In the fast-paced world of financial markets, binary options trading has emerged as a popular yet controversial investment strategy. With its potential for substantial gains, it’s crucial to equip oneself with a thorough understanding of this complex instrument. This comprehensive guide will delve into the very definition of binary options trading, its genesis, its key features, and the foundational pillars upon which it rests.

Image: tradingstrategyguides.com

Binary Options: A Primer

Binary options, simply put, are financial contracts that present a proposition: Will the underlying asset’s price exceed or fall below a specified strike price by a predetermined expiration time? This simplicity, however, belies the complexity of the strategy. Unlike traditional options, binary options offer a fixed payout, often ranging between 70% and 90% of the investment, or nothing at all. This inherent binary nature underscores the high-risk, high-reward dynamics of this trading vehicle.

The origins of binary options can be traced back to the early 2000s, when they emerged as a retail-focused investment product. Their popularity soared due to their accessible nature, requiring limited capital and offering a straightforward premise. As the industry evolved, binary options became available on a wider range of underlying assets, including stocks, currencies, commodities, and indices.

Mechanism of Binary Options

At the heart of binary options trading lies the concept of prediction. Traders must speculate whether the underlying asset’s price will rise or fall compared to the strike price at the specified expiration time. This time-sensitive element adds urgency and excitement to the trading process.

Binary options contracts are typically short-term, lasting anywhere from 60 seconds to several months. This flexibility allows traders to tailor their strategies to their risk tolerance and time constraints. Furthermore, binary options can be traded on both regulated and unregulated exchanges, with each offering distinct advantages and risks.

Types of Binary Options

Beyond the basic up/down binary options, a myriad of variations exist to cater to diverse trading styles and risk preferences. Some popular types include:

- Call/Put Options: These are the most basic binary options, where traders predict if the asset’s price will rise (call) or fall (put) above/below the strike price.

- Touch/No Touch Options: With touch options, traders speculate if the asset’s price will reach a specific price level (touch) within the contract’s lifespan. No-touch options, conversely, pay out if the price never touches that level.

- Boundary Options: These contracts involve predicting whether the asset’s price will fluctuate within a specified range (stay between boundaries) or break out of it (breach boundaries).

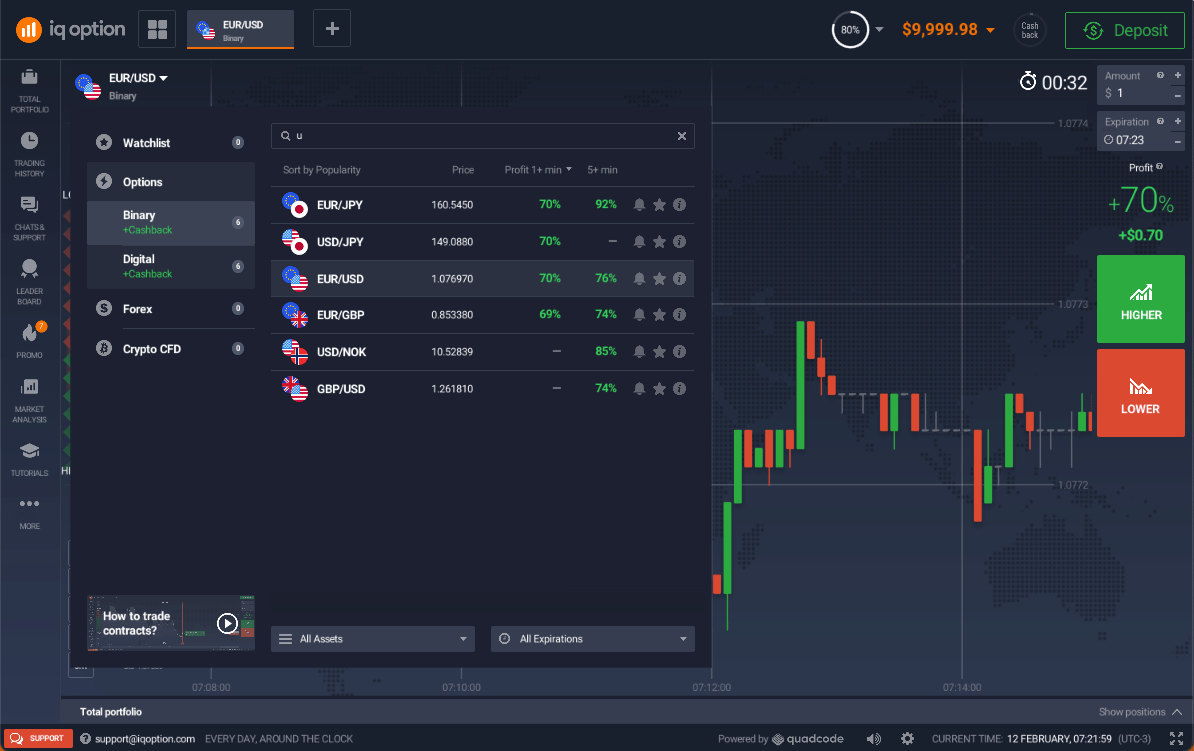

Image: iqbroker.com

Advantages and Disadvantages

As with any investment strategy, binary options trading comes with both advantages and disadvantages. It’s essential to weigh these factors carefully before embarking on this potentially lucrative yet risky endeavor.

Advantages:

- Limited Risk: Binary options offer a defined risk profile. Traders are aware of the maximum potential loss upfront, which can help manage risk effectively.

- High Potential Returns: With payouts ranging from 70% to 90%, binary options offer the allure of substantial gains within a short time frame.

- Simplicity: The underlying premise of binary options is relatively straightforward, making it accessible to traders of all experience levels.

- Flexibility: Binary options can be traded on various underlying assets, offering diversification opportunities.

Disadvantages:

- High Risk: The potential for significant losses is an inherent feature of binary options trading. Traders could lose their entire investment.

- Regulatory Concerns: Binary options trading has faced scrutiny due to concerns about fraud and abuse, particularly in unregulated markets.

- Addiction Potential: The thrill of quick gains and losses can lead to addictive behavior, emphasizing the need for discipline and caution.

Binary Options Trading Definition

Image: www.youtube.com

A Path Forward

The world of binary options trading is a dynamic and evolving landscape. While the potential for substantial gains exists, so too does the risk of significant losses. Traders must approach this strategy with caution, armed with a thorough understanding of the risks involved. Thorough research, sound risk management practices, and the guidance of reputable brokers are invaluable tools in navigating this complex market.

Remember, financial markets are inherently volatile, and binary options trading is not suitable for all. By carefully weighing the advantages and disadvantages and proceeding with prudence, traders can mitigate risks and potentially reap the rewards of this high-stakes investment arena.