In the dynamic world of stock market investing, options trading stands out as a powerful tool with the potential for significant gains. By understanding the best stocks for options trading in the USA, investors can unlock ample opportunities to amplify their returns and manage risk effectively. This comprehensive guide explores the fundamentals of options trading, identifies the most suitable stocks for this strategy, and provides actionable insights to help traders make informed decisions.

Image: club.ino.com

Understanding Options Trading

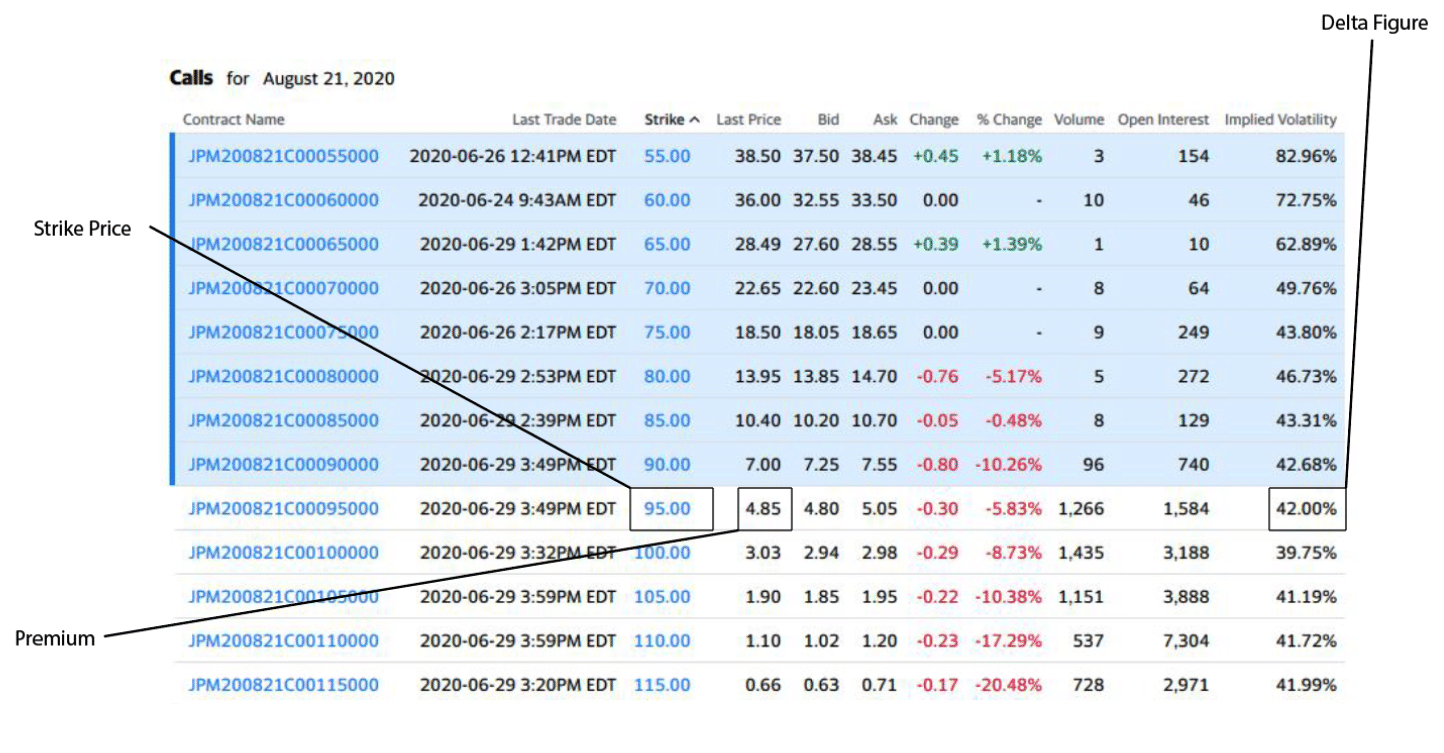

Options trading involves the buying and selling of contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a pre-determined price within a specific time frame. By utilizing options, investors can speculate on the future direction of a stock’s price, mitigate risk, or generate income through premiums.

Identifying Optimal Stocks for Options Trading

Selecting the right stocks for options trading is crucial to maximizing profit potential. Ideal candidates exhibit certain characteristics:

- High Liquidity: Stocks with high trading volume ensure easier entry and exit points, minimizing market impact and reducing bid-ask spreads.

- Volatility: Options premiums are directly influenced by underlying price movement. Stocks with higher volatility offer greater potential for profit but also involve increased risk.

- Earnings Impact: Companies releasing earnings reports often experience price fluctuations, creating opportunities for traders to profit by speculating on post-earnings price actions.

- Industry Trends: Industries experiencing growth or undergoing significant changes can offer favorable conditions for options trading.

- Technical Analysis: Technical patterns and indicators can provide valuable insights into potential price movements, guiding trading decisions.

Top Stocks for Options Trading in the USA

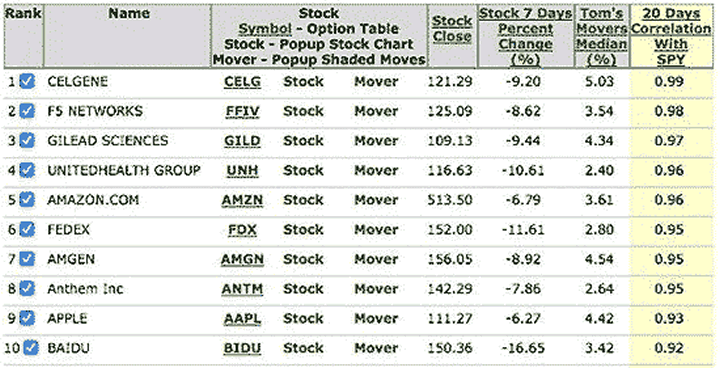

Based on these criteria, several US stocks emerge as particularly suitable for options trading:

- Apple (AAPL): A technology behemoth with high liquidity, regular earnings releases, and consistent stock price movements.

- Tesla (TSLA): An electric vehicle pioneer known for its high volatility and potential for significant price swings.

- NIO (NIO): A Chinese electric vehicle manufacturer with a growing US presence and strong growth prospects.

- Amazon (AMZN): E-commerce giant with high liquidity, a wide range of business segments, and frequent price movements.

- Microsoft (MSFT): A technology powerhouse with a large market capitalization, providing stability and liquidity.

- Nvidia (NVDA): A semiconductor company benefiting from AI and gaming industry growth, resulting in high volatility and ample trading opportunities.

- Starbucks (SBUX): A consumer staple with strong brand recognition and consistent financial performance, suitable for income-generating strategies.

- AT&T (T): A telecommunications giant with high dividend yields, offering opportunities for income generation and stock price speculation.

- Exxon Mobil (XOM): An oil and gas major influenced by global energy markets and events, providing potential for high volatility.

- Boeing (BA): Aerospace manufacturer with large contracts and a cyclical business, creating price fluctuations suitable for options trading.

Image: www.marketoracle.co.uk

Best Stocks For Options Trading Usa

Image: brjavocats.com

Conclusion

Options trading in the USA presents a wealth of opportunities for investors to amplify their returns and manage risk. By understanding the principles and selecting stocks with favorable characteristics, traders can navigate the options market strategically. The stocks presented in this guide offer a diverse range of trading opportunities, catering to various risk profiles and investment goals. Thorough research, diligent risk management, and a commitment to continuous learning remain essential ingredients for successful options trading.