Unveiling the Secrets of a Profitable Trading Strategy

In the world of investing, there is a vibrant landscape of options trading strategies, each crafted to achieve specific financial objectives. One such strategy, the call credit spread, has gained prominence among seasoned traders due to its potential for generating substantial returns with controlled risk. In this comprehensive guide, we delve into the intricacies of a call credit spread options trade, empowering you with the knowledge and confidence to navigate the exciting world of options trading.

Image: www.fintastic.trading

Defining a Call Credit Spread

A call credit spread is an options trading technique involving the simultaneous sale of one call option (short) and the purchase of another call option (long) with identical expiration dates but different strike prices. The strike price of the short (higher strike) option is essentially the selling price of the underlying asset, while the strike price of the long (lower strike) option is simultaneously the purchase price. Thus, the net value of the spread is the premium received from selling the short option minus the premium paid for buying the long option.

Why Call Credit Spreads?

Traders often employ call credit spreads when they anticipate sideways movement or a moderate increase in the underlying asset’s price within a defined time frame. This strategy benefits from limited risk, as the maximum loss is capped at the difference between the strike prices of the sold and purchased call options, minus the net premium received. Simultaneously, the reward potential can be substantial if the underlying asset’s price action aligns with the trader’s expectations.

Dissecting the Mechanics

Visualize a call credit spread in action: a trader sells a call option with a strike price of $105 and receives $5 in premium. They subsequently buy a call option with a strike price of $100 and pay $2 in premium. The net premium earned for the spread amounts to $3 ($5 – $2). Should the underlying asset’s price close between $100 and $105 at expiration, the trader retains the entire premium, pocketing the profit. If the asset price surpasses $105, the sale of the higher strike call may result in a loss, while if the price falls below $100, the purchase of the lower strike call may lead to a loss.

Image: thewrenchfinder.com

Expert Insights: Risk Management

Seasoned traders emphasize the importance of prudent risk management when engaging in call credit spread options trading. It’s crucial to meticulously calculate the profit/loss potential and carefully weigh it against personal risk tolerance. Furthermore, always adhere to sound money management principles, allocating only a portion of your investment capital to any given strategy.

Trading Recommendations: Timing Is Everything

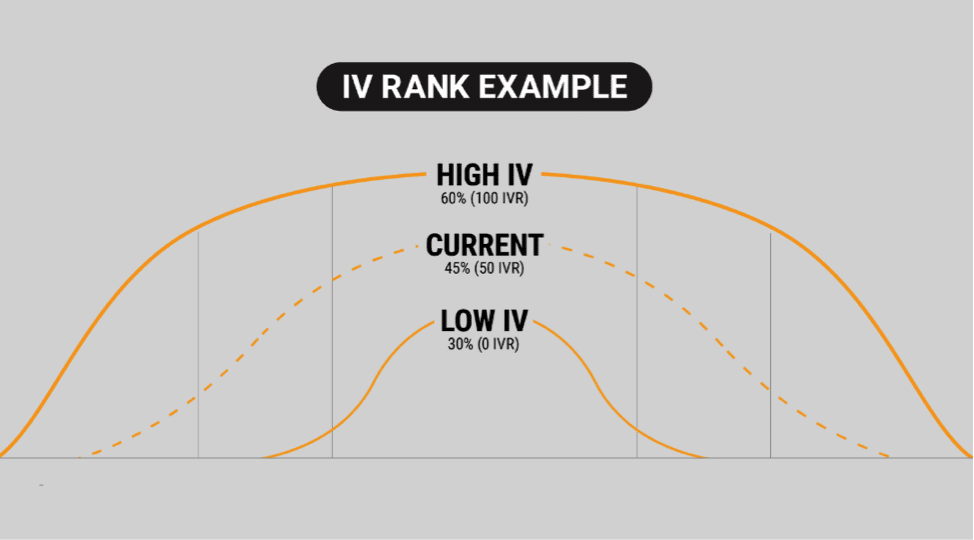

While call credit spreads offer the allure of profit, timing is paramount. Traders seeking success should seek market conditions exhibiting implied volatility (IV) suppression, as heightened volatility can erode the time value of the options, diminishing the spread’s profitability. Moreover, selecting the appropriate expiration date aligns with the underlying asset’s price action and expected volatility.

What Exactly Is A Call Credit Spread Options Trading

Image: www.asiaforexmentor.com

Conclusion

Call credit spread options trading is a sophisticated strategy that, when executed skillfully, can unlock the potential for significant returns. By understanding the mechanics of the spread, incorporating sound risk management practices, and leveraging expert insights, traders can harness the power of options to achieve financial success. Remember, the journey to mastering options trading demands dedication, continuous learning, and a keen eye for market dynamics.