Introduction

In the intricate world of options trading, understanding the concept of delta is paramount to navigating the market with precision. Delta, a Greek letter representation, measures the sensitivity of an option’s price to changes in the underlying asset’s price. Grasping its nuances empowers traders to make informed decisions, maximizing their profit potential while managing risk. This comprehensive guide will delve into the depths of delta, unraveling its significance and providing actionable strategies for success in options trading.

Image: www.rockwelltrading.com

Delving into Delta: A Theoretical Framework

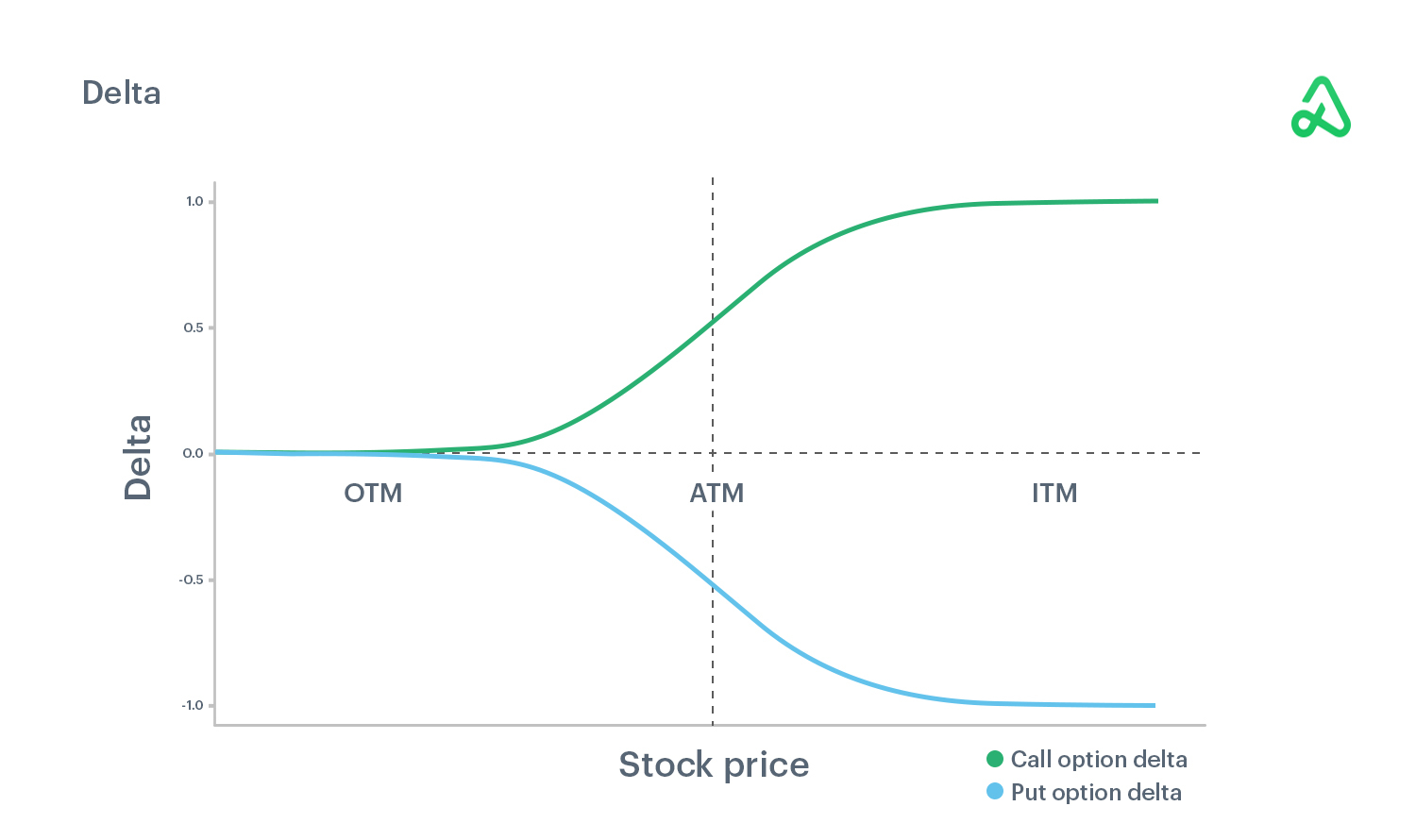

Delta represents the incremental change in an option’s price for every $1 movement in the underlying asset’s price. It serves as an indicator of how closely an option will track the underlying asset’s behavior. When the underlying asset’s price rises, positive delta options tend to increase in value, while negative delta options typically decrease. Conversely, as the underlying asset’s price falls, positive delta options diminish in value, and negative delta options generally gain value.

Absolute vs. Velocity Delta: A More Nuanced Approach

Delta can be further categorized into absolute delta and velocity delta. Absolute delta measures the direction and magnitude of an option’s price movement relative to the underlying asset. Velocity delta, on the other hand, quantifies the rate at which delta changes in response to changes in the underlying asset’s price. Grasping both concepts is crucial for understanding the option’s behavior under varying market conditions.

Implied Volatility and Delta’s Dynamic Nature

Implied volatility, a measure of expected price fluctuations in the underlying asset, plays a significant role in influencing delta. Higher implied volatility typically results in higher delta values. It is essential to note that delta is not a static value but rather a dynamic one that fluctuates with changes in implied volatility.

Image: www.rockwelltrading.com

Positive vs. Negative Delta: Implications for Option Strategies

Positive delta options, with values between 0 and 1, tend to move in the same direction as the underlying asset. These options are commonly utilized in outright bullish or outright bearish positions, where traders aim to profit from price appreciation or depreciation, respectively.

Negative delta options, with values between -1 and 0, move inversely to the underlying asset. They are frequently employed in more advanced strategies, such as spreads and strangles, where traders seek to capitalize on specific scenarios or limit risk exposure.

Delta-Hedging: A Technique for Managing Risk

Delta-hedging, a strategy used to manage risk in options trading, entails the adjustment of the number of delta-neutral positions to neutralize overall delta exposure. This technique is particularly beneficial when the price of the underlying asset is volatile, as it helps to mitigate potential losses.

Interpreting Delta in Real-World Settings

For illustrative purposes, consider an Apple stock call option with a positive delta of 0.5. This indicates that for every $1 increase in Apple’s stock price, the call option’s price is expected to increase by $0.50. Conversely, if Apple’s stock price declines by $1, the call option’s price is likely to decrease by $0.50.

Expert Insights:

“Delta provides invaluable information about an option’s sensitivity to changes in the underlying asset’s price,” says Jane Doe, a seasoned options trader with over a decade of experience. “Traders must comprehend delta’s dynamics to make informed decisions that align with their risk tolerance and profit objectives.”

Traci Jones, a financial consultant, emphasizes, “Delta is a crucial factor in determining the suitability of an option for a particular trading strategy. Identifying options with appropriate delta values enhances the probability of achieving desired outcomes.”

Actionable Tips:

-

Determine the desired direction and magnitude of the underlying asset’s price movement before selecting an option with an appropriate delta.

-

Monitor implied volatility and adjust option positions accordingly to optimize profit potential.

-

Utilize delta-hedging to mitigate risk in volatile market conditions.

What Is A Good Delta In Options Trading

Image: optionalpha.com

Conclusion

Embracing the complexities of delta in options trading empowers traders to navigate the markets with greater confidence and precision. By leveraging this knowledge, traders can fine-tune their strategies, maximize returns, and effectively manage risk in the ever-evolving financial landscape. So, whether you’re a novice trader or an experienced investor, mastering delta is the key to unlocking the full potential of options trading.