In the fast-paced world of trading, every second counts. ETRADE extended hours trading empowers investors with unprecedented access to market movements beyond traditional trading hours. This comprehensive guide will elucidate the nuances of extended hours trading on the ETRADE platform, unlocking a realm of opportunities for savvy investors.

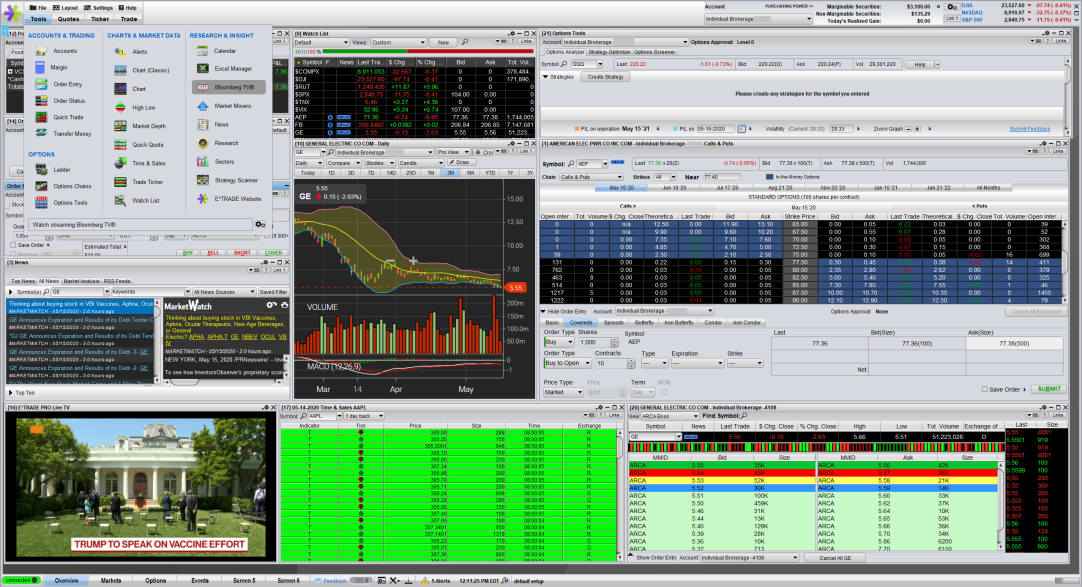

Image: www.warriortrading.com

E*TRADE Extended Hours Trading: A Gateway to Expanded Market Reach

Extended hours trading extends the trading window beyond the typical 9:30 AM to 4:00 PM EST. It allows investors to initiate and close trades from 8:00 AM to 8:00 PM EST on weekdays. This expanded schedule provides an invaluable advantage, enabling traders to capitalize on market swings and react promptly to breaking news that may impact asset prices.

The allure of extended hours trading lies in its flexibility and access to market liquidity. During these extended hours, investors can seize trading opportunities outside of normal business hours, potentially minimizing the impact of day-to-day market volatility and enhancing profit potential. Moreover, the extended trading window aligns with global market movements, enabling investors to align their trades with international economic events and geopolitical developments.

Navigating E*TRADE Extended Hours Trading

E*TRADE seamlessly integrates extended hours trading into its user-friendly platform. Traders can conveniently access the extended hours trading functionality through the same familiar interface, ensuring a seamless transition between regular and extended trading sessions.

To initiate trades during extended hours, traders simply need to select the desired security and enter the order details within the designated time frame. Real-time market data, including bid-ask spreads and price quotes, is readily available to support informed decision-making. The platform’s intuitive design ensures that extended hours trading is a straightforward and intuitive process.

It’s important to note that extended hours trading may entail different risk considerations compared to regular trading hours. Market volume and liquidity may be lower during these periods, potentially leading to wider bid-ask spreads and increased volatility. Therefore, investors should exercise caution and carefully assess market conditions before placing trades during extended hours.

Benefits of E*TRADE Extended Hours Trading

E*TRADE extended hours trading offers numerous benefits for discerning investors:

- Extended Trading Window: Access to the market from 8:00 AM to 8:00 PM EST provides greater flexibility and time to make informed trades.

- Enhanced Market Coverage: The ability to trade before and after regular hours allows investors to react to breaking news and global economic events.

- Reduced Market Volatility: Extended hours trading often features lower market volume, potentially leading to minimized price volatility and improved execution prices.

- Global Market Alignment: The extended trading window aligns with the hours of global markets, enabling investors to capitalize on international opportunities.

- Personalized Trading Strategies: Extended hours trading allows investors to adapt their trading strategies to suit their individual schedules and market preferences.

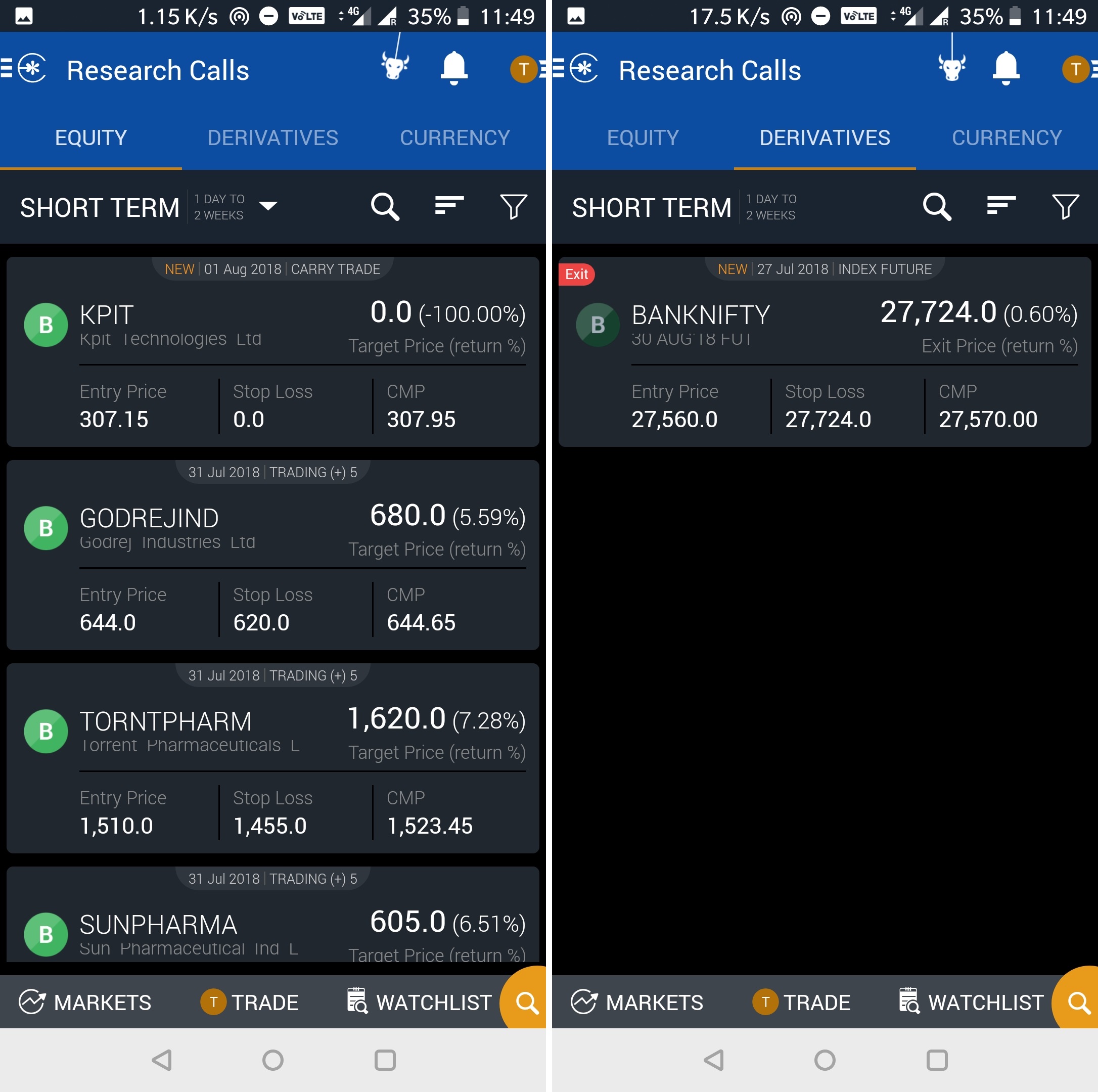

Image: creamyinn.com

Strategies for Successful Extended Hours Trading

Strategic use of extended hours trading can enhance trading outcomes. Consider these strategies:

- Pre-Market Execution: Enter trades before the market opens to potentially secure favorable prices based on overnight news and market developments.

- Post-Market Adjustments: Modify or close positions after hours to adjust to unexpected market movements that occurred during the day.

- Global Market Capitalization: Monitor and trade global markets during extended hours, capturing opportunities from overseas economies.

- News-Driven Trading: React swiftly to breaking news during extended hours to capitalize on market reactions.

- Reduced Volatility Strategy: Utilize extended hours to trade during periods of lower market volume, aiming to minimize the impact of volatility on trade outcomes.

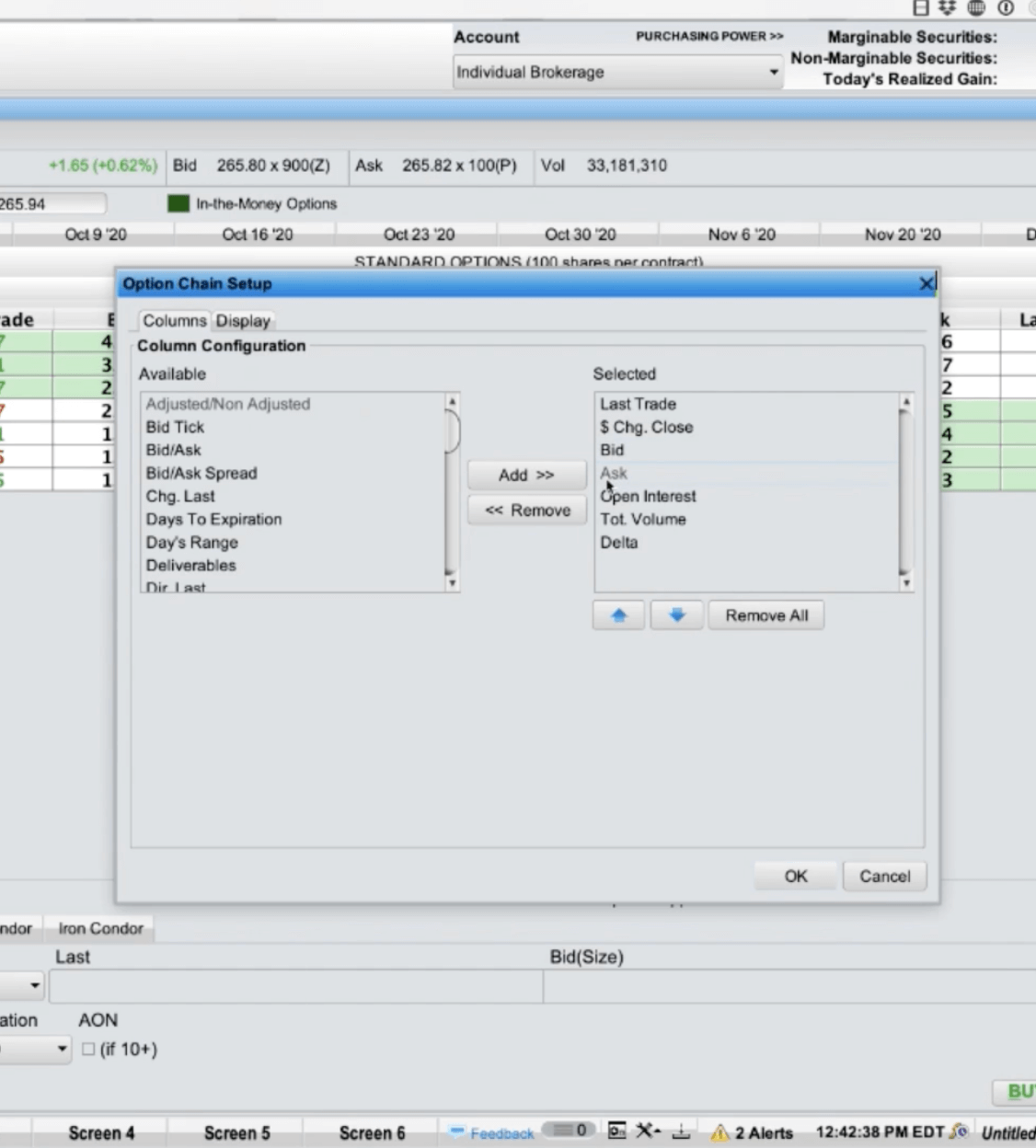

Etrade Extended Hours Trading Options

Image: thebrownreport.com

Conclusion: Embracing the Power of Extended Hours Trading

E*TRADE extended hours trading empowers investors with a powerful tool to expand their market reach, enhance their trading strategies, and capitalize on opportunities beyond traditional business hours. By embracing the flexibility, access to liquidity, and strategic advantages it offers, savvy investors can gain a competitive edge and unlock the full potential of the financial markets.