As an experienced trader, I have been using Interactive Brokers (IBKR) for years, and I can confidently say that it’s a top-notch platform with a wide range of offerings. One of the most important features for many traders is the ability to trade options. In this article, we’ll delve into the various aspects of options trading with IBKR, providing a detailed guide for both beginners and experienced traders alike.

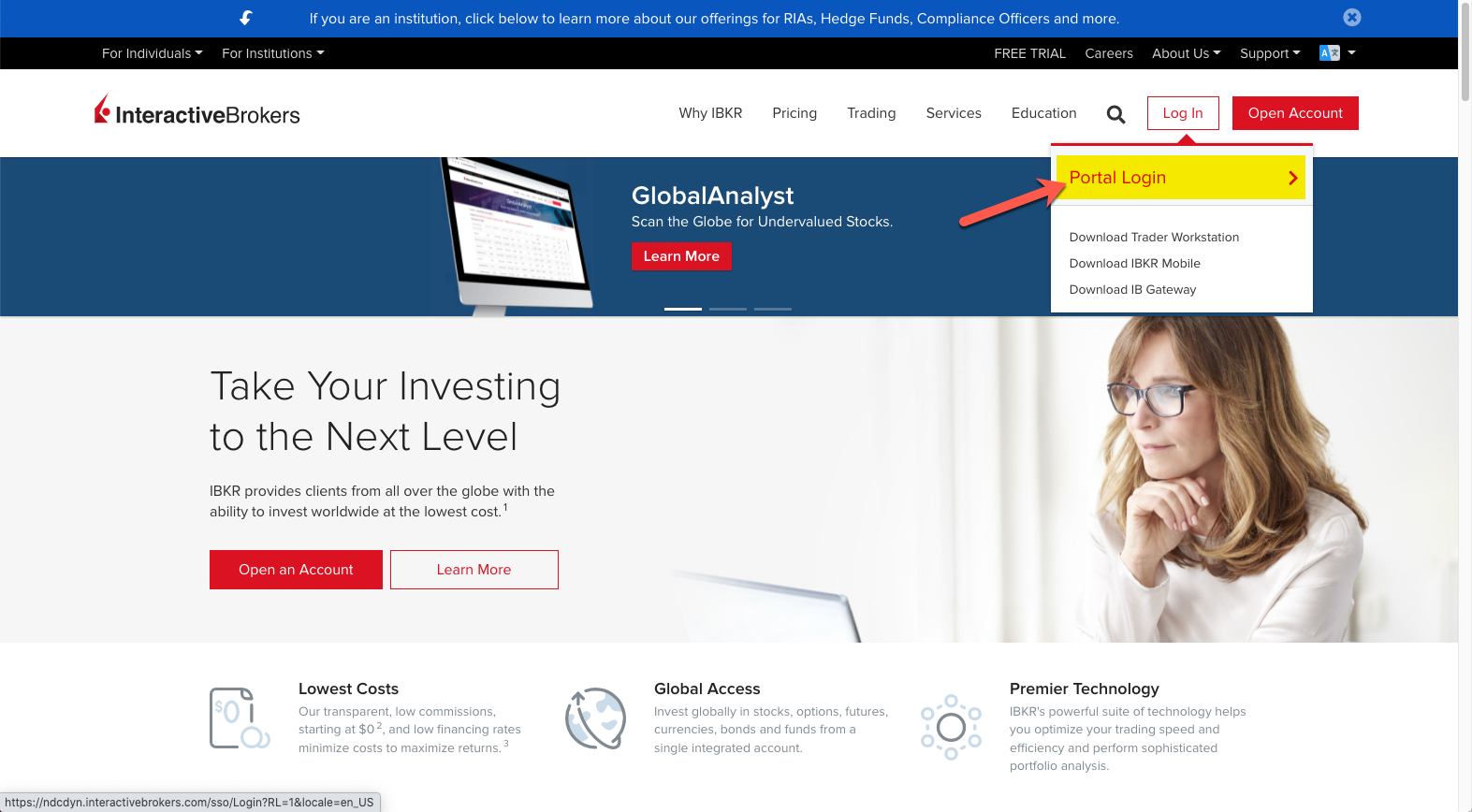

Image: support.collective2.com

Options Trading Explained

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predefined price on or before a certain date. Options can be used for hedging, speculation, or income generation strategies. There are two main types of options: calls and puts. Call options give the buyer the right to buy the underlying asset, while put options give the buyer the right to sell the underlying asset.

Interactive Brokers: A Reputable Options Trading Platform

Interactive Brokers is a well-established and regulated brokerage firm that offers a wide range of trading products, including options. IBKR has been in business for over 40 years and is known for its advanced trading platform, low commissions, and exceptional customer service. With its global reach and multi-currency support, IBKR caters to traders worldwide.

Features and Advantages of Options Trading with IBKR

- Access to Wide Range of Markets: IBKR offers options trading on a vast array of underlying assets, including stocks, indices, commodities, currencies, and bonds.

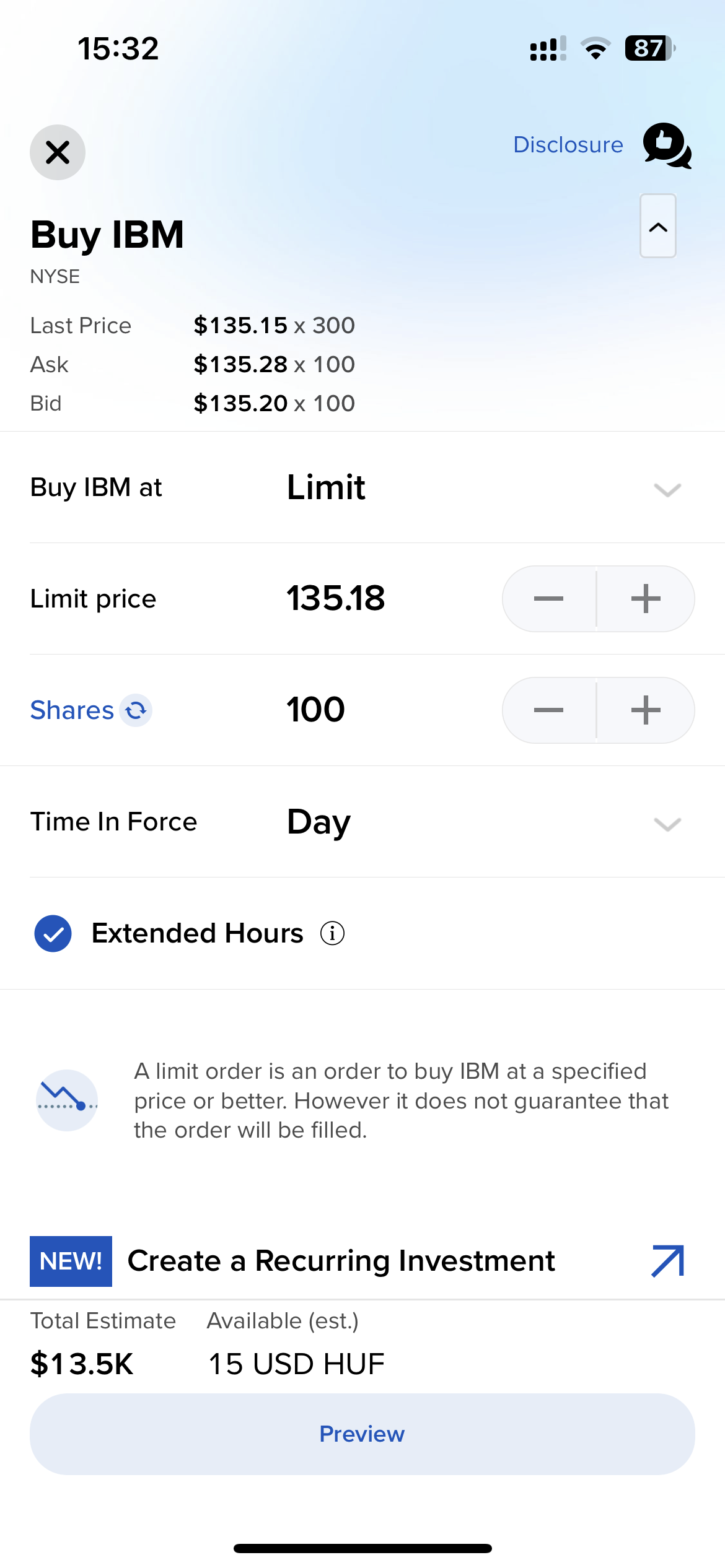

- Advanced Trading Platform: IBKR Trader Workstation and IBKR Mobile provide advanced charting tools, real-time market data, and sophisticated order placement capabilities.

- Competitive Commissions: IBKR offers some of the lowest commissions in the industry for options trading, making it cost-effective for traders.

- Global Reach: With a presence in over 135 countries, IBKR allows traders to trade options on exchanges worldwide.

- Dedicated Support: IBKR’s dedicated customer support team is available 24/5 to assist traders with any queries or issues.

Image: www.interactivebrokers.com

Getting Started with Options Trading on IBKR

- Open an Account: Create an account with IBKR by completing the online application process.

- Fund Your Account: Deposit funds into your account using various methods, including wire transfer, bank transfer, or credit card.

- Education and Research: Familiarize yourself with options trading concepts through IBKR’s educational resources and market analysis tools.

- Practice: Before trading with real capital, try out different strategies and familiarize yourself with the platform using IBKR’s paper trading feature.

- Place a Trade: Once you’re confident, place your first options trade by selecting the underlying asset, option type, strike price, and expiration date.

Tips and Expert Advice for Options Trading

To enhance your options trading experience, consider these tips and expert advice:

1. Define Trading Objectives and Risk Tolerance

Determine your specific trading goals and identify your risk tolerance. This will guide your trading strategies and help you manage risk effectively.

2. Research and Know the Market

Thoroughly research the underlying assets and market conditions. Understand the fundamentals, technical analysis, and potential risks associated with your trades.

3. Use Trading Tools and Strategies

Utilize the trading tools and strategies provided by IBKR, such as charting tools, option chains, and risk management features, to make informed decisions.

4. Manage Risk Prudently

Implement sound risk management practices by setting stop-loss orders, diversifying your portfolio, and avoiding overleveraging your trades.

Frequently Asked Questions (FAQs) on Options Trading with IBKR

Q: What is the minimum account balance required for options trading on IBKR?

A: The minimum account balance requirement varies depending on the type of options trading and the underlying asset.

Q: Can I trade options on margin with IBKR?

A: Yes, IBKR offers margin trading for options, subject to specific eligibility criteria and margin requirements.

Q: What are the fees associated with options trading on IBKR?

A: IBKR charges a commission per contract, based on the number of contracts traded. The specific fees vary depending on the market and option type.

Q: How do I evaluate options premiums?

A: Option premiums are influenced by factors such as the underlying asset price, time to expiration, volatility, and interest rates. Analyze these factors to assess the value of options contracts.

Does Interactive Brokers Have Options Trading

Image: brokerchooser.com

Conclusion

Options trading with Interactive Brokers provides traders with a robust and versatile platform to pursue various trading strategies. By understanding the basics, leveraging the platform’s capabilities, and following expert advice, traders can enhance their trading experience and potentially achieve their financial goals. Whether you’re a seasoned trader or just starting your options journey, IBKR offers a comprehensive suite of services to support your trading endeavors.

Would you like to learn more about options trading with Interactive Brokers? Join our online forum or connect with a financial advisor to delve deeper into the topic and stay up-to-date on the latest developments in the market.