Ace Your Option Trading Interview

As someone aspiring to succeed in option trading, you’re likely well aware of the significance of the Black-Scholes model. This indispensable formula provides the theoretical value of options, equipping traders with crucial decision-making capabilities. If you’re preparing for an interview related to option trading, chances are high that you’ll encounter questions pertaining to Black-Scholes.

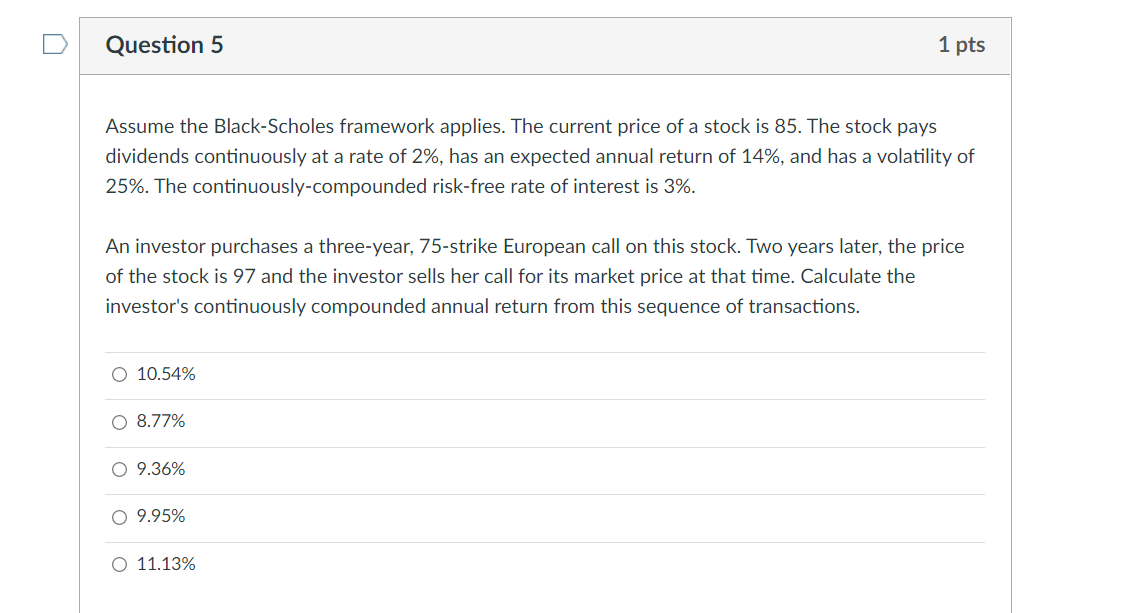

Image: www.chegg.com

To help you excel in your interview and showcase your expertise, we’ve compiled a comprehensive guide encompassing all the nitty-gritty details of the Black-Scholes model. Let’s dive right into it.

Understanding the Black-Scholes Model

The Black-Scholes option pricing model is a mathematical formula developed by Fischer Black and Myron Scholes in 1973. It calculates the theoretical value of an option by factoring in parameters like stock price, strike price, time to expiration, risk-free interest rate, and volatility. This model forms the cornerstone of modern option pricing and plays a vital role in option trading strategies.

Components of the Black-Scholes Model

To fully grasp the Black-Scholes model, it’s essential to understand its underlying components:

- Stock Price (S): The current price of the underlying stock.

- Strike Price (K): The price at which the option can be exercised.

- Time to Expiration (T): The number of days or years until the option expires.

- Risk-Free Interest Rate (r): The prevailing yield on a risk-free investment, such as a Treasury bill.

- Volatility (σ): A measure of the stock’s price fluctuations, typically expressed as annualized standard deviation.

Applying the Black-Scholes Model

Using the Black-Scholes model to determine option value involves plugging the aforementioned parameters into the formula. This calculation can be performed using financial calculators, Excel spreadsheets, or specialized software. The resulting value represents the theoretical price of the option based on the input parameters.

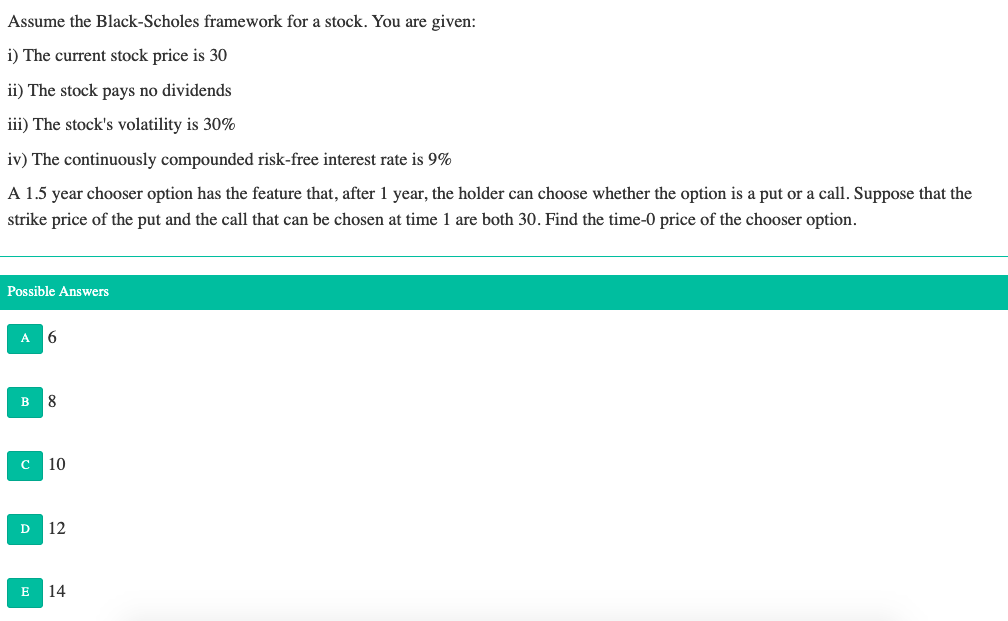

Image: www.chegg.com

Interview Preparation Tips

To prepare for Black-Scholes-related interview questions, consider the following tips:

- Comprehend the Basics: Ensure a thorough understanding of the Black-Scholes model, its components, and its applications in option trading.

- Practice Calculations: Practice applying the Black-Scholes formula using different scenarios. This will boost your confidence and demonstrate your proficiency.

- Discuss Limitations: Be aware of the assumptions and limitations of the Black-Scholes model. Discuss these limitations during the interview to showcase your depth of knowledge.

- Relate to Real-World Trading: Connect your understanding of the Black-Scholes model to practical option trading strategies and decision-making.

FAQ on Black-Scholes Model

Q: Is the Black-Scholes model always accurate?

A: While the Black-Scholes model provides a solid theoretical framework, it may not always be entirely accurate in practice due to factors such as market inefficiencies and unpredictable market dynamics.

Q: How do I use the Black-Scholes model to make trading decisions?

A: By comparing the model’s calculated value to the current market price of an option, traders can make informed decisions regarding whether to buy, sell, or hold an option based on perceived overvaluation or undervaluation.

Black Scholes Option Trading Interview Question

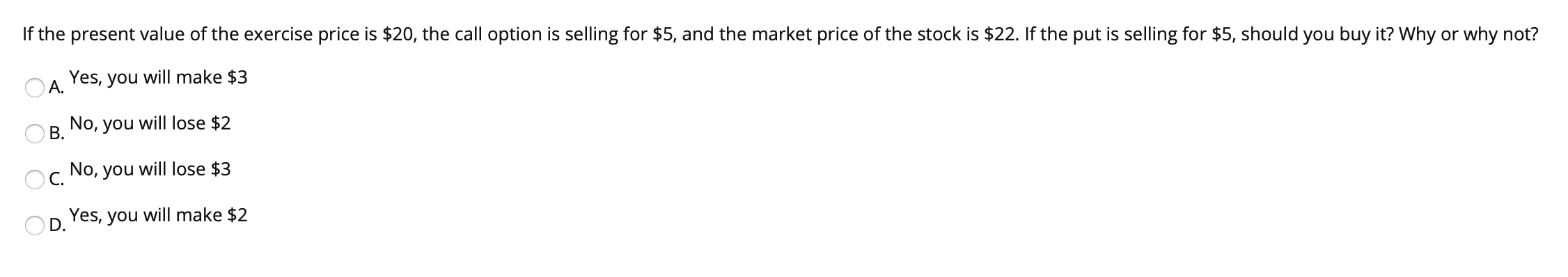

Image: www.chegg.com

Conclusion

Mastering the Black-Scholes option trading interview question is crucial for success in the competitive world of option trading. By embracing the insights provided in this comprehensive guide, you can confidently navigate interview questions, demonstrate your expertise in this fundamental model, and increase your chances of landing your dream job in the field.

Are you eager to explore the world of option trading and conquer the Black-Scholes model? Share your thoughts and questions in the comments section below, and let’s continue the conversation.