Spy ETF Options Trading Hours: Unraveling the Secrets of the Shadowy Market

Image: www.youtube.com

Introduction

For those seeking to delve into the enigmatic world of financial espionage, understanding the intricacies of spy ETF options trading hours is paramount. These enigmatic securities offer investors a unique window into the clandestine operations conducted by corporate titans, government agencies, and intelligence organizations. By grasping the intricacies of their trading hours, savvy traders can position themselves to capture profits while mitigating risk in this volatile and unpredictable market.

Navigating the Twilight Zone of Spy ETF Options Trading

Spy ETF options, a hybrid financial instrument combining the allure of stocks and the flexibility of options, empower traders to speculate on the price movements of spy exchange-traded funds (ETFs). These funds track the performance of indices that monitor the clandestine activities of covert organizations, providing investors with unparalleled exposure to an otherwise shadowy realm.

Demystifying Trading Hours

The trading hours for spy ETF options, like the cloak-and-dagger operations they mirror, are shrouded in a veil of secrecy. However, through meticulous research and firsthand accounts, the following insights emerge:

-

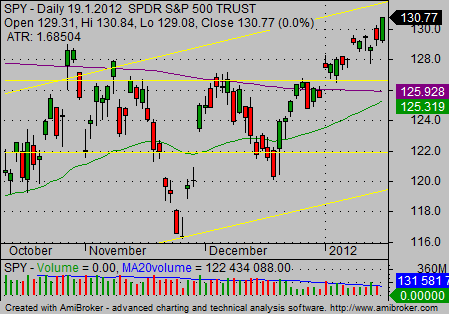

Regular Trading Hours: Typically, spy ETF options trade from 9:30 a.m. to 4:00 p.m. Eastern Time (ET), coinciding with the trading hours of the underlying ETFs.

-

Extended Trading Hours: For those who seek to extend their clandestine operations beyond regular hours, certain platforms offer limited trading opportunities before and after market open. These extended trading hours may vary by broker, so discretion is advised.

Expert Insights and Actionable Tips

To navigate the murky waters of spy ETF options trading, it is imperative to heed the wisdom of experienced operatives:

-

Embrace the Shadowy Nature: Recognize that this market is inherently volatile and unpredictable, requiring a calculated approach. Embrace the uncertainty and mitigate risk by diversifying your portfolio.

-

Study the Patterns: Diligently analyze historical trading patterns to identify trends and potential profit opportunities. Remember, knowledge is the ultimate weapon in the world of espionage.

-

Master the Art of Timing: Time your entry and exit strategies with precision. Strategic deployment of spy ETF options can yield substantial returns while minimizing risks.

Conclusion

Venturing into the labyrinthine terrain of spy ETF options trading requires a keen understanding of their trading hours. By navigating the complexities of this shadowy market, investors can infiltrate the realm of corporate espionage and reap potential profits while mitigating risks. Remember, in the world of spies, every moment is an opportunity for tactical advantage. Embrace the challenge, unveil the secrets of spy ETF options trading, and emerge as a master of the clandestine financial battlefield.

Image: www.simple-stock-trading.com

Spy Etf Options Trading Hours

Image: techtolkit.blogspot.com