In the ever-evolving financial landscape, options trading has emerged as a powerful tool for risk management and potential profit generation. Among the renowned brokers offering options trading services, Interactive Brokers (IBKR) stands out as a leader, providing traders with a comprehensive platform and unparalleled support. This article aims to provide a detailed exploration of options trading with IBKR, empowering you with the knowledge and strategies to navigate this market successfully.

Image: www.interactivebrokers.co.uk

What is Options Trading?

Options contracts are derivative instruments that give traders the right (but not the obligation) to buy (call options) or sell (put options) an underlying asset, such as a stock, bond, or commodity, at a predetermined price (strike price) on or before a specific date (expiration date). These contracts offer traders flexibility, allowing them to speculate on future price movements, hedge risks, or create income streams.

Why Trade Options with IBKR?

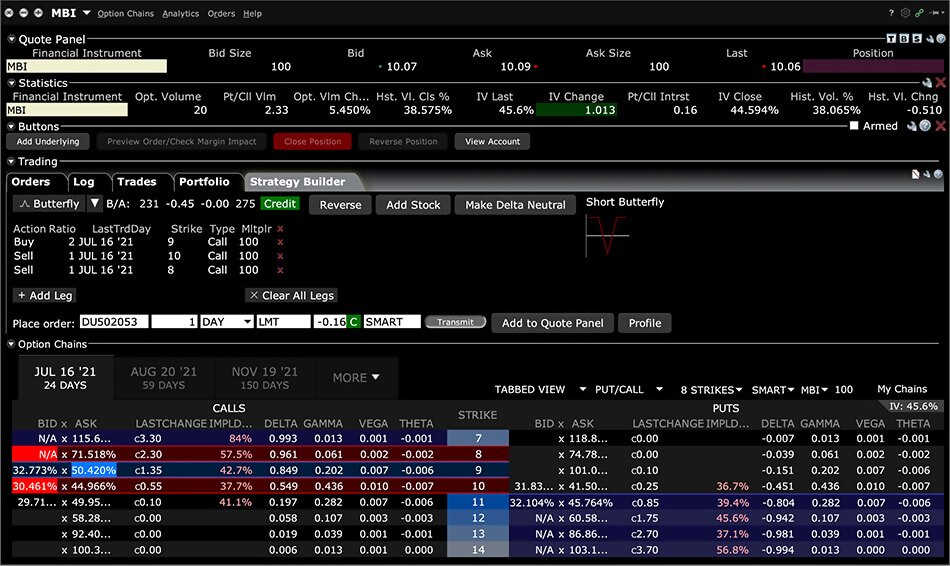

IBKR has established itself as a top choice for options traders for several reasons. Firstly, it provides access to a vast array of options markets, including stocks, indices, ETFs, futures, and bonds. Secondly, its proprietary trading platform, Trader Workstation (TWS), is renowned for its superior execution speed, advanced charting capabilities, and customizable trading tools.

Moreover, IBKR offers competitive commission rates, low margin requirements, and a wide range of educational resources to support traders of all levels. With its combination of robust technology, extensive product offerings, and dedicated support, IBKR empowers traders to maximize their options trading potential.

Understanding Options Trading Concepts

To embark on options trading, it’s crucial to grasp fundamental concepts:

- Call Options: These contracts grant the holder the right to buy an underlying asset at the strike price on or before the expiration date.

- Put Options: Put options give the holder the right to sell an underlying asset at the strike price on or before the expiration date.

- Strike Price: The predetermined price at which the underlying asset can be bought (call) or sold (put).

- Expiration Date: The date on which the options contract expires, rendering it worthless if not exercised.

Image: www.binarytradingforbeginners.com

Strategies for Options Trading with IBKR

Options trading encompasses a wide range of strategies tailored to different trading goals and risk profiles. Here are some popular approaches:

- Covered Calls: Involves selling (writing) call options against a long position in the underlying asset, generating income from option premiums.

- Protective Puts: Buying (purchasing) put options to protect a long position in the underlying asset from potential declines in value.

- Iron Condors: A combination of call and put options designed to profit from a sideways movement in the underlying asset.

- Strangles: Similar to iron condors, but with wider strike prices to capture more significant price movements.

Key Considerations for Trading Options with IBKR

While options trading can be a rewarding endeavor, it’s important to proceed with caution and consider the following factors:

- Risk Management: Options trading involves inherent risk, and traders should thoroughly understand the potential losses they may incur.

- Volatility: Options premia are heavily influenced by the underlying asset’s volatility, and traders should be aware of how price fluctuations affect their positions.

- Time Decay: The value of options contracts gradually declines as they approach their expiration dates, a factor that traders must account for.

Leveraging Expert Insights and Actionable Tips

To enhance your options trading success, consider these insights from seasoned traders:

- Thoroughly Research: Study the underlying asset, market trends, and historical volatility before making any trades.

- Start Small: Begin with small-scale positions to gain experience and familiarize yourself with options trading dynamics.

- Manage Risk: Employ stop-loss orders, position sizing, and hedging strategies to limit potential losses.

- Seek Guidance: Consult with financial advisors or experienced traders to gain valuable insights and support.

Options Trading Ibkr

Image: www.interactivebrokers.com

Conclusion: Empowering Options Traders

Options trading with IBKR offers substantial opportunities for risk management, potential returns, and income generation. By understanding the foundational concepts, exploring trading strategies, and adhering to prudent risk management principles, traders can navigate the options market with confidence. Remember, education, discipline, and a measured approach are the keys to unlocking the full potential of options trading with IBKR.