In the bustling financial landscape of the United Kingdom, option trading has emerged as a dynamic and lucrative opportunity for investors seeking both growth and income. Options contracts offer a versatile tool for hedging risks, accessing market upside, and generating passive returns. In this comprehensive guide, we delve into the intricacies of UK option trading, empowering you with the knowledge and strategies to navigate this exciting market.

Image: www.youtube.com

Options, financial instruments that derive their value from an underlying asset, provide investors with two fundamental choices: to buy (call) or sell (put) that asset at a predetermined price within a specified timeframe. This flexibility allows traders to tailor their strategies to their risk tolerance and market outlook, creating opportunities to profit from both rising and falling prices.

The UK option market is a well-regulated and transparent environment, with stringent measures in place to safeguard investors’ interests. The Financial Conduct Authority (FCA) oversees the market, ensuring compliance with ethical and best practice guidelines. This regulatory framework fosters confidence and promotes fair trading practices.

To understand UK option trading, a grasp of key concepts is essential. Options are characterized by their premium, which represents the cost of purchasing the contract. The strike price is the predetermined price at which the asset can be bought or sold at contract expiration. Traders can choose between various types of options, including vanilla options (simple calls and puts) and more complex strategies like spreads and straddles.

Real-world applications of option trading are vast. Hedging strategies, for instance, enable investors to protect their portfolios from potential losses. Income generation is another popular use, where traders sell covered call options to collect premium while maintaining ownership of the underlying asset. Market speculation presents another avenue, allowing investors to capitalize on price movements without directly owning the asset.

To navigate the UK option market with confidence, seeking the guidance of reputable brokers is crucial. Regulated brokers provide access to trading platforms, execute trades, and offer expert advice. They can also guide you through the intricacies of option contracts and help you develop a personalized trading strategy.

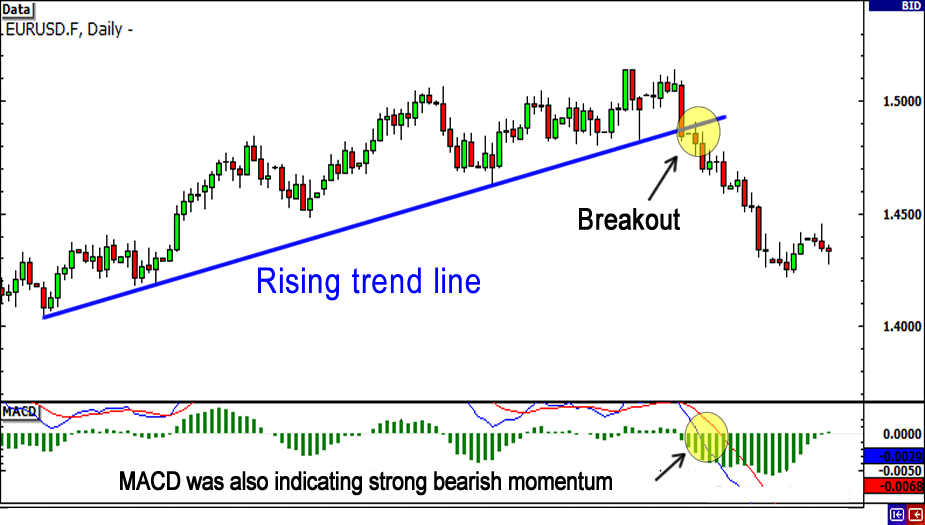

The key to successful option trading lies in thorough research and technical analysis. Understanding the factors influencing the underlying asset’s price, such as economic data, corporate earnings, and market sentiment, is vital. By leveraging historical data, traders can identify patterns and make informed decisions.

As you delve deeper into UK option trading, seeking additional resources can augment your knowledge and enhance your strategies. Industry publications, online forums, and educational courses provide invaluable insights into market dynamics and advanced trading techniques.

In conclusion, UK option trading presents a plethora of opportunities for investors seeking financial growth and risk management. By grasping fundamental concepts, understanding real-world applications, and leveraging the expertise of regulated brokers, traders can confidently navigate this dynamic market. Remember to couple your trading journey with comprehensive research, technical analysis, and a relentless pursuit of knowledge to maximize your chances of success in the exciting world of UK option trading.

Image: www.optionfinance.fr

Uk Option Trading

Image: www.blogforex.org