In the thrilling world of financial markets, options trading has emerged as a powerful tool for investors seeking to mitigate risk and enhance returns. Central to this strategy is the concept of options premiums, which play a crucial role in determining the profitability of these contracts. In this comprehensive article, we will embark on an in-depth exploration of options premiums, unraveling their mechanics, identifying key strategies, and providing valuable insights for traders of all levels. Join us as we delve into the intricacies of this fascinating financial instrument!

Image: medium.com

Defining Options Premiums

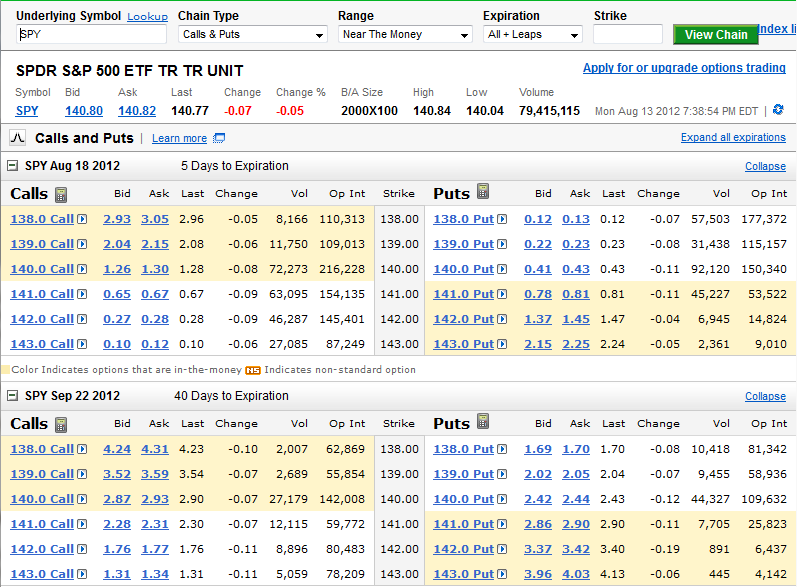

An options premium, simply put, is the price paid by an options buyer to the options seller in exchange for the right to exercise the option at a later date. This premium serves as compensation for the seller, who assumes the obligation to fulfill the terms of the contract upon its exercise. The premium’s value is influenced by several factors, including the strike price, time to expiration, underlying asset’s volatility, and prevailing interest rates.

Essential Concepts:

- Call Premium: Premium paid by the buyer of a call option, granting them the right to purchase the underlying asset at the strike price.

- Put Premium: Premium paid by the buyer of a put option, granting them the right to sell the underlying asset at the strike price.

- Break-Even Point: The price at which the value of the underlying asset equals the sum of the strike price and premium paid.

- Intrinsic Value: The inherent value of an option derived from its immediate exercise profitability.

Strategies and Payoffs

The beauty of options premiums lies in the wide range of trading strategies they facilitate. Let’s delve into some common approaches:

Image: www.seeitmarket.com

1. Covered Call Writing

This strategy involves writing (selling) call options while holding the underlying asset. By receiving a premium, the seller profits from a neutral to bullish market outlook. However, if the asset’s price rises above the strike price, the seller may be obligated to deliver the asset at a lower price.

2. Protective Put Writing

With this strategy, traders write (sell) put options against their existing long positions in the underlying asset. The premium received acts as a buffer against potential price declines. If the asset’s price falls below the strike price, the seller may be forced to purchase additional shares at a higher price.

3. Bullish Call Spread

This strategy combines buying a call option and selling another call option at a higher strike price. The trader profits from a sustained uptrend or a decrease in implied volatility. The profit potential is limited but has a higher probability of success compared to buying a single call option.

Latest Trends and Developments

The options market is constantly evolving, influenced by technological advancements and regulatory changes. Here are some noteworthy trends to watch:

- Rise of Online Trading Platforms: Online brokerages have made options trading accessible to a broader range of investors, empowering them to execute trades from anywhere with ease.

- Artificial Intelligence in Options Pricing: AI algorithms are increasingly used to analyze large datasets and predict option premium movements, enhancing traders’ decision-making process.

- Increased Use of Options in Risk Management: Institutions are embracing options as a valuable risk management tool, hedging against potential losses by incorporating them into their investment portfolios.

Trading Options Premiums

Image: www.entrepreneurshipsecret.com

Conclusion

Navigating the intricate world of options premiums requires a deep understanding of their mechanics, trading strategies, and evolving market dynamics. By equipping oneself with this knowledge, investors can unlock the potential of options trading, effectively mitigating risk, enhancing returns, and achieving their financial goals. Remember, knowledge is the key to success in the ever-changing arena of financial markets.