Introduction

The world of financial trading has evolved rapidly over the past decade, and options trading has emerged as one of the most popular investment strategies. As a leading online trading platform, eToro has also recognized the growing demand for options trading and has added this feature to its platform. This article will delve into the world of options trading on eToro, exploring its intricacies and providing valuable insights for aspiring traders. We will cover key concepts, the benefits and risks involved, and provide expert tips to help you navigate this exciting yet complex financial instrument.

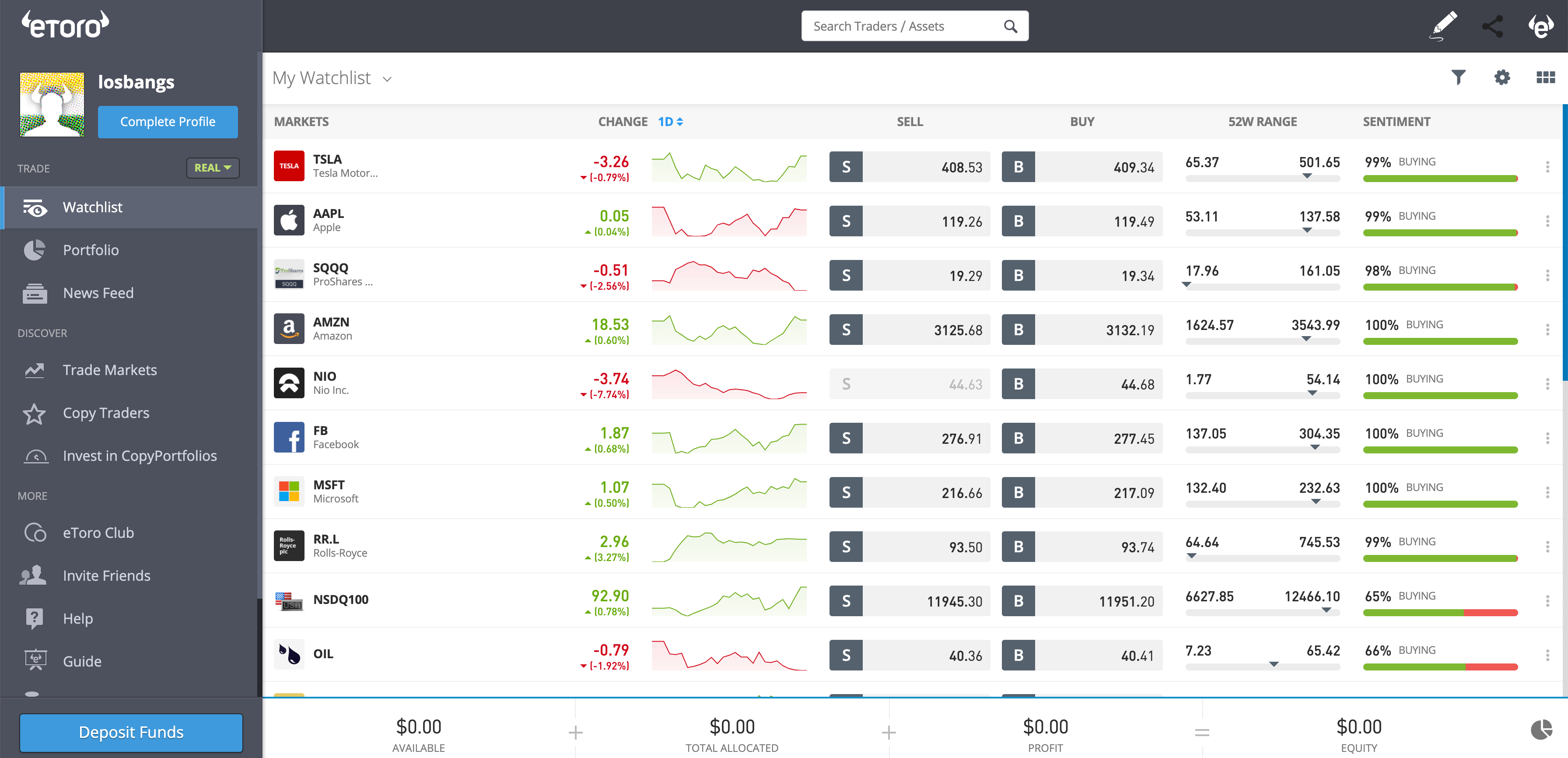

Image: holbornassets.com

What is Options Trading?

Options trading is a type of derivative contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. The underlying asset can be stocks, commodities, currencies, or indices. Options contracts come in two main types: calls and puts. Call options give the buyer the right to buy the underlying asset, while put options give the buyer the right to sell the underlying asset.

How Does Options Trading Work on eToro?

To trade options on eToro, you must first open an account and fund it with sufficient capital. Once your account is set up, you can browse eToro’s options market and choose the underlying asset and contract specifications that align with your trading strategy. eToro offers a wide range of underlying assets, including popular stocks, commodities, and currencies, making it easy to find the markets that interest you.

Once you have selected your underlying asset, you can choose the strike price and expiration date for your options contract. The strike price is the price at which you can buy or sell the underlying asset, and the expiration date is the date on which the contract expires. The price of an options contract is determined by a combination of factors, including the current market price of the underlying asset, the strike price, the expiration date, and the market’s perception of volatility.

Understanding Options Terminology

Before delving into options trading, it’s important to understand some key terms:

Image: www.bettingsites24.in

Call Option:

A contract giving the buyer the right to buy the underlying asset at a specified price on or before a specified date.

Put Option:

A contract giving the buyer the right to sell the underlying asset at a specified price on or before a specified date.

Strike Price:

The price at which the buyer can buy or sell the underlying asset in an options contract.

Expiration Date:

The date on which the options contract expires.

Premium:

The price paid by the buyer to purchase an options contract, representing the cost of the contract.

Options Trading Strategies:

Once you grasp the basics of options trading, you can explore different strategies to align with your risk tolerance and investment goals. eToro provides educational resources and tools to assist you in developing your strategies. Let’s uncover some common approaches:

1. Long Call:

Buying a call option with the expectation that the underlying asset’s price will rise above the strike price before the expiration date.

2. Long Put:

Buying a put option with the belief that the underlying asset’s price will fall below the strike price before the expiration date.

3. Covered Call:

Selling a call option against an underlying asset that you own, providing limited upside potential in exchange for premium income.

4. Protective Put:

Buying a put option as insurance against a potential decline in the underlying asset’s price, limiting potential losses.

Benefits of Options Trading on eToro:

Trading options on eToro offers several advantages to investors:

1. Flexibility and Versatility:

Options provide traders with flexibility in constructing tailored investment strategies to align with their individual risk tolerance and financial goals. Whether seeking speculative opportunities or hedging against market risks, options offer a dynamic tool.

2. Defined Risk:

Unlike traditional stock trading, where losses are potentially unlimited, options trading involves clearly defined risks. The maximum loss is limited to the premium paid for the contract, providing traders with a transparent understanding of their downside risk.

3. Profit Potential:

Options trading can offer substantial profit potential, especially in volatile market conditions. With options, traders can potentially leverage market movements to generate significant returns, using a variety of strategies to maximize their gains.

4. Diversification:

Incorporating options into your investment portfolio can enhance diversification and help manage overall risk. Options provide an additional layer of protection and can balance the volatility of other investments.

5. Income Generation:

Options offer opportunities for income generation through premium collection and theta decay strategies. Traders can sell call or put options to collect premium payments, generating income even if the underlying asset’s price remains steady.

Risks of Options Trading on eToro:

While options trading on eToro offers potential benefits, it’s crucial to be aware of the risks involved:

1. Time Decay:

Options are time-bound contracts, with a specified expiration date. The value of an option decays or erodes over time as it approaches expiration, regardless of the movement of the underlying asset’s price. This decay rate, known as theta decay, can impact profitability if the predicted market movement does not occur before expiration.

Does Etoro Do Options Trading

Image: www.fincyte.com

2. Volatility Risk:

Options trading is