In the ever-evolving world of financial trading, options have emerged as a powerful tool for investors seeking both profit potential and risk management. eToro, a leading social trading platform, has made options trading accessible to a wider audience, empowering traders to tap into this dynamic market. This comprehensive guide will provide a thorough understanding of option trading on eToro, covering key concepts, strategies, and the potential rewards and risks involved.

Image: www.business2community.com

What are Options?

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell a specified underlying asset, such as a stock, at a predetermined price on or before a specific date. With options, traders can speculate on the future movement of the underlying asset without having to own it outright.

There are two primary types of options:

- Call options give the buyer the right to buy the underlying asset at the strike price.

- Put options give the buyer the right to sell the underlying asset at the strike price.

Why Trade Options on eToro?

eToro offers a user-friendly and accessible platform for options trading, making it an attractive choice for both novice and experienced traders. Key benefits include:

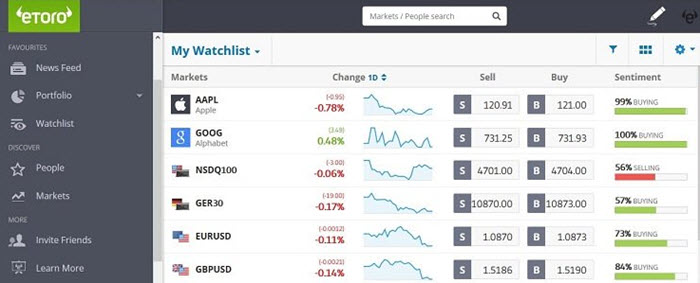

- Transparency: eToro displays real-time quotes and provides clear risk disclosures to ensure informed trading decisions.

- Variety of Assets: Traders can choose from a wide range of underlying assets, including stocks, ETFs, commodities, and indices.

- Leverage: eToro allows traders to utilize leverage, magnifying potential returns but also amplifying risks.

- Social Trading: eToro allows traders to connect with a community of experienced investors, sharing strategies and insights.

Key Concepts in Option Trading

To navigate the world of options trading effectively, it’s crucial to grasp a few key concepts:

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date on which the option contract expires and becomes worthless.

- Premium: The price paid to the option seller for the right to exercise the option.

- In-the-Money (ITM): An option is ITM when its intrinsic value is positive, meaning the buyer can profit by exercising it.

- Out-of-the-Money (OTM): An option is OTM when its intrinsic value is negative, meaning the buyer cannot profit by exercising it.

Image: binaryoptionsca.com

Option Trading Etoro

Option Trading Strategies

There are numerous option trading strategies, each with its unique risk-reward profile. Here are some common approaches:

- Covered Call: Selling a call option against an underlying asset the trader owns, generating premium income.

- Protective Put: Buying a put option to protect a long stock position against potential losses.

- Bull Call Spread: Buying a call option at a higher strike price and selling a call option at an even higher strike price, benefitting from a rise in the asset’s price.

- Bear Put Spread: Selling a put option at a higher strike price and buying a put option at an even higher strike price, profit