In the realm of financial trading, understanding price action is crucial. Candle charts are a popular tool that visually represents market fluctuations, providing traders with insights into asset behavior. If you’re interested in learning more about option trading candle charts, this comprehensive guide will equip you with the necessary knowledge.

Image: www.pinterest.nz

Understanding Option Trading Candle Charts

Option trading candle charts are specialized visualizations that depict the movement of an underlying asset over a specific time period. Each candle represents a time frame, typically ranging from one minute to one day or more. The vertical lines (wicks) extend up and down from the body, indicating the highest and lowest prices reached during that timeframe. The body represents the range between the open and close prices.

Anatomy of a Candle Chart

To effectively interpret candle charts, it’s important to understand their key components:

- Open Price: Represents the asset’s price at the beginning of the timeframe.

- Close Price: Indicates the asset’s price at the end of the timeframe.

- High Price: The highest price reached during the timeframe.

- Low Price: The lowest price reached during the timeframe.

- Body: The area between the open and close prices. The color of the body (green or red) indicates the direction of price movement.

- Wicks: The vertical lines extending from the body, representing the high and low prices.

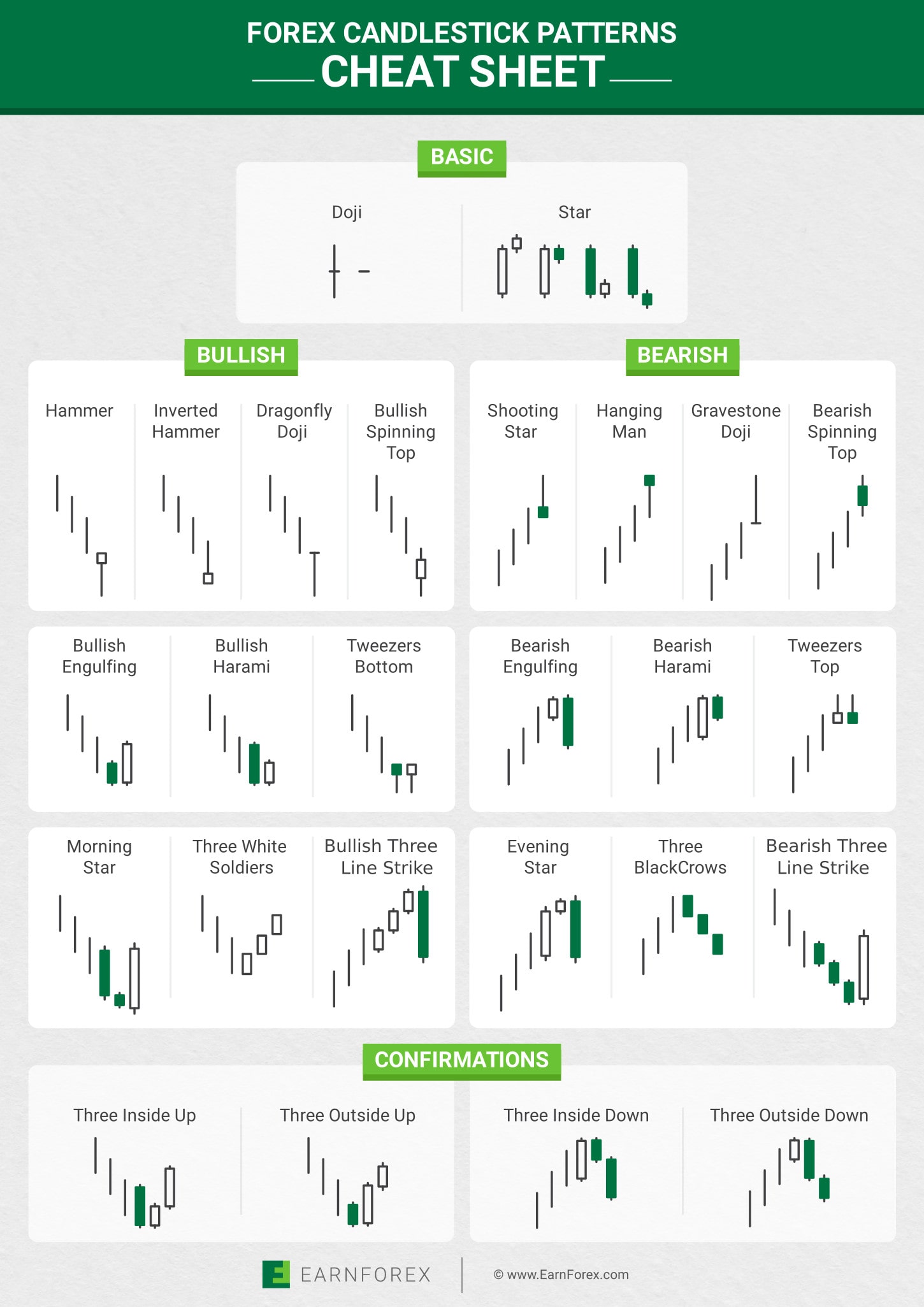

Candle Chart Patterns

By identifying and analyzing specific patterns formed by candlesticks, traders can gain insights into market trends and potential price movements. Some common patterns include:

- Bullish Engulfing Pattern: A large green candle that completely engulfs the previous red candle.

- Bearish Engulfing Pattern: A large red candle that completely engulfs the previous green candle.

- Bullish Hammer Pattern: A candle with a small body and a long lower wick, indicating a potential reversal.

- Bearish Hanging Man Pattern: A candle with a small body and a long upper wick, suggesting a potential decline.

- Doji Pattern: A candle with a body that is very close to its opening and closing prices, indicating indecision or consolidation.

Image: www.plafon.id

Tips and Expert Advice

To effectively use option trading candle charts, consider the following tips and expert advice:

- Identify Trends: Use candle charts to identify long-term trends in the market, as this can provide valuable insights into potential price movements.

- Pay Attention to Patterns: Learn to recognize and interpret common candle chart patterns, as they can indicate potential changes in direction.

- Consider Volume: Volume data can complement candle charts, providing information about the strength of price movements.

- Use Multiple Time Frames: Analyze candle charts across different time frames to gain a wider perspective on asset behavior.

FAQ

Q: What is a candle chart?

A: A visual representation of price action over a specific time period, with each candle representing a range of prices and indicating the open, close, high, and low prices.

Q: How do I interpret candle chart patterns?

A: By recognizing and analyzing specific candlestick formations, traders can gain insights into market trends and potential price movements.

Q: Can candle charts predict future price movements?

A: While candle charts can provide valuable insights, it’s important to note that they cannot accurately predict future price movements with complete certainty.

Option Trading Candle Chart Pdf

https://youtube.com/watch?v=pI2It-b7jfM

Conclusion

Option trading candle charts are indispensable tools for traders of all levels. By understanding the anatomy, patterns, and implications of candle charts, you can make more informed trading decisions. Remember, constant learning and practice are key to mastering this valuable technique.