Introduction

Imagine having a crystal ball that gives you a glimpse into the future of the stock market. Options trading signals aim to do just that, providing valuable insights to help you make informed decisions and potentially maximize profits. In this comprehensive review, we delve into the world of options trading signals, exploring their intricacies, benefits, and potential pitfalls. Get ready to embark on an educational journey that will empower you to navigate the complexities of financial markets with confidence.

Image: mountainhon.weebly.com

Understanding Options Trading Signals

Options trading signals are generated by algorithms or experienced traders to identify opportunities in the financial markets. They provide actionable insights, such as Buy, Sell, or Hold recommendations, based on technical analysis or predictive models. These signals can be utilized by both individual traders and sophisticated investment firms to enhance their trading strategies.

Different types of options trading signals exist, each employing unique methodologies and strategies. Some signals focus on spotting trends, while others prioritize volatility or momentum. It’s crucial to understand the underlying principles and limitations of each signal to make informed decisions about their suitability for your trading style and risk tolerance.

Benefits of Using Options Trading Signals

-

Precision Trading: Signals reduce the guesswork involved in options trading by providing clear entry and exit points, helping you time your trades effectively.

-

Time Savings: Signals save you the time and effort required for rigorous technical analysis. Instead, you can rely on expert-generated insights to make informed decisions quickly.

-

Trading Discipline: Signals can enforce trading discipline by providing objective recommendations, reducing emotional decision-making and adherence to a predefined strategy.

Choosing the Right Options Trading Signals

The key to successful options trading with signals lies in choosing the right provider. Consider the following factors when selecting a signal service:

-

Accuracy and Performance: Scrutinize the historical performance and accuracy rate of the signals. Consistency and reliability are vital for long-term profitability.

-

Transparency: Opt for providers who are transparent about their trading algorithms and signal methodology. This allows you to understand the logic behind the recommendations and make informed decisions.

-

Support and Education: Choose providers that offer ongoing support, educational resources, and training to help you optimize your trading strategies and address any queries.

Image: belucydyret.web.fc2.com

Leveraging Options Trading Signals Effectively

-

Treat Signals as Guidelines: Signals should complement your trading strategy rather than dictate it. Use them as a starting point and conduct your own due diligence before executing trades.

-

Risk Management: Always allocate trades according to your risk tolerance. Signals alone cannot guarantee profits. Implement proper risk management techniques and avoid overtrading.

-

Diversify Signal Sources: Consider using multiple signal providers with diverse strategies to reduce risk and enhance overall performance.

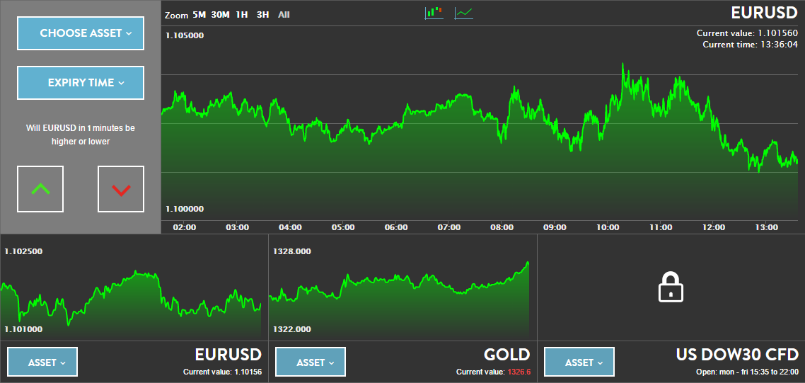

Options Trading Signals Review

Image: www.youtube.com

Conclusion

Options trading signals can be a valuable tool for investors seeking to enhance their trading strategies and potentially maximize profits. By understanding their benefits, limitations, and how to choose a reliable provider, you can harness the power of these insights to inform your decision-making and navigate the financial markets with greater confidence. Remember, trading involves inherent risks, and it’s crucial to approach it with a sound understanding of the principles involved.