In today’s fast-paced financial world, where volatility reigns supreme, navigating the treacherous waters of option trading can be akin to walking a tightrope. Yet, with the advent of free option trading alerts, everyday investors now have access to a powerful tool that can transform their trading experience, paving the way for unparalleled profitability and comprehensive risk management.

Image: fyers.in

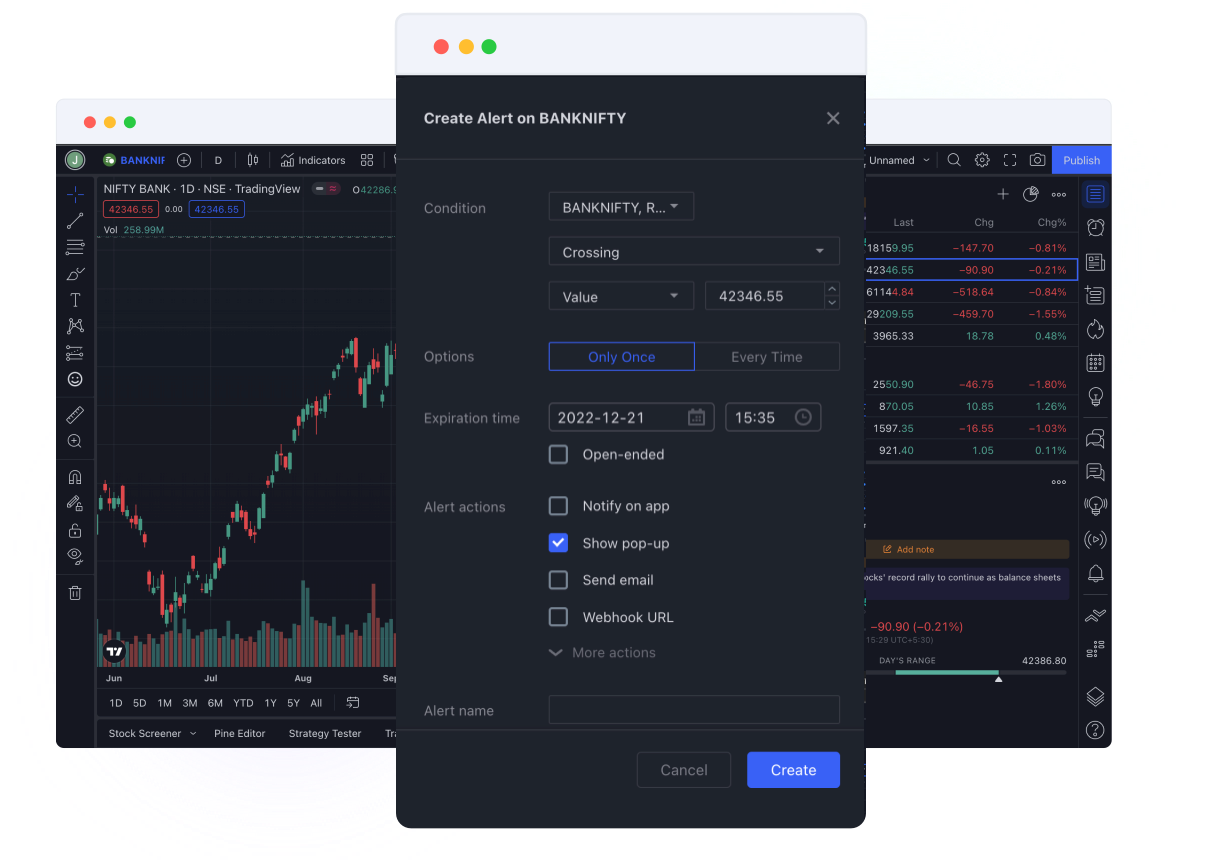

Picture this: you receive real-time alerts on potentially lucrative option trading opportunities, delivered straight to your preferred device. These alerts, like a financial compass, guide your investment decisions by providing precise entry and exit points, helping you optimize profits and mitigate risks. Join us as we embark on an in-depth exploration of free option trading alerts, uncovering their transformative capabilities for both novice and seasoned traders alike.

Deciphering Free Option Trading Alerts: Your Key to Success

Free option trading alerts are essentially notifications dispatched by trading platforms or dedicated third-party providers that pinpoint compelling trading opportunities in the options market. These alerts often include crucial details such as the underlying asset or index, option type (call or put), strike price, expiration date, and most importantly, recommended trading strategy. Armed with this information, traders can make informed decisions, execute trades with confidence, and maximize their earning potential.

The value of free option trading alerts lies in their ability to provide traders with a competitive edge. They serve as a constant financial companion, providing timely insights into the ever-evolving markets. With these alerts at their disposal, traders can identify promising opportunities that might otherwise have eluded them, enhancing their chances of capitalizing on market fluctuations and generating substantial profits.

Unveiling the Significance of Option Trading Alerts

The benefits of utilizing free option trading alerts are multifaceted, empowering traders with an array of advantages that can fundamentally alter their trading trajectory. Let’s delve into some of these key benefits:

- Timely Market Updates: Free option trading alerts provide traders with a real-time pulse on the markets, ensuring they remain abreast of the latest developments and potential trading opportunities. This continuous flow of information empowers traders to respond swiftly to market shifts, seizing profitable opportunities and swiftly adjusting to changing market conditions.

- Tailored Recommendations: Option trading alerts can be customized to align with specific trading preferences and risk tolerance. Traders can filter alerts based on volatility levels, underlying assets, and expiration dates, ensuring they receive only the most relevant and actionable trading ideas that match their unique trading style and goals.

- Enhanced Decision-Making: Free option trading alerts serve as a valuable decision-making tool, helping traders evaluate trading opportunities objectively. The alerts provide a comprehensive overview of each potential trade, including profit potential, risk assessment, and clear trading recommendations. This comprehensive analysis empowers traders to make informed decisions and execute trades with greater confidence and clarity.

- Risk Management Reinforcement: Option trading alerts can play a crucial role in risk management by providing traders with insights into potential risks associated with each trade. The alerts often include stop-loss and take-profit levels, enabling traders to define their risk tolerance and limit potential losses.

Image: www.ig.com

Free Option Trading Alerts

https://youtube.com/watch?v=B3sBWB-fyPE

Navigating Free Option Trading Alerts: Tips and Expert Advice

To effectively harness the power of free option trading alerts and maximize their trading potential, traders should consider the following tips and expert advice:

- Choose a Reputable Provider: The credibility and reliability of the alert provider are paramount. Look for providers with a proven track record, transparent methodologies, and a solid reputation within the trading community.

- Customize Your Alerts: Tailor your alerts to match your trading preferences, risk tolerance, and investment objectives. Determine which assets, strategies, and profit targets align with your trading style and goals.

- Test and Evaluate: Before implementing alerts into your trading strategy, thoroughly test and evaluate their performance