Introduction

Options trading can be a lucrative but complex endeavor. Understanding the intricacies of this financial instrument is essential for investors looking to maximize their returns. IG, a renowned online trading platform, offers a wide range of options trading opportunities, making it a popular choice among investors. This article delves into the world of IG options trading, providing a comprehensive guide to its advantages, strategies, and risk management techniques.

Image: www.business2community.com

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Options traders can speculate on the future price movements of an asset, hedge against risk, or generate income through premium collection. IG’s user-friendly platform and diverse options offerings make it a prime destination for both novice and seasoned options traders.

Understanding Key Concepts

Call Options

Call options give the buyer the right to buy an underlying asset at a predetermined price, known as the strike price. If the asset’s price rises above the strike price, the call option becomes valuable, allowing the buyer to exercise their right and purchase the asset at the lower strike price.

Put Options

Put options grant the buyer the right to sell an underlying asset at a predetermined strike price. When the asset’s price falls below the strike price, the put option becomes valuable, allowing the buyer to sell the asset at the higher strike price.

Image: play.google.com

Expiration Date

Options contracts have a finite lifespan and expire on a predetermined date. If the option is not exercised before the expiration date, it becomes worthless.

Advantages of IG Options Trading

Market Access

IG provides access to a vast array of underlying assets, including stocks, indices, commodities, and forex. This diversity allows traders to tailor their options strategies to their specific market views.

Flexible Trading

IG’s platform offers flexible trading options, enabling traders to choose from different order types, such as market orders, limit orders, and stop-loss orders. This customizability allows traders to implement various trading strategies.

Leverage

Options trading offers leverage, allowing traders to control a significant amount of the underlying asset with a relatively small investment. This leverage can amplify both profits and losses, making risk management crucial.

Essential Options Strategies

Bull Call Spread

This strategy involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price with the same expiration date. The trader profits if the underlying asset’s price rises, but the potential profit is capped.

Bear Put Spread

The bear put spread strategy is the inverse of the bull call spread. The trader buys a put option at a higher strike price and sells a put option at a lower strike price. Profits are realized when the underlying asset’s price falls, but again, the potential profit is limited.

Vertical Spread

Vertical spreads involve buying and selling options of the same type (call or put) but with different strike prices. The profit potential is limited compared to single options but offers a more defined risk-reward profile.

Risk Management Techniques

Understand Your Risk Tolerance

Before engaging in options trading, it is crucial to assess your risk tolerance. Options trading involves inherent risk, and traders should only invest with funds they can afford to lose.

Diversification

Diversifying your options portfolio across different underlying assets reduces your exposure to any single asset’s price fluctuations.

Hedging

Using options to hedge against potential losses in existing positions can help manage risk and protect your portfolio’s value.

Recent Trends and Developments

The options trading landscape is constantly evolving, with new products and strategies emerging. Some recent trends include:

Increased Use of Technology

Advanced trading platforms leverage artificial intelligence and machine learning to provide traders with enhanced analytics and trading tools.

Alternative Options

Binary options and digital options have gained popularity due to their simplicity and high potential returns, but they also carry higher risks.

Regulatory Changes

Regulators are paying closer attention to options trading, implementing measures to protect investors and maintain market integrity.

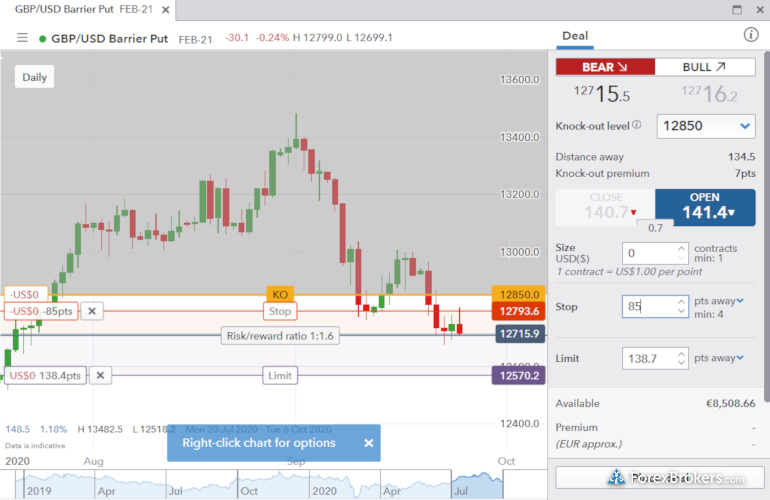

Ig Options Trading Example

Image: www.forexbrokers.com

Conclusion

IG options trading offers investors a versatile tool to enhance their market exposure and potential returns. Understanding the options market, key strategies, and risk management techniques is paramount to successful options trading. By leveraging IG’s platform and applying the principles outlined in this guide, investors can navigate the complexities of options trading with increased confidence and optimize their trading performance.

Remember, financial markets are dynamic and subject to constant change. Continuously educating yourself and staying abreast of market trends is essential for long-term success in IG options trading.