Unveiling the Secrets of Affordable Option Trading

In the world of financial markets, options trading offers a unique blend of risk and reward. However, high brokerage fees can often diminish potential profits. This article delves into the concept of option trading, highlighting the lowest brokerage options available and equipping traders with valuable tips for navigating the market effectively.

![10 Best Forex Brokers With Lowest Spreads [June 2021]](https://www.compareforexbrokers.com/wp-content/uploads/2021/01/Lowest-Spread-Forex-Brokers-768x342.png)

Image: www.compareforexbrokers.com

**What is Option Trading?**

Options are financial instruments that grant the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a predetermined date. This flexibility in decision-making makes options trading an attractive proposition for both risk-averse and aggressive investors.

**Navigating the Lowest Brokerage Rates**

When it comes to option trading, minimizing brokerage fees is crucial. Reputable online brokerages offer competitive rates, providing traders with a cost-effective platform to pursue their trading strategies.

**Factors to Consider When Selecting a Broker**

- Fees: This is a non-negotiable factor. Opt for brokerages with low per-contract rates and minimal account fees.

- Platform and Features: A user-friendly trading platform, robust charting tools, and real-time data are essential for successful option trading.

- Educational Resources: Well-established brokerages provide access to educational materials, webinars, and support teams to guide traders in their learning journey.

**Expert Advice for Option Trading**

- Understand the Risks: Option trading involves significant risks. Before venturing into this field, traders must fully grasp the potential for losses.

- Define Trading Objectives: Clearly outline your financial goals and risk tolerance to develop an effective trading plan.

- Master Risk Management: Employ stop-loss orders and position sizing techniques to mitigate potential losses and maximize profits.

- Stay Informed: Keep abreast of market news, economic updates, and industry trends to make informed trading decisions.

- Practice and Discipline: Consistency and dedication are key to mastering option trading. Utilize paper trading or small account sizes to test strategies before going live.

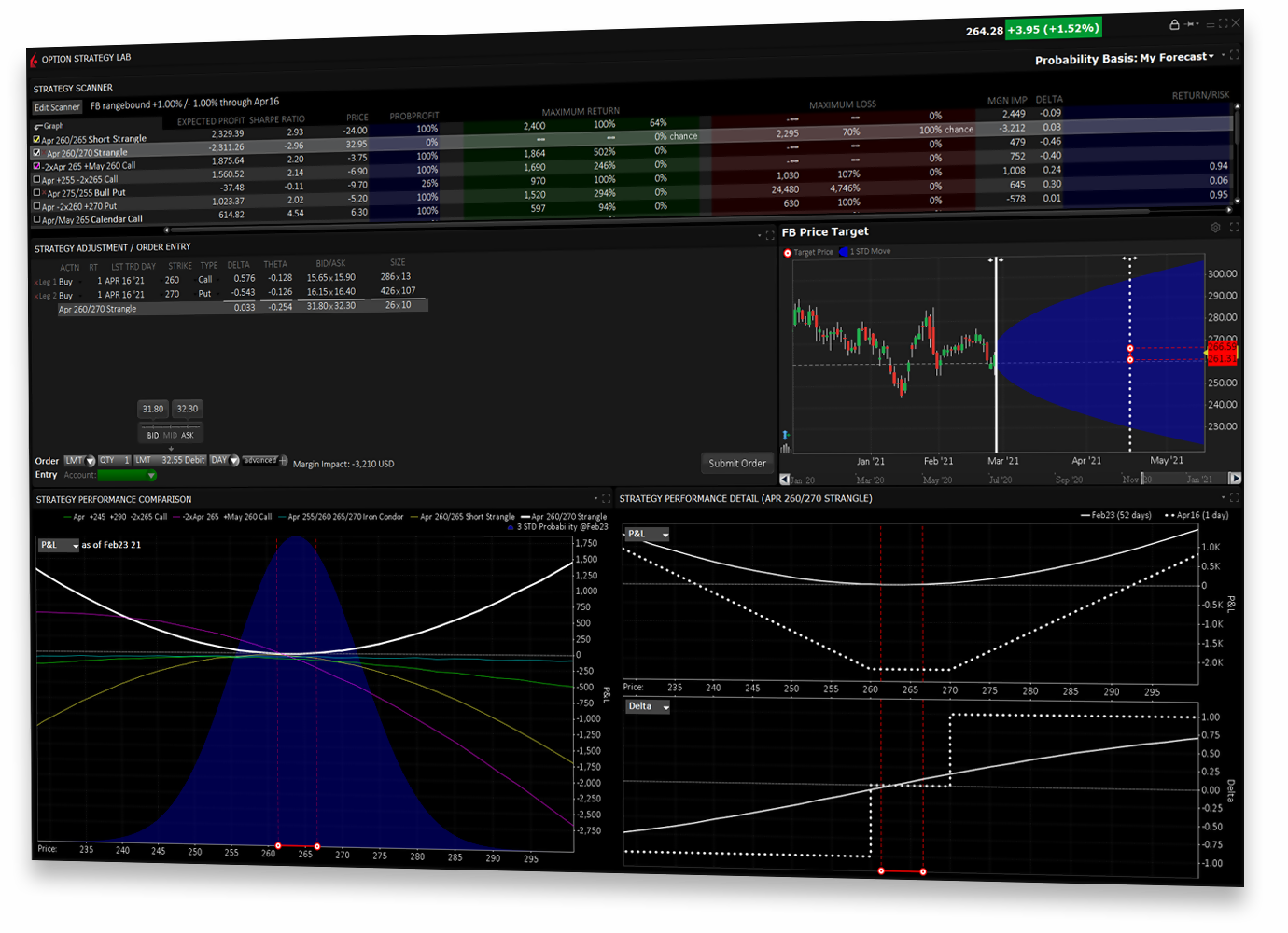

Image: www.interactivebrokers.com

Lowest Brokerage In Option Trading

Frequently Asked Questions

Q: What is the difference between call and put options?

A: Call options grant the right to buy an underlying asset, while put options grant the right to sell.

Q: What is the expiry date of an option?

A: The expiry date is when the option contract ceases to exist. Options can expire worthless if they are not exercised before this date.

Q: How are brokerage fees calculated?

A: Fees vary depending on the brokerage firm. They can be charged per contract, per transaction, or as a combination of both.

**Conclusion**

Understanding the lowest brokerage rates and adhering to expert advice empower traders to pursue option trading with greater efficiency and profitability. Whether you are a novice or an experienced trader, the insights provided in this article will equip you with the necessary tools to navigate the market strategically and capitalize on potential opportunities. Are you ready to unlock the world of option trading with confidence?