In the ever-evolving financial landscape, the ability to identify and manage risk has become paramount. Among the diverse financial instruments available, interest rate options stand out as a powerful tool for risk mitigation and profit generation. If you’re eager to delve into the world of trading in interest rate options, this article will serve as your comprehensive guide, navigating you through its complexities with clarity and precision.

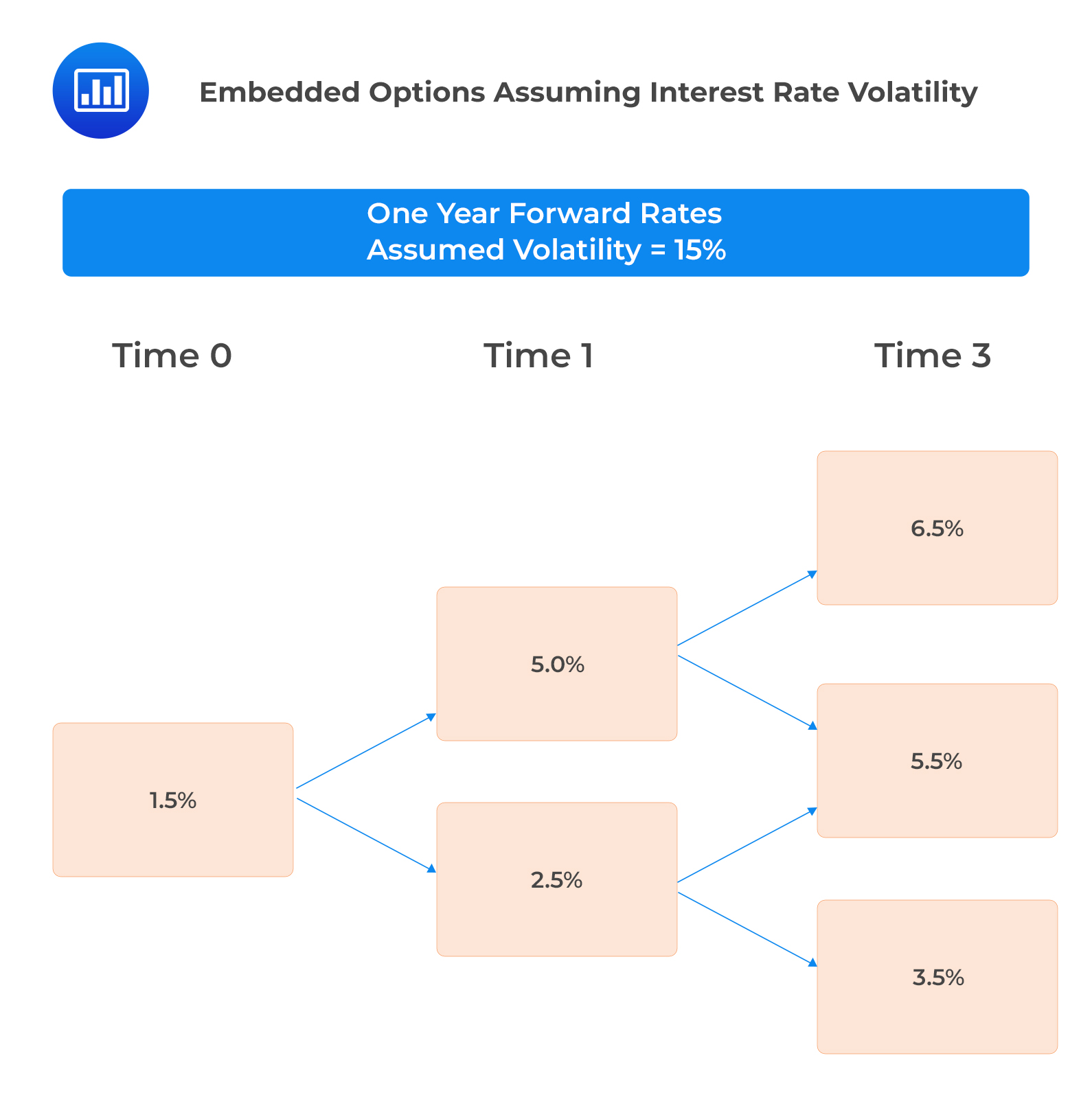

Image: analystprep.com

Unveiling the Essence of Interest Rate Options

Interest rate options, in essence, are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying interest rate security at a predetermined price within a specified time frame. These contracts derive their value from the underlying interest rate’s fluctuations, allowing traders to effectively hedge against interest rate risk or position themselves to capitalize on anticipated rate movements.

Unlocking the Applications and Advantages

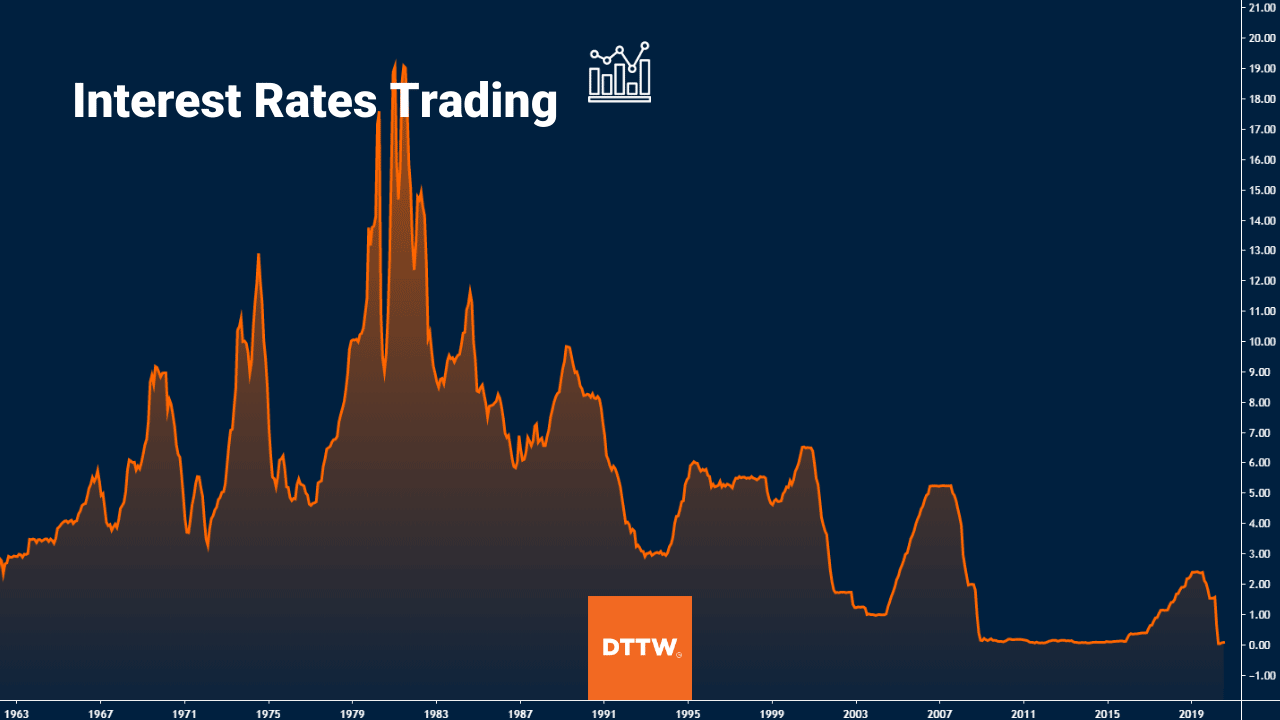

Trading in interest rate options offers a versatile array of benefits for both investors and corporations. By utilizing these contracts, investors can protect their portfolios from interest rate volatility, enhance their income-generating strategies, and capitalize on market inefficiencies. Corporations, on the other hand, can employ interest rate options to manage their interest rate exposure and optimize their borrowing and lending costs, ensuring financial stability in dynamic market conditions.

Navigating the Types and Strategies

The realm of interest rate options encompasses various types, each tailored to specific market conditions and objectives. Call options grant the holder the right to buy, while put options confer the right to sell the underlying interest rate security at the specified strike price. Furthermore, traders can employ diverse strategies, such as bull spreads, bear spreads, and straddles, to fine-tune their market positioning and manage risk.

Image: www.slideshare.net

Mastering the Mechanics: Hedging and Speculation

Understanding the mechanics of hedging and speculation is crucial for successful trading in interest rate options. Hedging involves using options to offset the risk associated with an underlying asset, effectively minimizing exposure to adverse market fluctuations. Speculation, on the other hand, involves taking calculated risks with the intent of profiting from market movements. By mastering these techniques, traders can navigate market dynamics and pursue both risk mitigation and profit generation.

Trading Tips and Expert Insights

To empower you on your trading journey, we’ve assembled a collection of expert insights and practical trading tips. Remember to conduct thorough research, identify reliable brokers, and maintain a disciplined approach to risk management. Moreover, stay abreast of market trends, geopolitical events, and economic indicators that may influence interest rates. By adhering to these guidelines, you’ll enhance your decision-making process and navigate market complexities with confidence.

Embracing the Future of Interest Rate Options

As technology continues to advance, the landscape of interest rate options trading is poised for further innovation. Digital platforms and algorithmic trading strategies are transforming the way traders interact with these contracts. By embracing these advancements, you’ll stay ahead of the curve and harness the full potential of interest rate options in the years to come.

Trading In Interest Rate Options

Image: www.daytradetheworld.com

Conclusion

Trading in interest rate options is a multifaceted and rewarding endeavor that requires a deep understanding of market dynamics, risk management techniques, and the nuances of these financial instruments. Whether you’re seeking to mitigate risk or pursue profit potential, this comprehensive guide has equipped you with the essential knowledge and insights. Remember to exercise due diligence, consult with experts, and continually expand your knowledge to maximize your success in this ever-evolving financial space.