Are you new to options trading and find yourself stumped by the term “delta”? Wondering what it means and how it can impact your trading decisions? You’ve come to the right place! In this comprehensive guide, we will delve into the world of option trading and shed light on the significance of delta, equipping you with the knowledge to navigate this exciting market with confidence.

Image: www.brrcc.org

Understanding Delta: A Key Metric in Option Trading

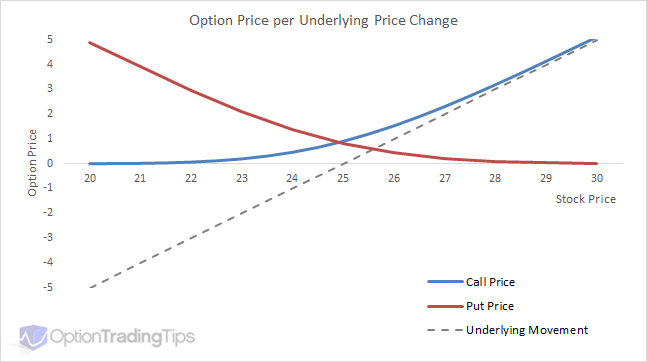

Delta is a Greek letter that measures the rate of change in an option’s price relative to changes in the price of its underlying asset. In simpler terms, it quantifies the sensitivity of the option’s value to the underlying asset’s performance. Delta values can range from -1 to +1, with each value holding specific implications for the option’s behavior.

For example, a positive delta indicates that the option’s price will move in the same direction as the underlying asset. A delta of 0.5 implies that for every $1 increase in the underlying asset’s price, the option’s price will increase by $0.50. Conversely, a negative delta signifies that the option’s price will move opposite to the underlying asset. A delta of -0.5 suggests that as the underlying asset’s price rises by $1, the option’s price will decrease by $0.50.

Classifying Options Based on Delta Values

Call Options with Positive Delta: Call options typically have a positive delta, meaning they increase in value as the underlying asset’s price rises. A high delta indicates that the call option is likely to move significantly in the same direction as the underlying asset.

Call Options with Zero Delta: This type of call option will not change in value even if there are changes in the underlying asset’s price. The delta is zero, making these options ideal for strategies where traders aim to benefit from time decay (the reduction in the option’s value over time).

Call Options with Negative Delta: Negative delta call options behave inversely to the underlying asset’s price movements. As the asset’s price increases, these options will lose value.

Put Options with Negative Delta: Put options typically have a negative delta, indicating that they increase in value as the underlying asset’s price falls. A high absolute value for a negative delta suggests that the put option is likely to move significantly in the opposite direction of the underlying asset’s price.

Put Options with Zero Delta: This type of put option is not affected by changes in the underlying asset’s price. With a delta of zero, traders can use these options to speculate on market direction or implement hedging strategies.

Put Options with Positive Delta: Similarly to call options with negative delta, put options with positive delta move inversely to the underlying asset’s price movements. They gain value as the underlying asset’s price rises.

Using Delta to Make Informed Trading Decisions

Understanding delta and its implications can aid traders in assessing risk and determining optimal trading strategies. For instance, if a trader believes that the underlying asset’s price will rise, they might consider purchasing a call option with a high positive delta. This approach allows them to benefit significantly from the potential price increase.

On the other hand, if the trader anticipates that the underlying asset’s price will decline, they might opt for a put option with a high negative delta. This way, they can profit from the drop in the asset’s value.

Image: www.youtube.com

Impact of Time on Delta

It’s crucial to consider that delta is dynamic and can change over time, primarily due to the time decay of options. As an option approaches its expiration date, the delta value generally decreases. This occurs because the time remaining for the option to reach its break-even point decreases, reducing the sensitivity of the option’s price to changes in the underlying asset’s price.

Combining Delta with Other Greeks

While delta provides valuable insights, traders should also consider other Greek letters when making trading decisions. Combining delta with other Greeks, such as gamma and vega, can offer a more comprehensive view of the potential risks and rewards associated with a particular option.

What Does Delta Mean In Option Trading

Image: tradeoptionswithme.com

Conclusion

Mastering the concept of delta is essential for navigating the world of option trading with confidence and increasing your chances of success. Whether you’re a seasoned trader or just starting out, understanding delta’s significance will empower you with the knowledge to make informed decisions, manage risk effectively, and seize trading opportunities. So, arm yourself with the insights provided in this comprehensive guide, and get ready to elevate your option trading game to new heights.