Introduction

In the realm of financial markets, where fortunes are forged and lost, the intricate dance of options trading offers a tantalizing blend of risk, reward, and strategic maneuverability. Among the myriad of options strategies lies one particularly compelling concept: being short a call option. Embark on an intellectual journey with us as we delve into the depths of this financial instrument, exploring its intricacies, nuances, and potential.

Image: learn.moneysukh.com

Understanding the fundamentals of selling call options requires a firm grasp of options themselves. Options, in essence, represent contracts that grant buyers the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price, known as the strike price, on or before a designated expiration date. By being short a call option, an individual assumes the obligation of selling the underlying asset if the buyer of the call option exercises their right to buy.

Diving into the Mechanics

The mechanics of being short a call option can be likened to a contractual agreement between two parties. The seller of the call option (the one who is short) essentially receives a premium from the buyer in exchange for granting the buyer the aforementioned right to buy the underlying asset at the agreed-upon strike price. In return, the seller assumes the obligation to deliver the underlying asset if the buyer chooses to exercise their option.

Crucially, the seller of a call option is not obligated to sell the underlying asset unless the option is exercised. If the option expires unexercised, the seller retains the premium received from the buyer, effectively earning a profit. However, if the underlying asset’s price rises above the strike price, the buyer may find it advantageous to exercise the option, compelling the seller to sell the asset at a price potentially lower than its current market value, resulting in a loss for the seller.

Risk and Reward Dynamics

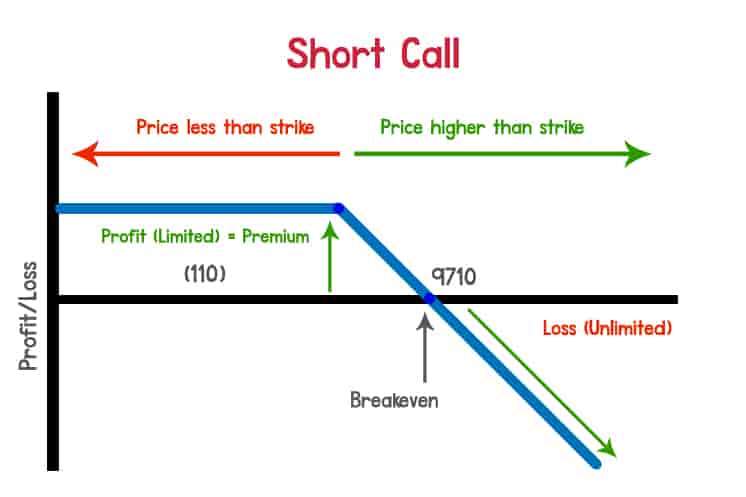

The interplay between risk and reward is an inherent aspect of being short a call option. The potential profit for the seller is limited to the premium received upon selling the option. However, the potential loss can be significant if the underlying asset’s price surges, leading to the obligation of selling at a loss.

The risk-reward profile of being short a call option is often influenced by factors such as the strike price, the time to expiration, and the volatility of the underlying asset. A higher strike price, a shorter time to expiration, and a higher volatility generally amplify both the potential profit and the potential loss.

Strategic Applications

Being short a call option is not merely a speculative endeavor; it also serves as a valuable tool for sophisticated investors seeking to enhance their portfolio strategies. Prudent use of call options can help investors generate income, hedge against potential losses, and even amplify returns.

Income generation through the sale of call options is a common strategy, as it allows investors to collect the premium received from buyers. If the option expires unexercised, the premium becomes a pure profit. However, if the option is exercised, the investor must deliver the underlying asset, potentially incurring a loss if the asset’s price has risen significantly.

Hedging against potential losses is another key application of short call options. Investors who own underlying assets can mitigate downside risk by selling call options at or above the current market price. If the asset’s price falls, the premium received from the sale of the call option can help offset the decline in the asset’s value.

Additionally, investors can amplify returns through the strategic sale of call options. By selling call options with strike prices above the current market price, investors can generate income while maintaining exposure to potential upside in the underlying asset. If the asset’s price rises, the investor retains the potential to benefit from its appreciation, while limiting their potential loss to the difference between the strike price and the current market price.

Image: top10stockbroker.com

Expert Insights and actionable Tips

To further illuminate the complexities of being short a call option, we sought the wisdom of seasoned market experts. Here’s what they had to share:

“Understanding the nuances of being short a call option is imperative for successful implementation,” advised renowned options strategist Mark Sebastian. “Traders should carefully consider the interplay of factors such as strike price, time to expiration, and volatility to optimize their risk-reward profile.”

“When it comes to income generation through the sale of call options, it’s crucial to select underlying assets with strong fundamentals and limited downside risk,” remarked veteran trader Tom Sosnoff. “This strategy can provide a steady stream of income, but it’s essential to manage expectations and understand the potential for losses if the underlying asset’s price rises substantially.”

Trading Definition Being Short A Call Option

Image: www.tradethetechnicals.com

Conclusion

Being short a call option is a multifaceted strategy that offers a unique blend of risk and reward to investors of all levels. Whether it’s for income generation, hedging against losses, or amplifying returns, a thorough comprehension of the mechanics, risk dynamics, and strategic applications of this option strategy is paramount. By embracing the insights and actionable tips presented in this article, investors can navigate the complexities of being short a call option with increased confidence and a greater likelihood of success. Remember, knowledge is the cornerstone of informed decision-making in the ever-evolving financial markets.