Unveiling the Secrets of the VIX

In the tumultuous ocean of financial markets, fear serves as an ever-present force, guiding investors’ decisions like a beacon guiding ships through treacherous waters. The Cboe Volatility Index, popularly known as the VIX, has ascended as the quintessential measure of this market apprehension, acting as a “barometer of fear” for savvy investors. Trading options on the VIX empowers traders with the ability to capitalize on market volatility, unlocking significant return potential amidst periods of uncertainty.

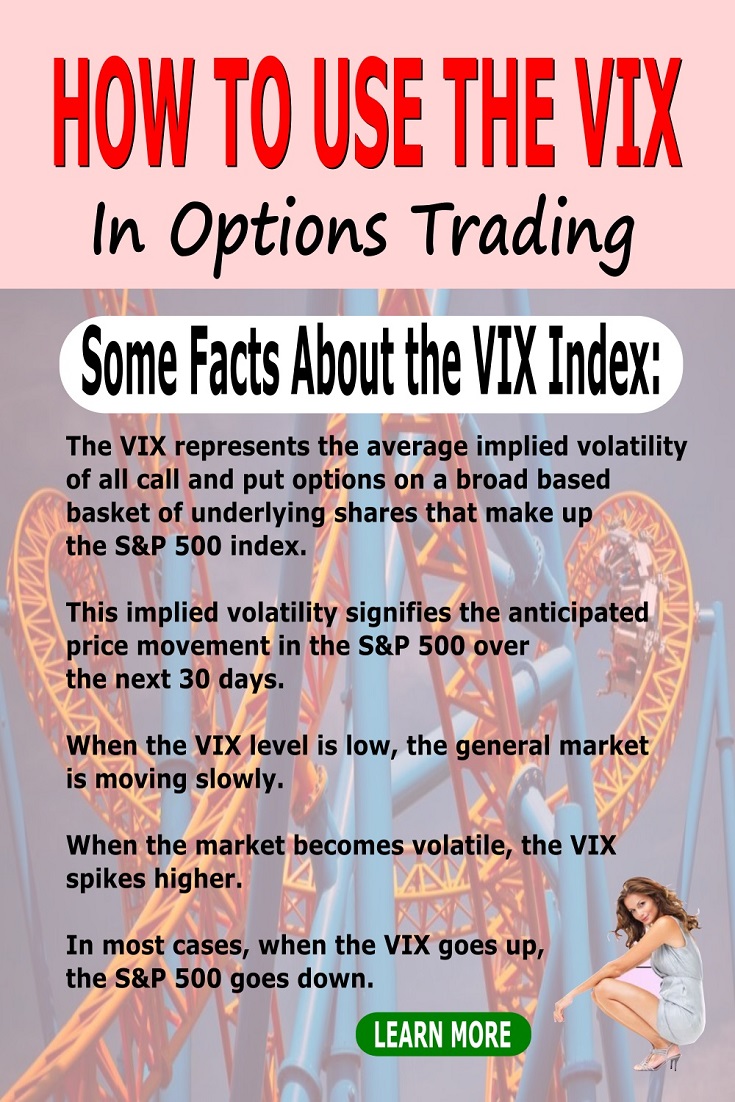

Image: www.options-trading-mastery.com

A Glimpse into the VIX’s Genesis

Conceived in 1993, the VIX originated as a tool designed to aid options traders in gauging the implied volatility of the S&P 500 index. It measures the market’s perception of risk and uncertainty over the next 30 days, utilizing a complex formula that analyzes the prices of options contracts. The higher the VIX, the greater the perceived volatility, reflecting an elevated level of fear and uncertainty among market participants.

A Deeper Understanding of VIX Options

Trading options on the VIX presents traders with an array of strategic opportunities. By purchasing VIX call options, investors can speculate on rising volatility, anticipating periods of increased market turbulence. On the flip side, selling VIX put options allows traders to profit from a decline in volatility, betting on calmer market conditions.

Mastering the Nuances of VIX Trading

Navigating the realm of VIX options trading requires a keen understanding of several crucial aspects. Seasoned traders emphasize the importance of thorough research, urging aspiring investors to delve into the underlying dynamics of the VIX and its historical behavior. Moreover, selecting appropriate strike prices and understanding the unique characteristics of VIX options are essential for maximizing trading success.

Image: www.tradingview.com

Expert Insights and Practical Strategies

Renowned financial analyst Mark Sebastian underscores the significance of incorporating technical analysis into VIX trading strategies. By scrutinizing historical charts and identifying key patterns, traders can glean valuable insights into potential market movements. Additionally, Sebastian advocates for position sizing, employing a risk management approach that aligns with one’s financial goals and tolerance.

Trading Options On The Vix

Image: www.quantifiedstrategies.com

Conclusion: Embracing the Challenge, Seizing the Opportunity

Trading options on the VIX presents a compelling opportunity for investors seeking to profit from market volatility. By harnessing the power of this fear gauge, traders can skillfully navigate uncertain market conditions, unlocking the potential for exceptional returns. However, it is imperative to approach VIX trading with a comprehensive understanding of its complexities, a robust trading plan, and the unwavering discipline to manage risk effectively.