An Exploration of the Strategies, Tips, and Expert Insights for Empowering Traders

In the realm of financial markets, options trading stands as a potent tool, arming traders with the potential to harness market movements for substantial gains. Amidst this dynamic landscape, the option trading formula emerges as a compass, guiding traders toward informed decisions and unlocking the full scope of opportunities within this intricate sphere.

Image: www.danielsoper.com

This comprehensive treatise will delve into the intricacies of the option trading formula, laying bare its foundational concepts, uncovering its practical applications, and empowering you with the strategies employed by seasoned experts. Embark on an educational odyssey that will transform you from a novice to a proficient navigator of the options trading terrain.

Delving into the Core of the Option Trading Formula

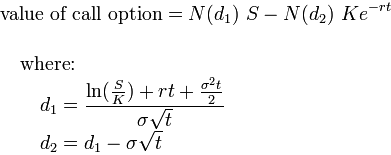

At its heart, the option trading formula embodies a mathematical equation that calculates the theoretical value of an option contract. This formula takes into account several crucial variables, including the underlying asset’s price, the strike price, time to expiration, risk-free interest rate, and volatility. Understanding these components is paramount for grasping the formula’s complexities and applying it effectively.

Untangling the Variables: A Deeper Look

Underlying Asset Price: This represents the current market price of the underlying asset, such as a stock, index, or commodity.

Strike Price: The predetermined price at which the buyer can exercise their right to buy or sell the underlying asset.

Time to Expiration: The duration remaining before the option contract expires and becomes worthless.

Risk-Free Interest Rate: The prevailing interest rate on government bonds, which serves as the benchmark for discounting future cash flows.

Volatility: A measure of the underlying asset’s price fluctuations over a specific period.

Mastering the Craft: Strategies for Profitable Option Trading

Armed with a solid understanding of the option trading formula, traders can embark on the next phase of their journey: mastering profitable trading strategies. By combining technical analysis, risk management principles, and an intuitive grasp of market dynamics, traders can navigate the ever-changing landscape and increase their chances of success.

Image: igotiyycixoq.web.fc2.com

Unveiling the Secrets of Successful Option Traders

1. Covered Call Strategy: This strategy involves selling (or writing) a call option while simultaneously owning the underlying asset. The aim is to generate income from the option premium while limiting potential losses.

2. Protective Put Strategy: A defensive strategy that entails purchasing a put option to safeguard against potential downside risk in owning the underlying asset.

3. Iron Condor Strategy: A neutral strategy that combines buying and selling options to capitalize on a range-bound underlying asset’s movement.

4. Collar Strategy: A combination of a protective put and a covered call, designed to limit both potential losses and gains.

Empowering Insights from Seasoned Experts

In the realm of option trading, experience is a precious commodity. To enhance your knowledge and strategic prowess, seek out the wisdom of seasoned experts who have navigated the markets and emerged triumphant. Their insights will provide invaluable guidance as you forge your path toward trading mastery.

“Discipline is the key to successful option trading. Stick to your trading plan, manage your risk, and never let emotions cloud your judgment.” – Mark Douglas, Trading Psychologist

“Understanding volatility is crucial. It’s the lifeblood of option trading, and traders must have a firm grasp of how it affects option prices.” – Nassim Taleb, Author of “The Black Swan”

Option Trading Formula

A Call to Action: Unleash Your Trading Potential

Embarking on the path of option trading demands a commitment to continuous learning, strategic thinking, and unwavering discipline. By embracing the knowledge imparted in this comprehensive guide, you have laid the foundation for a transformative trading journey. Seek out additional resources, engage in discussions with fellow traders, and refine your strategies over time. The path to success lies in the relentless pursuit of knowledge and the unwavering application of sound trading principles.

Remember, the option trading formula is merely a tool, a compass to guide your decision-making. It is your understanding of market dynamics, your ability to manage risk, and your emotional discipline that will ultimately determine your success in this challenging yet rewarding domain. Embrace the journey, learn from your experiences, and let the thrill of option trading fuel your pursuit of financial empowerment.