Introduction

The financial world is a complex and volatile place, where investors constantly seek ways to mitigate risks and maximize returns. In this ever-evolving market, the Trading Option Zone Index (TOZI) has emerged as a powerful tool for investors to gauge market uncertainty and make informed trading decisions. In this article, we will delve into the depths of the TOZI, exploring its history, concept, applications, and latest trends to provide you with a comprehensive guide to utilizing this invaluable index.

Image: www.shortform.com

Understanding the Trading Option Zone Index (TOZI)

The TOZI, developed by CBOE Global Markets, is a volatility index that measures the 30-day implied volatility of at-the-money options on the S&P 500 Index. It is designed to reflect market participants’ expectations of future market uncertainty and is often considered a “fear gauge” or “volatility barometer.” Higher TOZI values indicate increased market volatility, while lower values suggest a more stable market environment.

Historical Perspective and Significance

The TOZI was created in 2003 as a complement to the CBOE Volatility Index (VIX), which measures short-term volatility expectations. While the VIX focuses on 30-day volatility, the TOZI extends the time horizon to 60 days, providing a longer-term perspective on market uncertainty. This makes the TOZI particularly useful for investors seeking to assess potential risks over a longer investment horizon or for those engaged in long-term trading strategies.

Applications of the Trading Option Zone Index

The TOZI serves a wide range of applications in the financial markets:

-

Risk management: By monitoring the TOZI, investors can gauge potential market volatility and adjust their risk exposure accordingly. Higher TOZI values indicate increased volatility, prompting investors to consider strategies such as reducing leverage or hedging positions.

-

Trading strategies: Traders can utilize the TOZI to identify potential trading opportunities. For instance, when the TOZI rises, it may signal increased market volatility, offering opportunities for volatility-related trades such as buying volatility or selling out-of-the-money options.

-

Investor sentiment: The TOZI can serve as a barometer of investor sentiment towards future market conditions. Rising TOZI values may indicate growing fear and uncertainty among investors, while declining values suggest increased optimism and stability.

Image: www.storytel.com

Latest Trends and Developments

The TOZI has evolved over time to meet the changing needs of market participants:

-

TOZI-linked ETFs: Several ETFs have been launched that are linked to the TOZI, such as the ProShares Ultra VIX Short-Term Futures ETF (UVXY) and the VelocityShares 2x VIX Short-Term ETN (TVIX), providing investors with additional ways to access volatility-based strategies.

-

TOZI futures contracts: To meet demand for even longer-term volatility exposure, CBOE has introduced TOZI futures contracts, which allow traders to speculate on the future trajectory of the TOZI index.

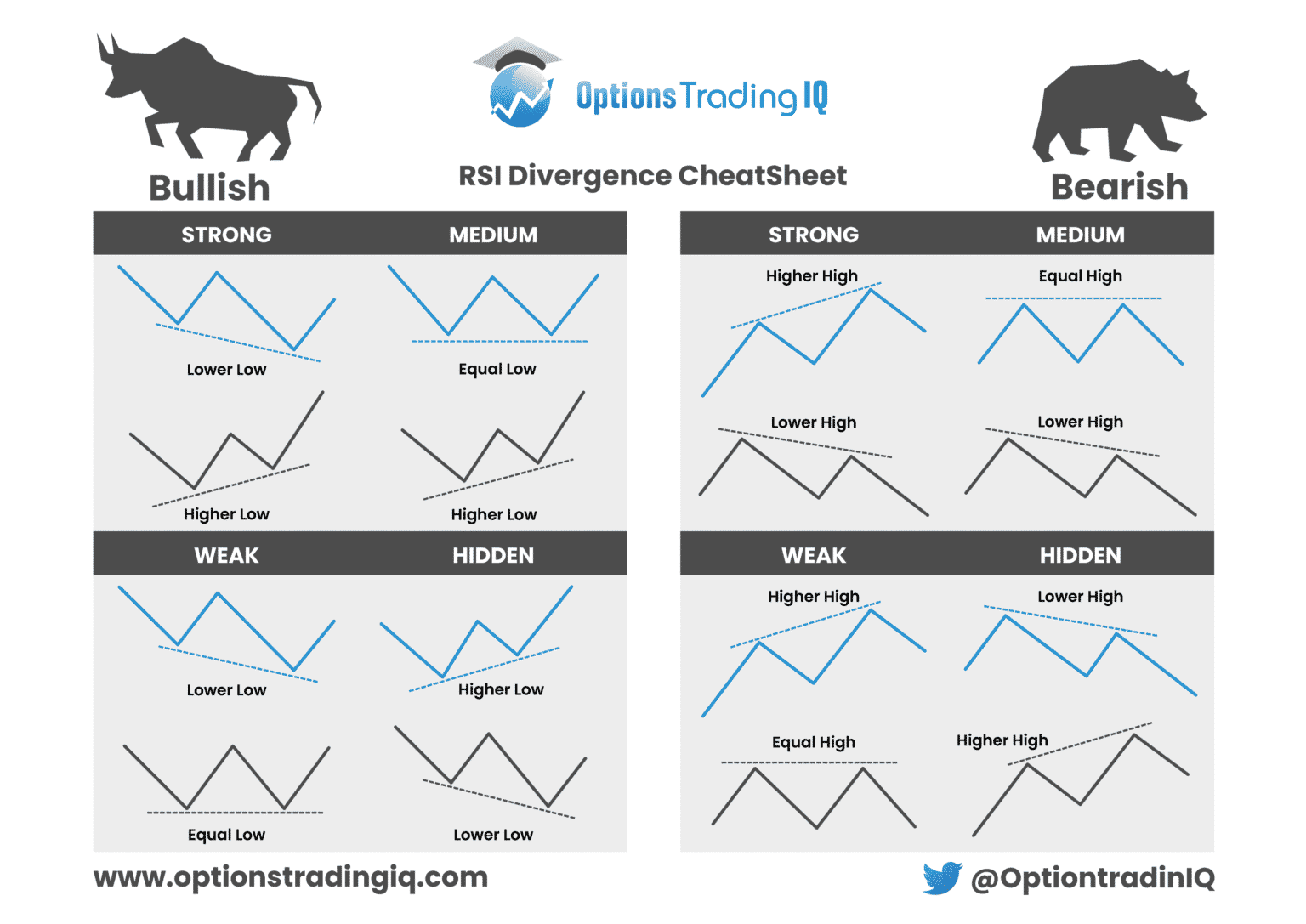

Trading Option Zone Index

Image: optionstradingiq.com

Conclusion

The Trading Option Zone Index (TOZI) is an invaluable tool that provides investors with a unique perspective on future market volatility. By understanding its concept, history, and applications, investors can effectively utilize the TOZI to mitigate risks, identify trading opportunities, and gauge investor sentiment. As the financial markets continue to evolve, the TOZI is expected to remain a vital instrument for investors seeking to navigate the complexities and uncertainties of the investment landscape.