Introduction

Are you curious about the world of options trading? Do you want to learn how to navigate this complex market and make informed decisions? If so, then you’ve come to the right place. In this comprehensive guide, we will explore everything you need to know about options trading, from its history and basic concepts to its real-world applications and latest trends. By the end of this article, you will have a solid understanding of options trading and be well-equipped to make smart decisions in this ever-evolving market.

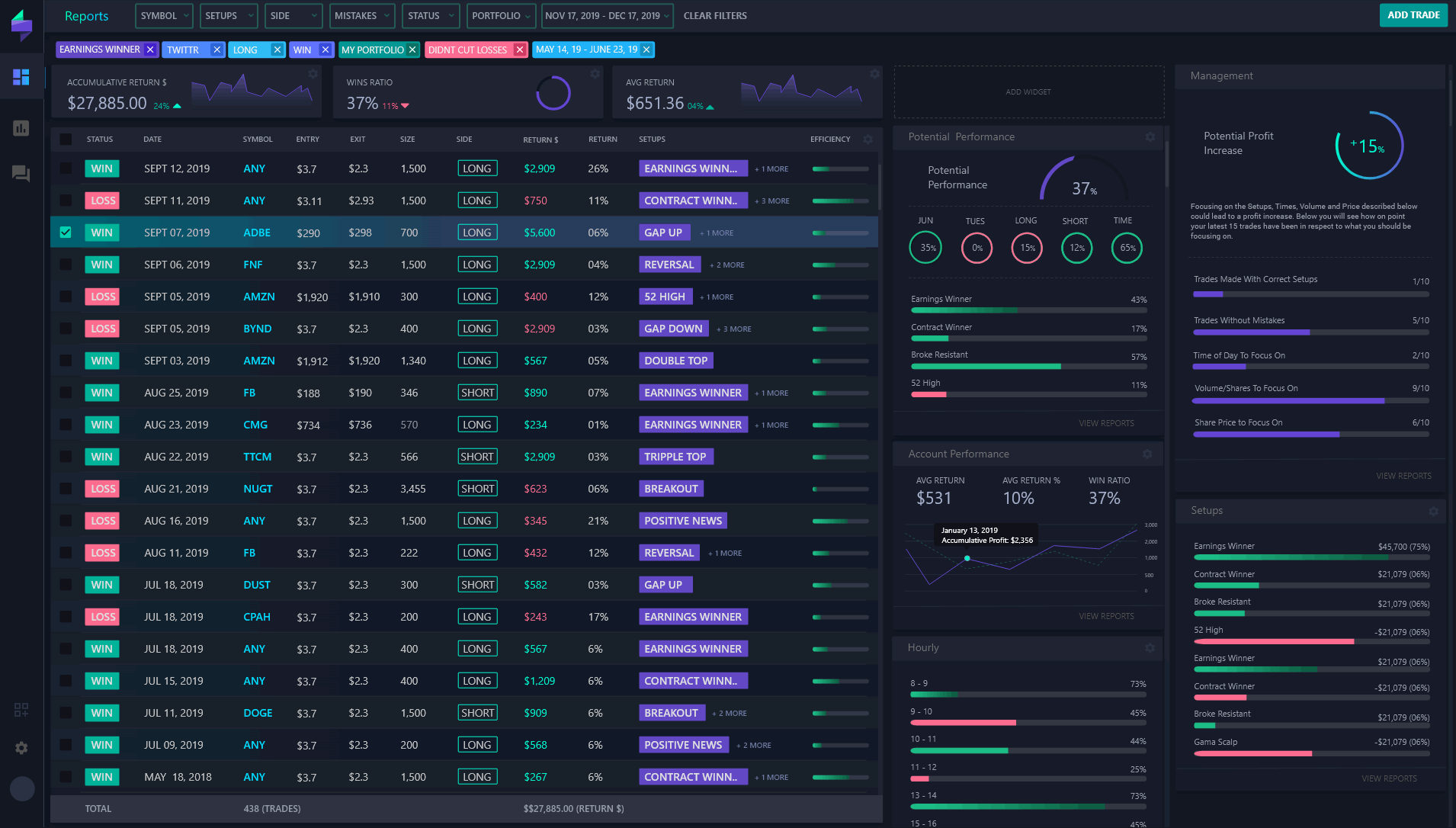

Image: tradersync.com

What is Options Trading?

Simply put, options trading is a strategy that gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price within a specified time frame. This flexibility makes options trading a versatile tool that can be used for various purposes, such as hedging against risk, speculating on price movements, and generating income.

History of Options Trading

The concept of options trading dates back to ancient Greece, where it was used to trade commodities such as wheat and oil. In the 17th century, options trading became formalized in Europe, and by the 19th century, it had become a popular investment strategy in the United States. The development of the Chicago Board Options Exchange (CBOE) in 1973 marked a significant milestone in the evolution of options trading, as it standardized the trading process and made it more accessible to individual investors.

Basic Concepts of Options Trading

To understand options trading, you need to be familiar with a few basic concepts:

Call Option: Gives you the right to buy an underlying asset at a specified price (the strike price) on or before a specified date (the expiration date).

Put Option: Gives you the right to sell an underlying asset at a specified price (the strike price) on or before a specified date (the expiration date).

Strike Price: The price at which you can buy or sell the underlying asset.

Expiration Date: The date on which the option contract expires.

Premium: The price you pay to the seller of an option contract in exchange for the right to buy or sell the underlying asset.

Image: appadvice.com

Real-World Applications of Options Trading

Options trading offers numerous possibilities in the real world. Here are some of its key applications:

Hedging against Risk: Options can be used to reduce the risk associated with owning or shorting an underlying asset. For example, an investor who owns a large number of shares in a particular stock could buy a put option to protect against a potential decline in the stock’s price.

Speculating on Price Movements: Options can also be used to speculate on the future price movements of an underlying asset. For instance, an investor who believes that a particular stock will rise in value could buy a call option to profit from the appreciation.

Generating Income: Options can be used to generate income through various strategies such as selling covered calls or cash-secured puts. These strategies involve selling options contracts while maintaining a certain level of ownership or cash collateral.

Latest Trends in Options Trading

The world of options trading is constantly evolving, with new trends and developments emerging regularly. Some of the latest trends include:

Increased Use of Technology: Advanced trading platforms and mobile apps have made options trading more accessible and convenient than ever before.

Growth of Volatility Trading: Options that provide exposure to market volatility have become increasingly popular as investors seek to capitalize on periods of market uncertainty.

Rise of Index Options: Options that track the performance of entire market indexes, such as the S&P 500 or the Nasdaq 100, have gained popularity due to their diversification benefits.

Options Trading Magazine

Conclusion

Options trading is a versatile and powerful financial tool that can be used for a variety of purposes. Whether you are new to options trading or a seasoned professional, it is essential to have a solid understanding of the basic concepts, real-world applications, and latest trends involved. With the knowledge gained from this comprehensive guide, you can confidently navigate the options market and make informed decisions that align with your investment goals. Remember, the key to success in options trading lies in continuous learning, prudent risk management, and adapting to the ever-changing市場动态。