I remember when I first started trading options, I was like a deer caught in the headlights. There was so much to learn and it was all so confusing. But I was determined to figure it out. So I read books, I took courses, and I practiced relentlessly. And after a while, it started to click.

Image: blog.quantinsti.com

Options Trading: A Powerful Tool for Growth

Options trading is a powerful tool that can be used to generate income, hedge risk, and grow your wealth. But it’s also a complex and risky strategy, so training is essential to help navigate.

Types of Options Trading

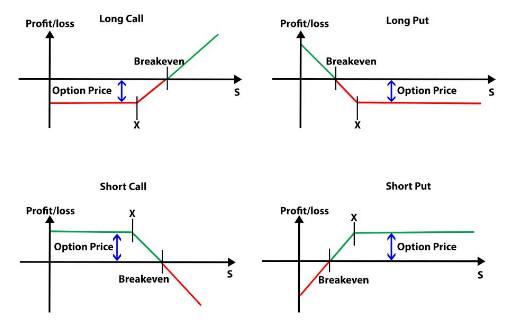

There are two main types of options trading: buying and selling. When you buy an option, you are essentially purchasing the right to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a certain price on or before a certain date. When you sell an option, you are essentially selling the right to someone else to buy or sell the underlying asset at that price.

The Greeks: Understanding Option Pricing

Understanding the Greeks is critical. The Greeks are a set of metrics that measure the sensitivity of an option’s price to changes in the underlying asset’s price, volatility, time to expiration, and interest rates.

Image: www.pinterest.es

How to Get Started with Options Trading Training

Online Courses

There are many online courses that can teach you the basics of options trading. These courses can be a great way to get started because they are often self-paced and affordable.

Live Workshops

Live workshops are another great way to learn about options trading because you can ask questions and get feedback from a live instructor. However, these workshops can be more expensive than online courses.

Paper Trading

Paper trading is a great way to practice options trading without risking any real money. With paper trading, you can trade virtual options and track your progress.

Tips for Successful Options Trading

Start Small

When you first start trading options, it’s important to start small. This will help you get a feel for the market and avoid losing too much money.

Understand the Risks

Options trading is a risky strategy, so it’s important to understand the risks involved before you get started. Make sure you do your research and understand the potential for losses.

FAQs About Options Trading

Q: What is the difference between a call option and a put option?

A: A call option gives the buyer the right to buy an underlying asset at a certain price on or before a certain date. A put option gives the buyer the right to sell an underlying asset at a certain price on or before a certain date.

Q: What are the Greeks?

A: The Greeks are a set of metrics that measure the sensitivity of an option’s price to changes in the underlying asset’s price, volatility, time to expiration, and interest rates.

Options Trading Traning

Image: tradersexclusive.com

Conclusion

Options trading can be a powerful tool for growth, but is also a complex and risky strategy. That’s why it’s important to get the right training before you get started. By following the tips in this article, you can increase your chances of success and achieve your financial goals. Whether or not you want to venture into the intriguing realm of options trading? Let me know your questions, comments, or insights in the section below.