.com