In the dynamic world of financial markets, options trading stands as a powerful tool for investors seeking to navigate the complexities of hedging risks and generating potential profits. Among the various strategies employed in options trading, short positions offer unique opportunities and require careful consideration. Embark with us on an enlightening journey exploring the intricacies of options trading short positions, unlocking their potential and empowering you with informed decision-making.

Image: top10stockbroker.com

A Tale of Risk and Reward: Understanding Options Trading Short Positions

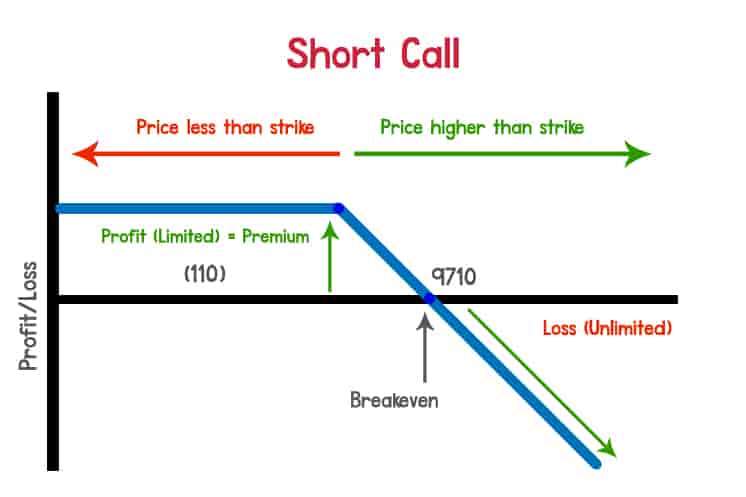

Options trading, in essence, involves the purchase or sale of contracts that provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. Shorting an option involves selling a contract that gives the buyer the right to sell an underlying asset at a specified price. In short, the seller of a short option bet against the rise in the underlying asset’s price.

This strategy, often employed by experienced traders, carries both potential rewards and risks. By correctly predicting the decline or stagnation of an underlying asset’s value, short option sellers can profit from the premium received when selling the contract. However, if the asset’s price unexpectedly surges, they may incur substantial losses, a fact that underscores the significance of thorough due diligence and risk management.

Deconstructing Options Trading Short Positions: A Step-by-Step Guide

-

Identify the Underlying Asset: Determine the security or index whose price movements will impact the option’s value.

-

Specify the Strike Price: Set the price at which the buyer has the right to sell the underlying asset.

-

Select the Expiration Date: Establish the date by which the option contract expires and becomes worthless if not exercised.

-

Calculate the Premium: Determine the price at which the option contract will be sold, representing the potential profit if the underlying asset’s price falls or remains stable.

-

Execute the Sale: Sell the option contract to a willing buyer, transferring the right to sell the underlying asset at the specified price.

Expert Insights and Actionable Tips for Shorting Options

-

Seek Guidance from Reputable Experts: Consult financial analysts and seasoned traders to gain valuable insights and learn from their experiences.

-

Master Risk Management Techniques: Implement robust strategies to mitigate potential losses, including setting stop-loss orders and diversifying your portfolio.

-

Stay Informed and Monitor Market Trends: Continuously monitor market conditions, economic indicators, and company-specific news to make informed decisions about option shorting.

Image: futuresoptionsetc.com

Options Trading Short Position

Image: www.benzinga.com

Conclusion: Unveiling the Potential of Options Trading Short Positions

Options trading short positions, while potentially lucrative, demand a deep understanding of market dynamics, risk management, and the underlying assets. By embracing knowledge, seeking expert guidance, and implementing prudent strategies, you can harness the power of short positions to potentially augment your financial returns. However, remember that options trading, like any investment endeavor, carries inherent risks, and it is crucial to approach it with a measured mindset and a meticulous risk management approach.