In the ever-evolving financial landscape, options trading has emerged as a powerful tool for investors seeking to maximize returns and mitigate risk. Among the various underlying assets available for options trading, Exxon Mobil Corporation (XOM) stands out as a particularly compelling choice due to its global presence, stable operations, and strong dividend yield.

Image: newsfilter.io

Options trading involves the purchase or sale of contracts that confer the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility allows investors to tailor their trading strategies to specific market conditions and risk tolerances.

Exxon Mobil: A Global Energy Leader

Exxon Mobil is a multinational oil and gas corporation that operates in various countries worldwide. It is one of the largest publicly traded companies in the world, with a market capitalization exceeding $400 billion. The company’s integrated business model encompasses exploration, production, refining, and marketing of crude oil, natural gas, and petroleum products.

Exxon Mobil benefits from a diversified asset portfolio that spans key hydrocarbon-producing regions, including the United States, Canada, Europe, and Asia. This diversification provides resilience against geopolitical risks and fluctuations in regional demand, ensuring stable cash flows and dividend payments.

Options Trading Strategies for Exxon Mobil

Investors can utilize various options trading strategies to capitalize on the opportunities presented by Exxon Mobil’s stock. Some common approaches include:

- Covered Calls: Selling call options against shares of XOM owned by the investor. This strategy generates income while maintaining exposure to potential upside in the stock price.

- Protective Puts: Buying put options to protect against declines in the stock price below a certain level. This strategy limits downside risk, especially in volatile market conditions.

- Bullish Call Spreads: Purchasing a call option at a higher strike price and simultaneously selling a call option at a lower strike price. This strategy provides leverage to the upside while capping potential losses.

Tips for Successful Options Trading

Successful options trading requires a combination of knowledge, experience, and sound risk management practices. Here are some tips to help you navigate the options market:

- Understand the Risks: Options trading can magnify both potential gains and losses. It is crucial to thoroughly understand the risks involved before engaging in such transactions.

- Set Clear Objectives: Define your trading goals and risk tolerance before entering any trade. This will help you make informed decisions and avoid emotional trading.

- Manage your Portfolio: Diversify your options positions across different underlying assets, option types, and expiration dates to mitigate overall risk.

- Seek Expert Advice: If you are new to options trading, consider consulting with a financial advisor who can provide guidance and support.

By adhering to these principles, investors can increase their chances of success in the often volatile world of options trading.

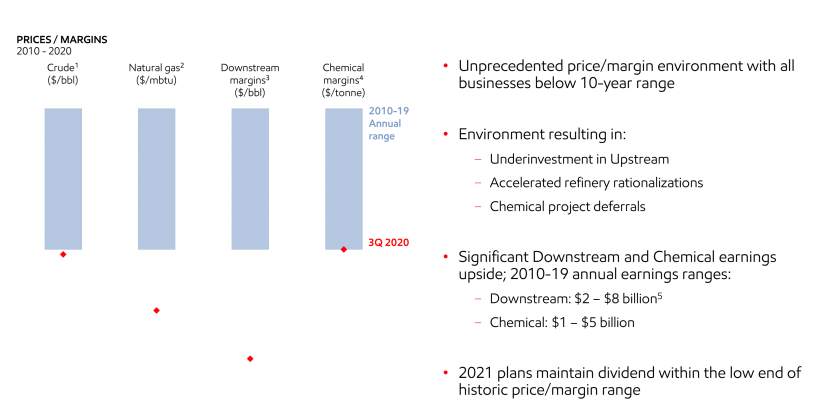

Image: seekingalpha.com

Frequently Asked Questions (FAQs)

Q: What are the different types of options available?

A: The two main types of options are call options (giving the right to buy) and put options (giving the right to sell).

Q: What is the expiration date of an option contract?

A: The expiration date is the last day on which the option can be exercised.

Q: How is the value of an option determined?

A: The value of an option is influenced by various factors, including the underlying asset price, strike price, time to expiration, and market volatility.

Exxon Mobil Options Trading

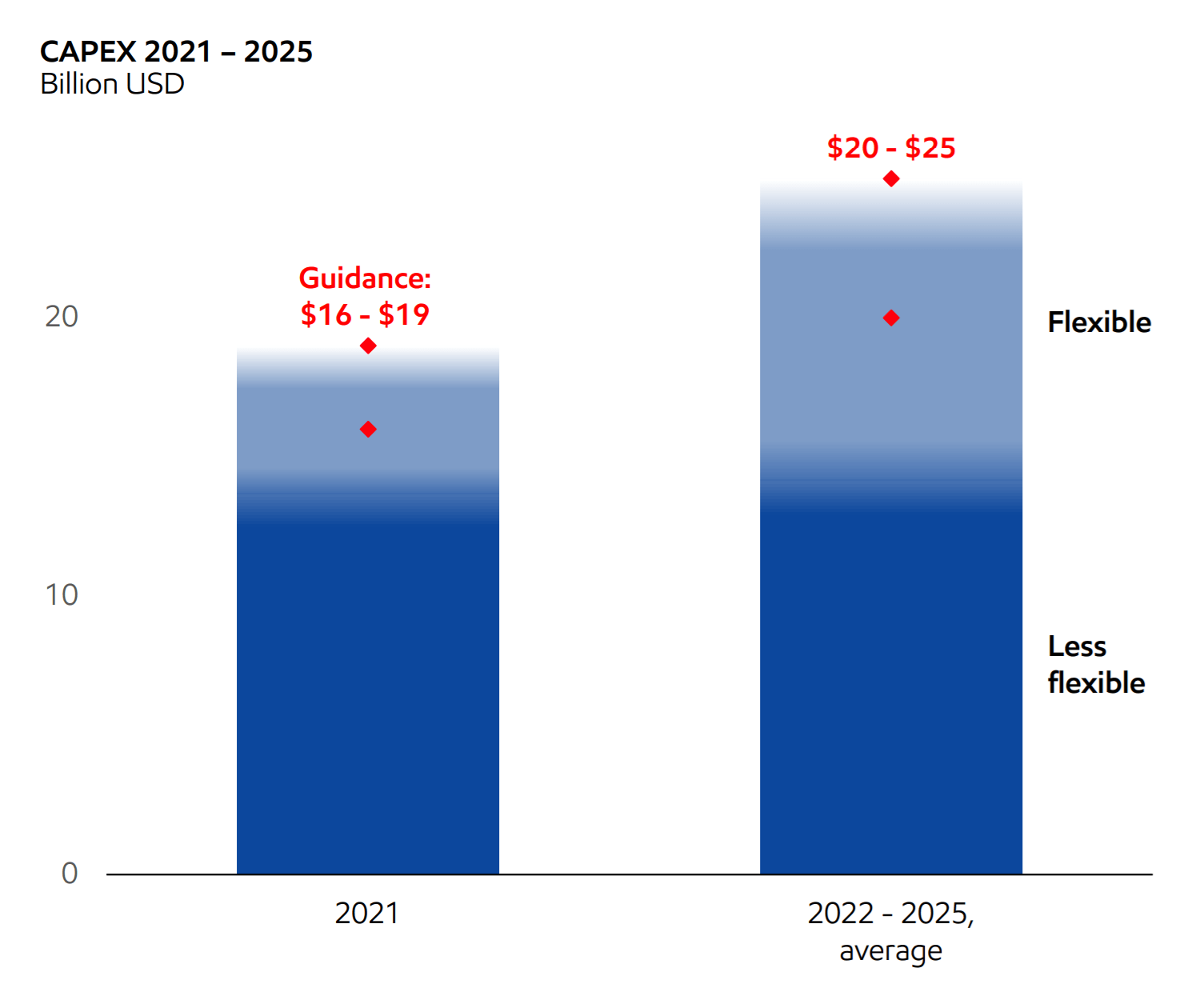

Image: stocrot.blogspot.com

Conclusion

Exxon Mobil options trading provides investors with a range of opportunities to capitalize on market movements while managing risk. By understanding the underlying asset, employing appropriate strategies, and following sound trading principles, investors can harness the power of options to enhance their financial performance.

Are you interested in learning more about Exxon Mobil options trading? Do not hesitate to reach out for further information or professional guidance.