Introduction

In the world of options trading, the Black-Scholes option calculator has become an indispensable tool. This sophisticated instrument empowers traders with the ability to accurately calculate option prices and make informed trading decisions. Join us as we delve into the intricacies of the Black-Scholes option calculator, mastering the techniques that will unlock your options trading potential.

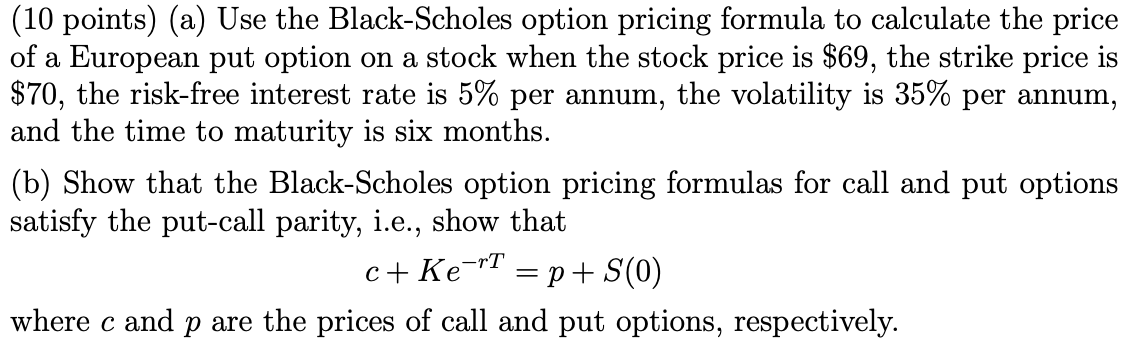

Image: www.chegg.com

As a seasoned options trader, I have witnessed firsthand the transformative power of the Black-Scholes option calculator. Its precision and accuracy have consistently guided my trading strategies, allowing me to navigate market complexities with confidence. In this comprehensive guide, I will share my insights and expertise, helping you harness the full capabilities of the Black-Scholes option calculator.

Understanding the Black-Scholes Option Calculator

The Mechanics of Black-Scholes

The Black-Scholes option pricing model was developed by Fischer Black and Myron Scholes in 1973. It relies on mathematical formulas to determine the fair value of an option based on several key variables: the underlying asset price, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset. These inputs are then integrated into the Black-Scholes formula, yielding an accurate estimate of the option’s price.

Key Assumptions and Limitations

It’s important to note that the Black-Scholes model assumes several key factors: that the underlying asset’s price follows a lognormal distribution, that markets are efficient and information is symmetrically distributed, and that there are no transaction costs or taxes. While these assumptions may not always hold true in reality, the Black-Scholes model generally provides a reliable approximation of option prices.

Image: github.com

Utilizing the Black-Scholes Option Calculator for Strategic Trading

Benefits of the Black-Scholes Option Calculator

The Black-Scholes option calculator offers a wealth of benefits to option traders:

- Accurate Option Pricing: It provides precise calculations of option prices, enabling traders to make informed decisions based on fair value.

- Risk Assessment: The calculator allows traders to estimate the potential risks associated with different options strategies, helping them manage their risk exposure.

- Informed Trading Strategies: With accurate price calculations, traders can develop and implement effective options trading strategies that align with their investment goals.

Expert Tips for Maximizing Results

To harness the full potential of the Black-Scholes option calculator, consider the following expert tips:

- Verify your Inputs: Before using the calculator, double-check the accuracy of your input variables, particularly the volatility estimate.

- Consider Market Sentiment: While the Black-Scholes model relies on mathematical formulas, it does not factor in market sentiment. Incorporating this information can enhance your trading decisions.

- Monitor Market Conditions: Continuously monitor market conditions, including volatility and interest rates, as they can significantly impact option prices.

Frequently Asked Questions About Black-Scholes Option Calculator Trading

To clarify common queries, here is a concise FAQ about Black-Scholes option calculator trading:

- Q: How accurate is the Black-Scholes model?

A: The Black-Scholes model generally provides reliable estimates of option prices, but it’s important to keep in mind its underlying assumptions. - Q: Can I use the Black-Scholes calculator for any option?

A: The Black-Scholes model is only applicable to European-style options. For American-style options, other pricing models should be considered. - Q: Is the Black-Scholes calculator free to use?

A: Many online Black-Scholes calculators are free to use. However, some advanced calculators with additional features may require a subscription or payment.

Black Scholes Option Calculator Trading Today

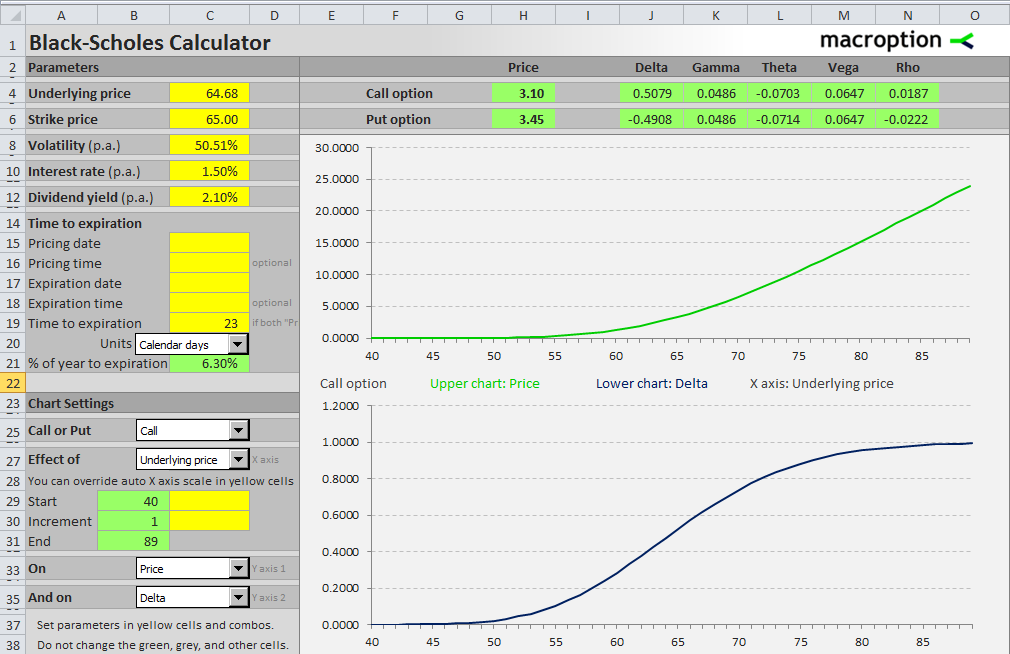

Image: www.macroption.com

Conclusion

In the realm of options trading, the Black-Scholes option calculator stands as an indispensable tool. Its ability to accurately determine option prices and assess risk empowers traders to navigate the market with precision and confidence. By harnessing the knowledge and insights shared in this guide, you will gain an edge, unlocking the potential of the Black-Scholes option calculator for profitable trading.

Are you ready