Introduction

In today’s dynamic and complex world, the ability to navigate financial markets is paramount for those seeking to secure their financial futures. Options trading has emerged as a powerful tool in this realm, providing investors with the potential to enhance returns and manage risk. However, understanding option pricing and trading strategies can be daunting for beginners. Enter the Basic Black-Scholes Option Pricing and Trading, Revised Fourth, an indispensable resource for anyone seeking to navigate these uncharted waters.

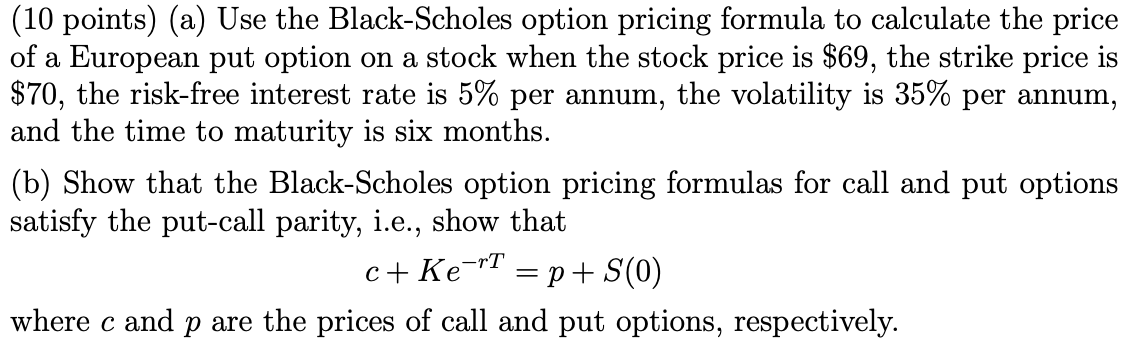

Image: www.chegg.com

The Black-Scholes model, developed by Fischer Black and Myron Scholes in 1973, has become the industry standard for pricing options. It provides a mathematical framework for determining the theoretical value of an option based on a host of factors, including the underlying asset’s price, time to expiration, volatility, and risk-free interest rate. This model has revolutionized options trading, enabling investors to make informed decisions about their trades.

Deep Dive into Basic Black-Scholes

The Revised Fourth Edition of Basic Black-Scholes Option Pricing and Trading offers a comprehensive and accessible guide to this essential model. Written by an expert team of financial professionals, this book unravels the intricacies of option pricing and trading strategies in a straightforward and engaging manner.

Delving into the history, foundations, and practical applications of the Black-Scholes model, the book provides readers with a solid understanding of its underlying principles. It explains the impact of key parameters such as the strike price, time value, and volatility on option pricing.

Beyond theoretical concepts, the book also explores the practical applications of the Black-Scholes model in real-world trading. Readers will gain insights into how to use the model to determine the fair value of an option, construct trading strategies, and manage portfolio risk.

Expert Insights and Actionable Tips

The Revised Fourth Edition of Basic Black-Scholes Option Pricing and Trading is not merely an academic treatise; it is a practical guidebook for investors of all levels. The book features insights from seasoned market experts who share their knowledge and strategies for successful option trading.

These experts offer actionable tips and strategies that readers can implement in their own trading decisions. They cover topics such as choosing the right options for your needs, managing risk, and maximizing returns.

Image: www.chegg.com

Basic Black-Scholes Option Pricing And Trading Revised Fourth

Compelling Conclusion

In an ever-evolving financial landscape, the ability to navigate option pricing and trading is more critical than ever. The Basic Black-Scholes Option Pricing and Trading, Revised Fourth Edition, empowers readers with the knowledge and skills necessary to make informed and profitable decisions.

Whether you are a seasoned trader or just starting your journey into options trading, this book is an invaluable resource. It provides a comprehensive understanding of the Black-Scholes model, practical guidance from experts, and actionable tips that will help you navigate the world of options trading with confidence.