Introduction

Are you ready to delve into the exciting and lucrative world of option trading? This comprehensive guide will empower you with the knowledge and strategies to succeed. Whether you’re a seasoned trader or just curious about this alternative investment avenue, this article will unravel the mysteries and set you on the path to financial growth.

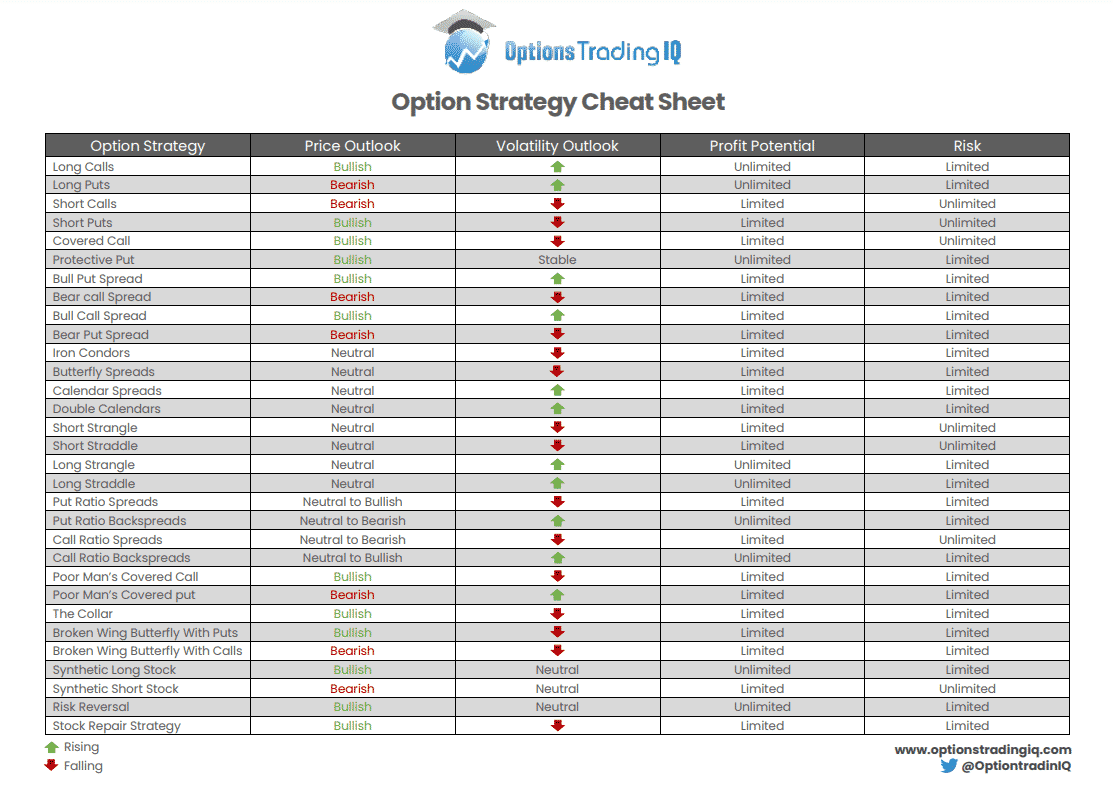

Image: optionstradingiq.com

Options trading involves the buying and selling of option contracts, which give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. The versatile nature of options allows you to manage risk, enhance returns, or speculate on price movements.

Foundations of Option Trading

Options contracts have three key components:

- Underlying asset: This could be a stock, index, commodity, or currency.

- Strike price: The price at which you can buy or sell the underlying asset.

- Expiration date: The date when the option contract expires.

There are two main types of options:

- Calls: Grants you the right to buy the underlying asset.

- Puts: Grants you the right to sell the underlying asset.

Understanding Option Premiums

Option contracts are not free; they come with a price called the premium. The premium value represents the cost of purchasing the option. It is influenced by several factors such as:

- The difference between the strike price and the underlying asset’s current market price.

- The time remaining until the expiration date.

- The volatility of the underlying asset.

Option Trading Strategies

The beauty of option trading lies in its versatility. You can employ various strategies depending on your risk tolerance and market outlook, including:

- Covered calls: Selling a call option against a stock you own.

- Naked calls: Selling a call option without owning the underlying asset.

- Long calls: Buying a call option with the expectation that the underlying asset’s price will rise.

- Short calls: Selling a call option with the expectation that the underlying asset’s price will fall.

Image: www.e-futures.com

Risk Management and Hedging

Option trading comes with inherent risks. However, by employing proper risk management techniques, you can mitigate potential losses. These techniques include:

- Protective puts: Buying a put option to hedge against a long stock position.

- Stop-loss orders: Placing an order to automatically sell an option if it falls below a certain price.

- Diversification: Spreading your investments across multiple options contracts and asset classes.

Expert Insights

Renowned option trader Nassim Nicholas Taleb emphasizes the importance of understanding probability and risk management. He advises traders to focus on probabilities rather than potential outcomes.

Another expert, Mark Fisher, advocates for a systematic approach to option trading. He suggests using statistical models to analyze market trends and make informed decisions.

Actionable Tips

To succeed in option trading, consider these actionable tips:

- Start small: Don’t overextend yourself. Begin with a small amount of capital that you’re comfortable risking.

- Educate yourself: Continuously learn about option trading theories, strategies, and risk management techniques.

- Use online resources: Several platforms provide real-time data, trading tools, and educational materials.

Option Trading Lessons

Image: www.pinterest.com

Conclusion

Option trading presents a myriad of opportunities for financial growth. By grasping the concepts outlined in this guide, implementing robust risk management strategies, and seeking expert guidance when needed, you can navigate this complex market and reap the rewards. Remember, trading involves both potential profits and risks, so approach it with informed decisions and a well-crafted plan. Embrace the learning curve, stay vigilant, and enjoy the journey towards financial empowerment.