Introduction

In the dynamic realm of financial markets, shrewd investors seek innovative strategies to navigate volatility. One instrument that has gained prominence in this arena is the option volatility index (VIX), a benchmark that measures the market’s expectation of future volatility in the S&P 500. Understanding this index and its trading intricacies can empower investors to make informed decisions in the face of market uncertainty.

Image: www.instafxng.com

The Volatility Index (VIX), often referred to as the “fear gauge,” holds significant relevance for investors. It serves as a gauge of the market’s perception of short-term volatility over the next 30 days. Crunched from the option premiums of S&P 500 options, the VIX mirrors market participants’ sentiment towards the future market terrain. When the VIX climbs, it signals increasing market anxiety and anticipation of heightened swings. Conversely, a declining VIX suggests waning volatility expectations, presenting a more stable market outlook.

Historical Context of the VIX

The introduction of the VIX in 1993 marked a watershed moment in the financial world. Preceding its inception, investors lacked a reliable metric to gauge market volatility, a crucial indicator for risk management and investment decisions. The VIX swiftly emerged as a beacon of clarity, providing unparalleled insights into the market’s perception of uncertainty.

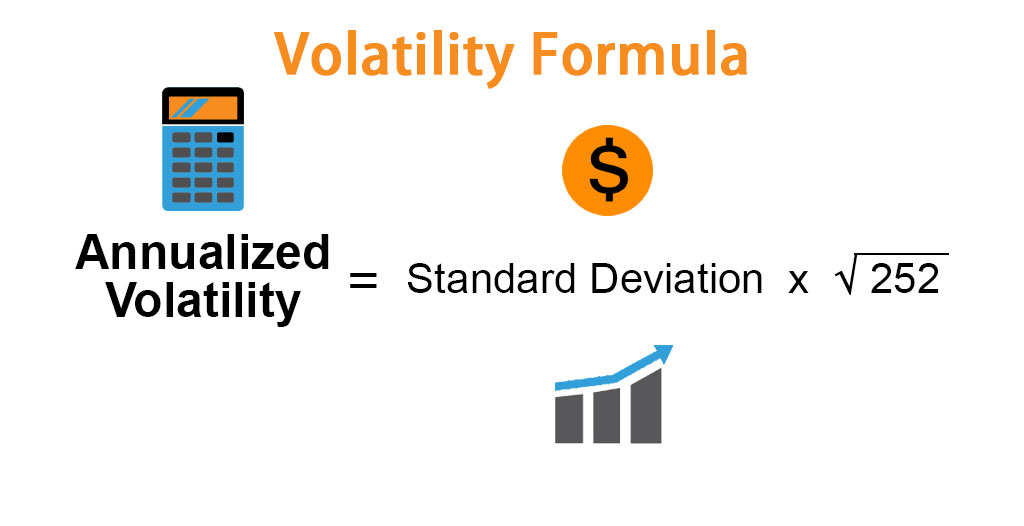

Calculation Methodology

The VIX calculation involves a complex process. The Chicago Board Options Exchange (CBOE) compiles real-time option premium data from S&P 500 index options with various strike prices and expiration dates. This data feeds into a sophisticated mathematical model that weights the option premiums to generate a single value representing the expected volatility for the subsequent 30 trading days.

Interpretation and Applications of the VIX

Once calculated, the VIX becomes a powerful tool for investors. It conveys valuable market sentiment information, allowing investors to make informed judgments about the potential level of turbulence in the market. Higher VIX readings signify elevated market anxiety and heightened volatility expectations, while lower VIX readings indicate reduced market jitters and anticipation of smoother sailing ahead. For investors, this information is a double-edged sword. On one hand, it helps them brace for potential risks and adjust their portfolios accordingly. On the other hand, it can be a catalyst for tactical trading, such as capitalizing on market overreactions or profiting from volatility spikes.

Image: www.educba.com

Trading Volatility: Strategies and Techniques

The VIX opens up an array of trading opportunities for investors seeking to profit from market volatility. Numerous strategies and techniques have emerged, each catering to specific risk appetites and investment horizons.

-

Direct VIX Trading: Through VIX futures and options, traders can speculate on the level of future volatility, aiming to profit from significant deviations in VIX movements.

-

Volatility ETFs: Exchange-traded funds (ETFs) have emerged as convenient tools for investors looking to gain exposure to market volatility. Volatility-tracking ETFs, such as VXX and UVXY, offer a diversified method to tap into volatility trends.

-

Volatility Trading Spread: Savvy investors can employ volatility trading spreads, which entail purchasing one VIX derivative (future or option) while simultaneously selling another with a different expiration date or strike price. Such strategies can offer reduced risk exposure while potentially capturing volatility fluctuations.

Advancements and Innovations

The financial markets’ evolution has witnessed perpetual advancements in VIX trading. The development of volatility indices tailored to various asset classes, such as the VIX for the Nasdaq 100 (VXN) and the VIX for gold (GVZ), has catered to the needs of diverse investors seeking exposure to specific markets.

Trading Option Volatility Index

Image: steadyoptions.com

Conclusion

The option volatility index (VIX) stands as a potent market barometer, mirroring investors’ expectations of future market turmoil. Its versatile applications and the array of trading strategies it facilitates empower investors to navigate the ever-shifting waters of financial markets. By comprehending the VIX’s intricacies and employing appropriate trading techniques, investors can make informed decisions, position themselves for market fluctuations, and harness volatility as a potential source of profit.