In the ever-evolving realm of financial markets, astute traders seek to decipher the subtle nuances of price action to gain a competitive edge. One such pattern that often instills trepidation in investors is the enigmatic black candle. These bearish harbingers signal a potential shift in market sentiment, and traders who can effectively navigate their treacherous waters can unlock lucrative opportunities. Enter the world of black candle trading options.

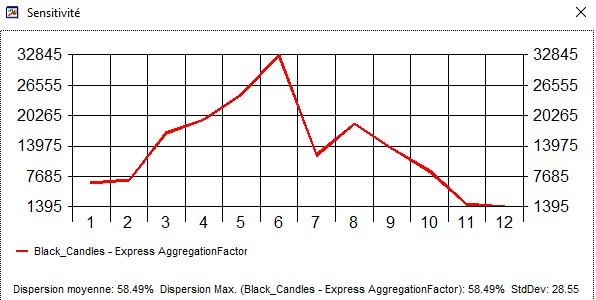

Image: www.best-trading-platforms.com

What is a Black Candle?

A black candle in technical analysis represents a period during which the closing price of a security falls below its opening price. Its visual manifestation on a candlestick chart is a solid black or red column, depending on the charting software used. The length of the candle’s body indicates the magnitude of the price decline, while the size of the wicks (the thin lines extending above and below the body) reflects the range of price fluctuations during the period.

Significance of Black Candles in Trading

Black candles serve as a potent indicator of bearish market sentiment, signaling that sellers are aggressively pushing prices lower. They can appear as isolated events, indicating a temporary setback, or as part of broader downtrends, portending further declines. The context and technical indicators surrounding black candles play a crucial role in determining their predictive value.

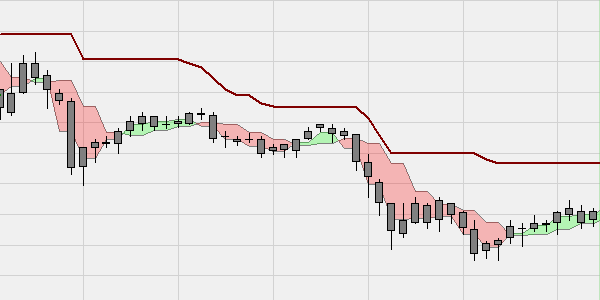

Identifying and Interpreting Black Candles

To effectively utilize black candles in trading, traders must develop a keen eye for identifying and interpreting their nuances. Isolated black candles, especially if they occur during an uptrend, often represent minor retracements that can be leveraged as potential entry points for long positions. However, clusters of black candles, particularly those with long bodies and small wicks, typically indicate sustained selling pressure and increased likelihood of further downtrends.

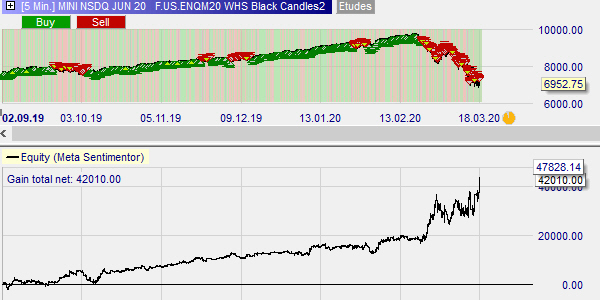

Image: www.best-trading-platforms.com

Black Candles in Option Strategies

Option traders can capitalize on the predictive power of black candles by incorporating them into their trading strategies. One common approach is to sell put options when black candles emerge, betting on a continued decline in the underlying asset. Conversely, buying call options when black candles are rejected by the market can yield substantial profits if the price rebounds.

Cautions and Considerations

While black candles can provide valuable insights into market sentiment, traders should exercise caution and consider the broader technical context before making trading decisions. False signals can occur, especially during volatile market conditions. Therefore, combining black candles with other technical indicators, such as moving averages or support and resistance levels, can enhance the accuracy of trading decisions.

Black Candle Trading Options

Image: www.best-trading-platforms.com

Conclusion

Black candles, often shrouded in bearish connotations, offer astute traders a powerful tool for navigating market downturns. By understanding the significance of these patterns, identifying their nuances, and incorporating them into option strategies, traders can harness the forces of market sentiment to their advantage. However, it is crucial to approach black candle trading with a cautious and informed approach, considering the broader technical landscape and always seeking to verify signals before making trades.