In the enigmatic world of options trading, a diagonal spread emerges as a potent strategy that beckons the savvy investor. Defined as the simultaneous purchase of a call option at a higher strike price and expiration date and the sale of a call option at a lower strike price and earlier expiration date, this intriguing technique offers a unique blend of risk and reward. Prepare to embark on an enlightening journey as we delve into the intricacies of diagonal spreads, exploring their multifaceted applications and arming you with actionable insights to optimize your trading prowess.

Image: www.investopedia.com

A Lexicon of Diagonal Spreads: Unraveling the Fundamentals

The allure of diagonal spreads stems from their versatility and adeptness in adapting to various market scenarios. Investors may wield this powerful tool to capitalize on expected price appreciation, cushion against potential market downturns, or generate income through premium collection. Let’s unravel the cornerstone principles that underpin this multifaceted strategy:

-

Strike Price: Representing the predetermined price at which you can buy (call option) or sell (put option) the underlying asset upon expiration.

-

Expiration Date: Denoting the specific date on which the option contract expires and becomes void if unexercised.

-

Premium: The upfront payment required to purchase an option contract, essentially representing the cost of acquiring the right to buy or sell the underlying asset at the agreed-upon strike price on or before the expiration date.

Harnessing the Power of Diagonal Spreads: Strategic Applications

-

Bullish Outlook: If you anticipate an upward price trajectory for the underlying asset, a diagonal spread can provide a leveraged position to amplify your potential gains. By purchasing a call option at a higher strike price, you secure the right to buy the asset at a premium to the current market price. Simultaneously, the sale of a call option at a lower strike price and earlier expiration date generates an immediate inflow of premium, partially offsetting the initial investment.

-

Bearish Perspective: Conversely, if you foresee a bearish market trend, diagonal spreads can offer a tactical defense against potential losses. By selling a call option at a higher strike price, you effectively cap your potential upside while simultaneously collecting premium. This prudent strategy limits your exposure to adverse price movements and generates income even in declining markets.

-

Income Generation: Diagonal spreads can also serve as a potent income-generating strategy. By selling call options at a higher strike price and earlier expiration date, you effectively create a stream of premium payments. These regular inflows can supplement your investment income and provide a steady cash flow.

Expert Insights: Distilling Wisdom from Seasoned Traders

To further enhance your understanding of diagonal spreads, let’s glean invaluable insights from seasoned traders who have mastered this sophisticated strategy:

“Diagonal spreads are particularly advantageous when the underlying asset is expected to experience moderate price fluctuations within a defined timeframe. By carefully calibrating strike prices and expiration dates, traders can optimize their profit potential while managing risk effectively,” advises John Carter, a veteran options trader with over two decades of experience.

“The beauty of diagonal spreads lies in their flexibility. They can be tailored to suit diverse market conditions and investor risk appetites. A deep understanding of options pricing dynamics and market analysis is essential for successful implementation,” adds Emily Norris, a renowned options expert and author of multiple books on options trading.

Mastering Diagonal Spreads: Actionable Tips for Success

-

Diligent Research: Before venturing into diagonal spreads, equip yourself with a comprehensive understanding of options trading mechanics and risk management principles. Dedicate ample time to studying market trends, company fundamentals, and economic indicators.

-

Strategic Strike Price Selection: Meticulously select strike prices that align with your investment thesis and risk tolerance. Consider the potential price range of the underlying asset within the specified time frame.

-

Expiration Date Management: Carefully evaluate expiration dates to optimize your profit potential and minimize risks. Longer-dated options provide greater flexibility but also carry higher premiums.

-

Risk Mitigation: Employ sound risk management techniques to safeguard your capital. Set clear stop-loss orders to limit potential losses and avoid overleveraging your portfolio.

-

Continuous Monitoring: Regularly monitor your diagonal spread positions and adjust them as needed based on market conditions and your investment objectives.

Conclusion: Empowering the Savvy Investor

Diagonal spreads represent a versatile and potent tool in the arsenal of savvy options traders. Whether you seek to capture bullish trends, hedge against market downturns, or generate income, this sophisticated strategy offers a customizable solution. By embracing the principles outlined in this comprehensive guide and leveraging the insights of experienced traders, you can elevate your options trading skills to new heights. Remember, knowledge and discipline are the cornerstones of success in the captivating realm of diagonal spreads.

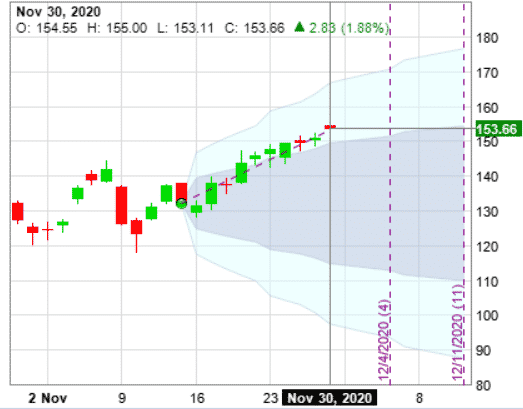

Image: www.investorsobserver.com

Diagonal Spreads Options Trading

Image: optionstradingiq.com