Introduction

In the realm of financial markets, option trading has emerged as a powerful tool for investors seeking to maximize their returns and manage risks. While option trading may seem intimidating at first glance, understanding its intricacies can open up a world of opportunities for astute investors. Australia, with its vibrant financial hub and robust regulatory framework, offers an ideal environment to delve into the world of options trading. This definitive guide will demystify option trading in Australia, empowering you with the knowledge and strategies to navigate this dynamic arena.

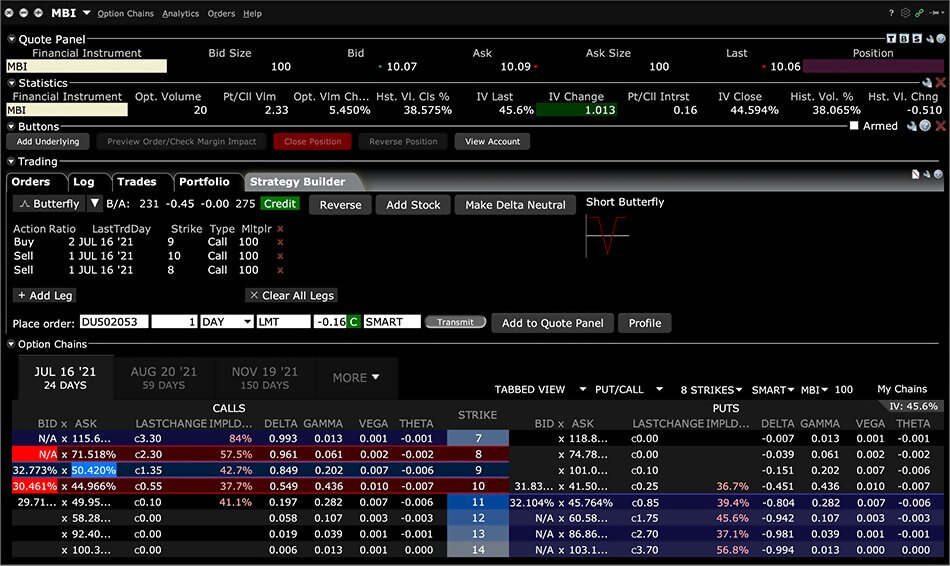

Image: www.interactivebrokers.com.au

What is Option Trading?

Options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility makes options a versatile instrument for speculators and investors alike, enabling them to capitalize on market movements or hedge against potential losses.

Understanding the Basics

At the heart of option trading lies the concept of “call” and “put” options. Call options give the buyer the right to buy the underlying asset, while put options give the buyer the right to sell the asset. The strike price is the predetermined price at which the buyer can exercise the option. The option’s “expiration date” defines the timeframe within which it can be executed.

The Advantages of Option Trading in Australia

Australia’s financial markets are renowned for their liquidity and robust regulatory oversight, providing a secure platform for option trading. The ASX Options Market, in particular, offers a wide range of option contracts on underlying assets such as stocks, indices, and commodities. This provides traders with diverse opportunities to tailor their strategies to varying market conditions.

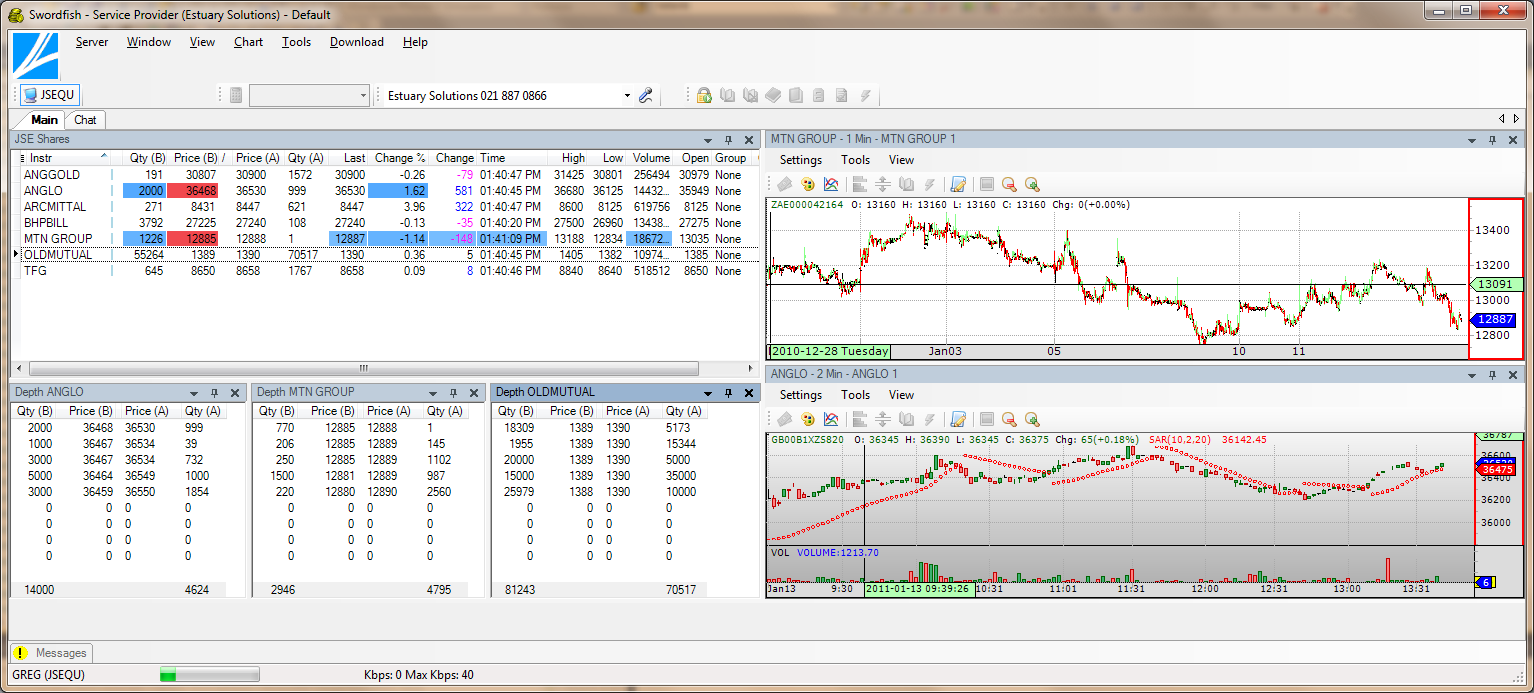

Image: yyizibily.web.fc2.com

Expert Insight: “Understanding Greeks”

Delving into option trading involves understanding the concept of “Greeks.” These mathematical metrics measure the sensitivity of option prices to changes in underlying factors such as price, volatility, time, and interest rates. By comprehending these Greeks, traders can refine their strategies and make informed decisions.

Types of Option Strategies

The spectrum of option trading strategies is vast, catering to different investment objectives. Popular strategies include:

- Buy-Write: Generating income by selling an option while owning the underlying asset.

- Naked Option Selling: Selling an option without owning the underlying asset, bearing greater risk but potentially higher returns.

- Covered Call: Hedging against potential losses in an underlying stock while generating income by selling a call option.

Actionable Tips for Success

- Start Small: Begin with small trades to familiarize yourself with the market and mitigate potential losses.

- Manage Risk: Implement robust risk management strategies, including setting stop-loss orders and diversifying your portfolio.

- Research Thoroughly: Educate yourself on various option trading strategies, underlying assets, and market trends.

- Seek Professional Guidance: Consider consulting with a financial advisor who specializes in option trading for personalized advice and support.

Option Trading In Australia

Image: www.youtube.com

Conclusion

Option trading in Australia presents a wealth of opportunities for those seeking to enhance their financial prospects. By understanding the basics, leveraging expert insights, and employing sound strategies, you can harness the power of options to achieve your investment goals. Remember, the key to success lies in continuous learning, prudent risk management, and a patient approach to navigating the ever-evolving financial markets. Embrace the world of option trading and unlock its potential for financial success in Australia today.