In the bustling world of financial markets, options trading stands as a potent tool, empowering investors to navigate market complexities and amplify their returns. And at the heart of effective options trading lies a language understood by savvy investors – candle stick charts. These visual representations of price movements over time hold valuable insights, guiding traders toward informed decisions that can turn the odds in their favor.

Image: www.indian-share-tips.com

Unlocking the Power of Candle Stick Charts

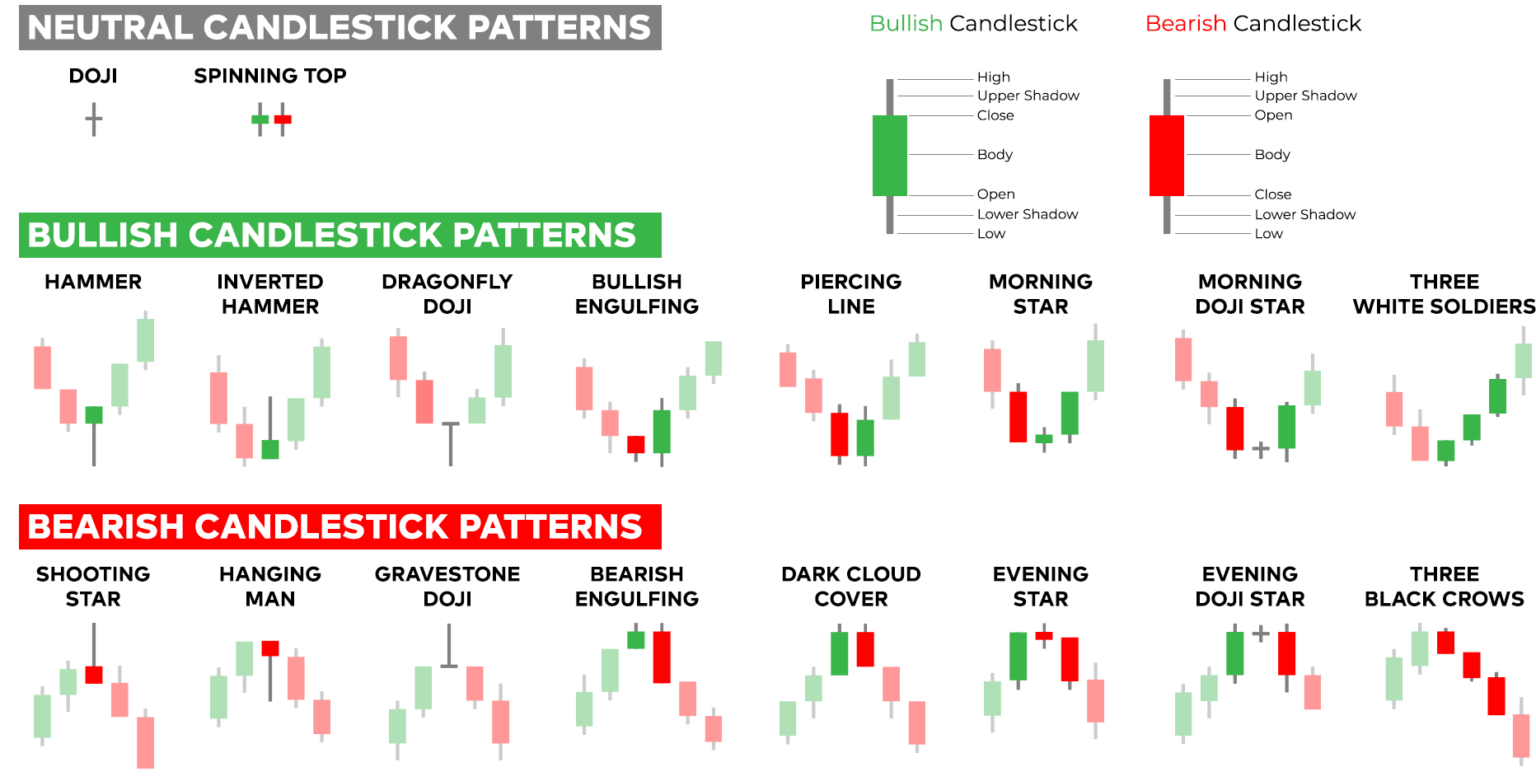

Think of candle stick charts as pictorial tales, narrating the fluctuations of an underlying asset’s value. Each candle, representing a specific time interval, encapsulates the essential elements of price action – the open, close, high, and low prices. The interplay of these elements creates unique patterns, revealing the underlying trends, momentum, and sentiments that drive market movements.

Mastering the art of reading candle stick charts empowers traders with a discerning eye, enabling them to identify potential trading opportunities with greater precision. Whether you’re a seasoned veteran or a novice in the financial arena, understanding candle stick charts is the gateway to unlocking the full potential of options trading.

Navigating the Options Trading Landscape

Options trading, while potentially lucrative, also carries inherent risks. By employing candle stick charts as your guiding compass, you gain a tactical advantage in navigating this dynamic market. Whether you’re implementing bullish or bearish strategies, these charts equip you with the insights to identify trends, spot reversals, and capitalize on market fluctuations.

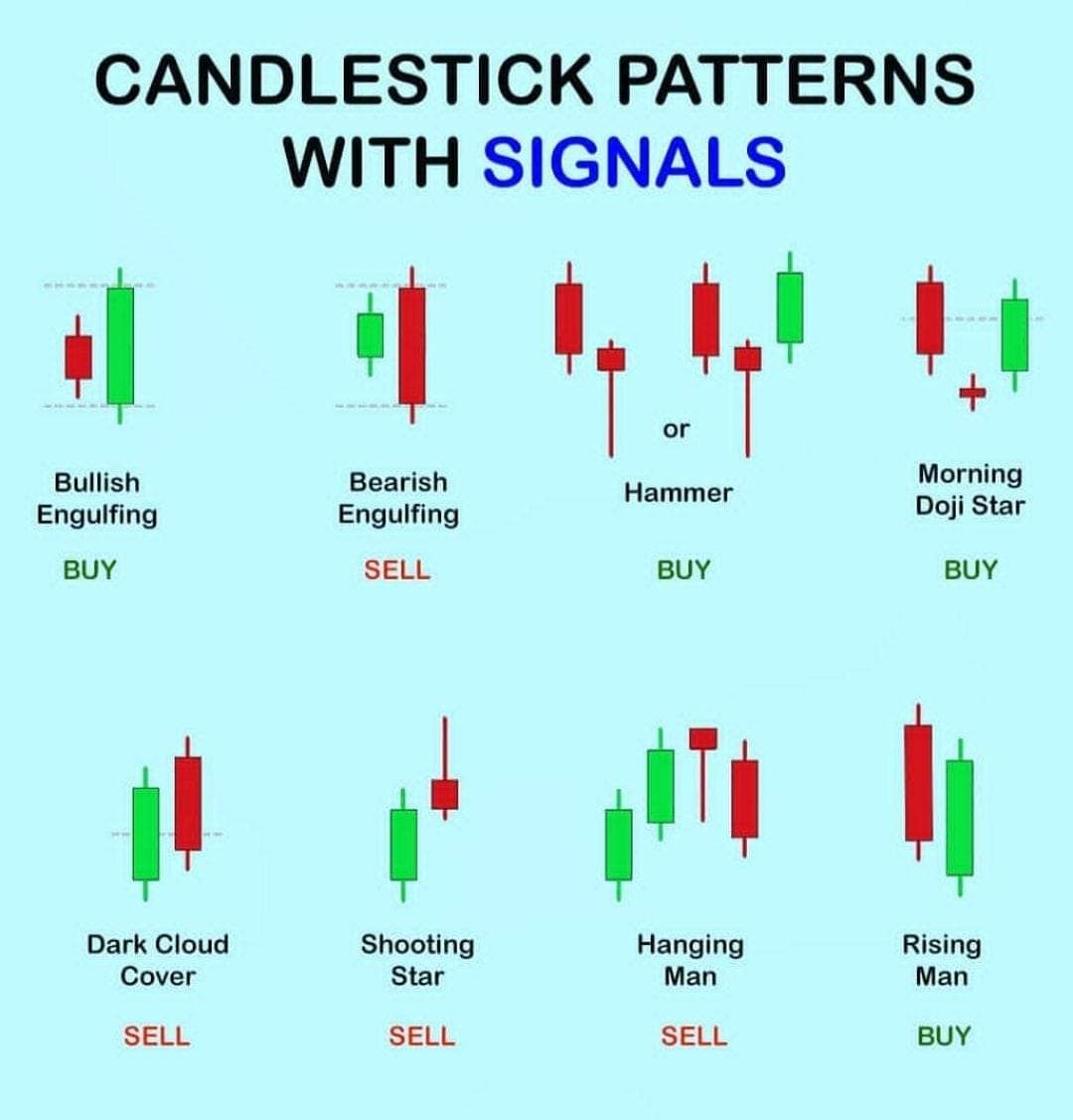

Intricate patterns, such as engulfing patterns, doji candles, and hammer candles, serve as vital indicators, providing traders with valuable clues about the prevailing market sentiment. The ability to decipher these patterns empowers you to make well-informed trades, increasing your odds of successful outcomes.

Expert Insights for Augmented Returns

Renowned experts in the field of options trading advocate the use of candle stick charts as an indispensable tool in their trading strategies. Jack Schwager, an acclaimed author and hedge fund manager, emphasizes, “Candle stick charts provide a visual representation of price action, making it easier to identify trends, support and resistance levels, and potential trading opportunities.”

Echoing Schwager’s sentiments, Mark Douglas, a renowned trading coach, asserts, “By incorporating candle stick charts into your options trading strategy, you gain a competitive edge in anticipating market movements and making more informed decisions.”

Image: www.andrewstradingchannel.com

Actionable Tips for Enhanced Trading

Embrace the following practical tips to harness the full potential of candle stick charts in your options trading endeavors:

-

Study historical charts to identify recurring patterns and their implications for future price movements.

-

Utilize multiple time frames, ranging from hourly to daily and weekly charts, to gain a comprehensive perspective of market dynamics.

-

Combine candle stick chart analysis with technical indicators, such as moving averages and Bollinger Bands, for a more robust trading strategy.

-

Practice disciplined risk management techniques to mitigate potential losses and preserve capital.

Candle Stick Charts Options Trading

Image: www.pinterest.com

Conclusion: Embracing the Power of Knowledge

In the realm of options trading, candle stick charts emerge as a transformative tool, illuminating the path to informed decision-making and heightened returns. By grasping the intricacies of these visual representations, you empower yourself to navigate market complexities with confidence and precision, unlocking the gateway to financial success.

Remember, the journey to mastery requires dedication and a thirst for knowledge. Immerse yourself in the study of candle stick charts, consult expert insights, and relentlessly seek opportunities to refine your trading strategies. The rewards of your efforts will unfold in the form of optimized trades, enhanced portfolio performance, and a profound understanding of the financial markets. Embrace the power of knowledge and elevate your options trading prowess to new heights.