In the world of finance, where relentless tides of numbers dance across screens, trading has become an art mastered by the few. Amidst the diverse financial instruments at their disposal, one option worth exploring is **Time-Decayed (TD) option trading**. Like a skilled sculptor chiseling away at unyielding marble, TD option traders seek to leverage the waning value of time to their advantage, extracting profits from the ebb and flow of the market.

Image: binaroiespejulietotnes.logdown.com

Delving into TD Option Trading: The Art of Capturing Time’s Value

At its core, TD option trading hinges on a single principle: the **time-decay** inherent in options contracts. As time inches closer to an option’s expiration date, its value inevitably dwindles. This decay in value can be attributed to the diminishing probability of the underlying asset reaching the option’s strike price before its expiry.

TD option traders capitalize on this predictable devaluation by selling options contracts that are unlikely to be exercised before they expire. They profit from the time-decay component of the option’s premium, while simultaneously collecting potential gains if the option remains out-of-the-money (OTM). This approach requires meticulous timing and a keen eye for identifying options with a favorable time-decay profile.

Strategies for Success: Navigating the TD Option Landscape

Selling Out-of-the-Money (OTM) Options: This strategy forms the cornerstone of TD option trading, as it positions traders to benefit from the time-decay of options that are unlikely to be exercised. By selling OTM options, traders effectively collect premiums while betting against the underlying asset’s substantial price movement.

Spreading Options: Options spreads involve combining multiple options contracts with different strike prices and/or expiration dates into a single trading strategy. This approach allows traders to enhance their risk-reward profile by simultaneously capturing downside protection and limiting potential losses.

Theta Harvesting: Theta is a Greek letter that measures an option’s sensitivity to time-decay. Harvesting theta involves holding options contracts until their premium has decayed significantly, maximizing the profit from the passage of time.

Unveiling the Latest Trends and Developments in TD Option Trading

TD option trading has witnessed a surge in popularity of late, attracting both retail and institutional investors seeking to harness the benefits of time-decay. This burgeoning interest has sparked notable developments in the space.

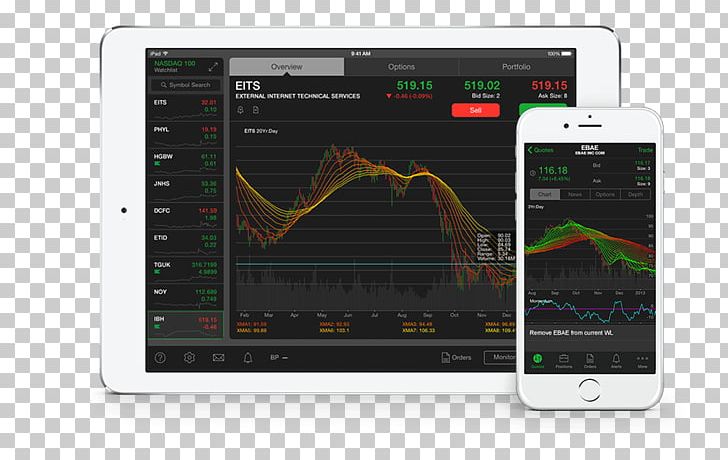

Technological Advancements: Sophisticated trading platforms empower traders with precision tools for analyzing and executing TD option strategies, automating complex calculations and providing real-time market data.

Growth of Structured Products: Structured products have emerged as an alternative for investors seeking structured exposure to TD option strategies, offering varying risk-reward profiles catered to different investor preferences.

Image: userwiringjens.z13.web.core.windows.net

Embracing Expert Tips and Advice for Enhanced Trading Prowess

Manage Risk Vigilantly: TD option trading, while potentially lucrative, carries inherent risks. Traders must implement robust risk management strategies, including position sizing, protective stop-loss orders, and scenario analysis.

Master Time-Value Decay Concepts: A profound understanding of time-value decay is paramount for successful TD option trading. Traders must grasp the relationship between an option’s time to expiration, its delta, and its premium value.

FAQs: Unraveling the Complexities of TD Option Trading

Q: What are the potential benefits of TD option trading?

A: TD option trading offers a unique combination of income generation and risk management, allowing traders to potentially earn profits from time decay while limiting downside exposure.

Q: What is the difference between an ITM (in-the-money) option and an OTM (out-of-the-money) option?

A: An ITM option has an exercise price that is below (for call options) or above (for put options) the underlying asset’s current price, while an OTM option has an exercise price that is above (for call options) or below (for put options) the underlying asset’s current price.

Td Option Trading

Image: imgbin.com

Conclusion: Embarking on a Journey into Time-Value Trading

TD option trading presents an intriguing opportunity for investors to profit from the relentless march of time. By understanding the concepts of time-decay, mastering trading strategies, and incorporating expert tips, traders can harness the potential of this dynamic market segment. Whether you’re a seasoned trader or embarking on this journey anew, TD option trading beckons you to explore the uncharted waters of time-value discovery.

Are you intrigued by the intricacies of TD option trading? Share your thoughts and questions in the comments below. Together, let’s unlock the secrets of this captivating realm.