Navigate the multifaceted world of options trading with this comprehensive guide to spread options. As a savvy trader seeking enhanced risk management and potential profit opportunities, understanding the intricacies of spread options is crucial. This article will delve into the concept, strategies, and nuances of this powerful trading technique, empowering you to make informed decisions in the dynamic financial landscape.

Image: www.tradingview.com

Defining Spread Options: A Synergy of Contracts

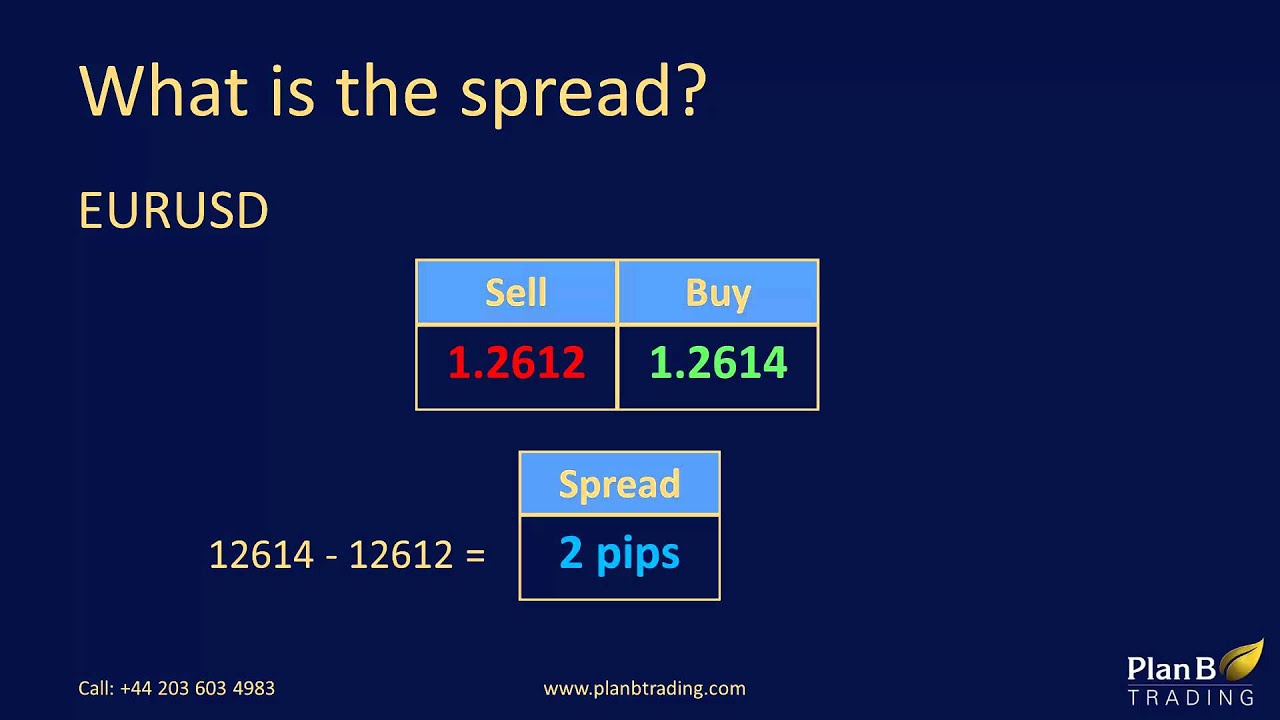

Spread options, also known as multi-leg options, involve the simultaneous purchase and sale of two or more options on the same underlying asset. These options differ in strike prices and/or expiration dates, creating a carefully calibrated position with defined risk and reward parameters. By combining these contracts, traders aim to capitalize on specific market scenarios while mitigating potential losses.

Unlocking the Versatility of Spread Options

Spread options offer a range of strategies tailored to different market conditions and risk appetites. Bullish spreads, such as call spreads and butterfly spreads, are employed when traders anticipate an upward movement in the underlying asset’s price. Bearish spreads, like put spreads and iron condors, are deployed when a decline in the underlying asset’s value is expected. Understanding the intricacies of each strategy is key to successful spread option trading.

Weighing the Benefits and Risks: A Calculated Approach

Spread options provide several advantages over single-leg options. The defined risk involved limits potential losses compared to holding individual options. Additionally, spread options offer greater flexibility in customizing positions to align with specific market views. However, it’s crucial to acknowledge that spread options also carry unique risks, including potential for profit loss and the complexity involved in managing multiple contracts.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

Image: scuba-dawgs.com

Deciphering the Key Considerations: A Strategic Framework

Before embarking on spread option trading, several key considerations must be meticulously evaluated. Understanding the underlying asset’s price behavior, volatility, and expected market direction is paramount. Moreover, selecting the appropriate option strike prices and expiration dates requires careful analysis and judgment. Managing risk effectively by setting stop-loss orders and adjusting positions as needed is essential for prudent trading.

Harnessing Technology for Enhanced Trading

In today’s digital age, leveraging the advancements of technology can significantly enhance spread option trading. Online brokerage platforms provide powerful tools for real-time market analysis, option chain visualization, and trade execution. Utilizing these tools empowers traders to make informed decisions and execute their strategies efficiently.

Exploring Real-World Applications: Success Stories and Market Insights

Successful spread option traders illustrate the practical applications and profitability of this versatile technique. Case studies and market examples provide valuable insights into how spread options have been effectively employed in diverse market environments. Analyzing these real-world examples contributes to a deeper understanding of the strategic applications of spread options.

Stay Informed: Keeping Pace with the Evolving Landscape

The financial landscape is constantly evolving, and staying abreast of the latest trends and developments in spread option trading is imperative. Subscribing to industry publications, attending webinars, and engaging with experienced traders provide invaluable opportunities for continued knowledge expansion. By embracing this continuous learning mindset, traders can adapt to changing market dynamics and refine their trading strategies.

Trading Spread Options

Image: www.ydeho.com

Conclusion: Empowering Traders with Spread Option Mastery

Spread options offer traders a powerful tool for managing risk, customizing positions, and potentially enhancing returns in the complex world of options trading. By diligently studying the concepts, strategies, and nuances outlined in this article, traders are well-positioned to navigate the complexities of spread options with confidence. Embracing a calculated approach, harnessing technological advancements, and staying informed empower traders to leverage spread options as a valuable instrument in their financial arsenal.